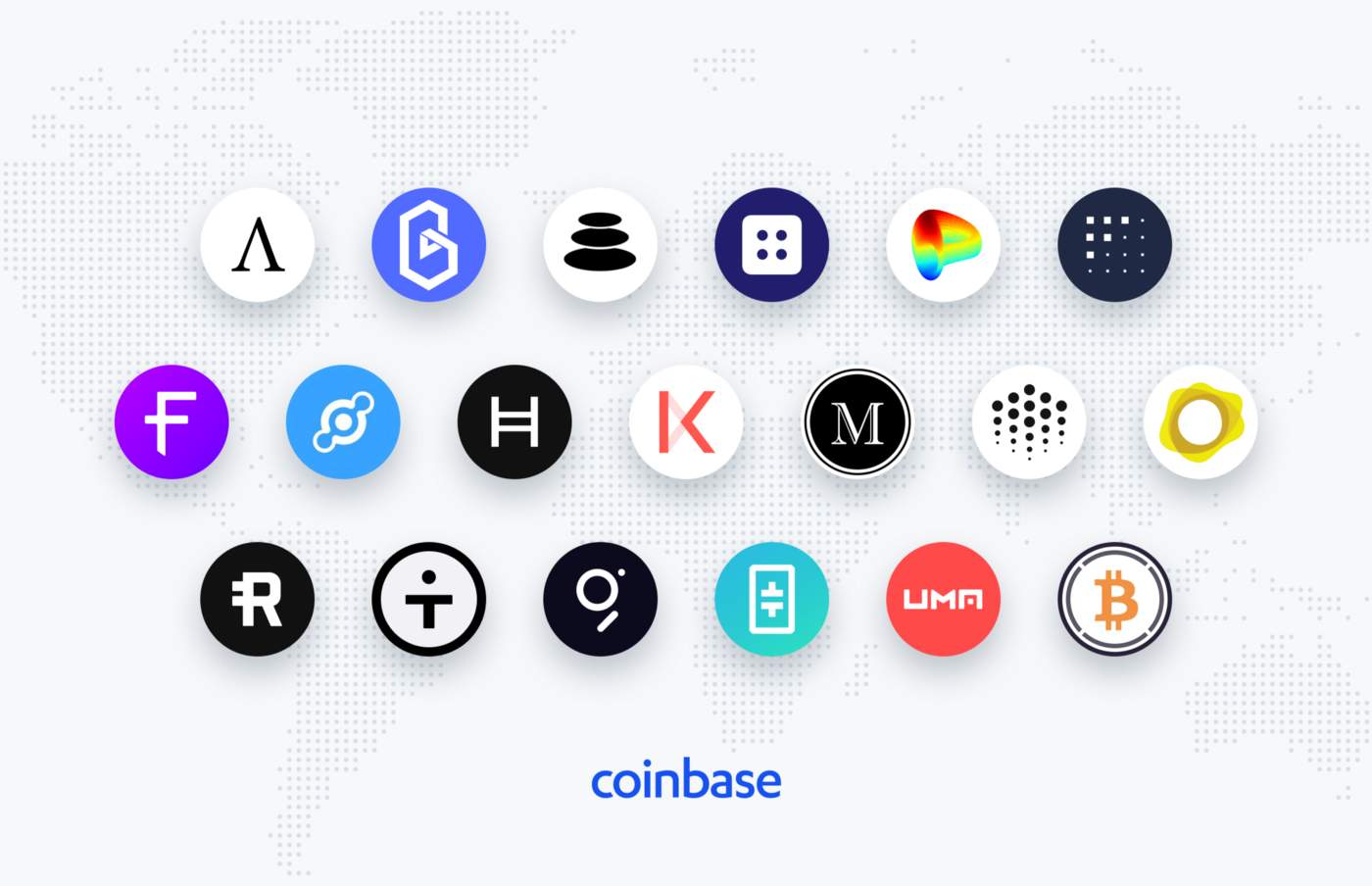

The leading US cryptocurrency exchange Coinbase is exploring potential support for 19 new cryptocurrencies on its platform.

Most of the coins that the firm is evaluating have ties to decentralized finance (DeFi), the red hot crypto craze designed to blend traditional financial services with decentralized technologies such as blockchain technology and smart contracts.

The announcement comes as the DeFi industry sees impressive growth. According to the industry website DeFiPulse.com, the market has now hit past $4 billion from just $1.83 billion on July 1st.

In a blog post published on Friday, the firm says it is evaluating Ampleforth, Band Protocol, Balancer, Blockstack, Curve, Fetch.ai, Flexacoin, Helium, Hedera, Hashgraph, Kava, Melon, Ocean Protocol, Paxos Gold, Reserve Rights, tBTC, The Graph, THETA, UMA, and WBTC, as it aims to make at least 90% of the total market cap of crypto assets in circulation accessible to its customers.

“As part of the exploratory process customers may see public-facing APIs and other signs that we are conducting engineering work to potentially support these assets.”

Coins that are added to the platform often experience the “Coinbase bump” and rise in value before dropping back to where they began.

Coinbase says there is no guarantee that all 19 coins will be eventually supported. Each asset should pass technical and compliance review, and may require regulatory approval in some jurisdictions.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NanEstalrosa