A low-cap DeFi cryptocurrency is the latest to shake up the cryptoverse after surging 409% in just a few days.

Tendies, a new cryptocurrency that bills itself as the “next generation autonomous and hyperinflationary coin,” is attracting attention after jumping from $0.1853 on July 30th to a high of $0.9449 on Sunday, according to CoinGecko. The asset now stands at $0.70 at time of publishing.

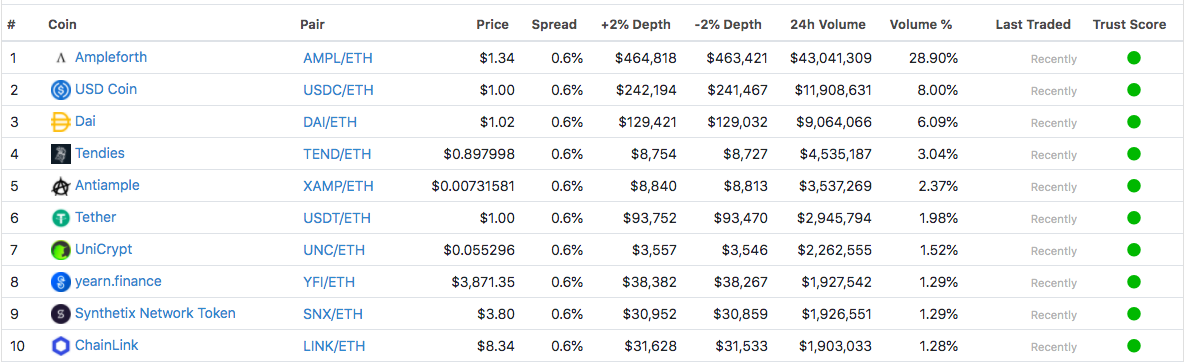

The coin is also gaining significant volume on the Uniswap Protocol as its 24-hour trading volume soars to more than $4.5 million, surpassing stablecoin powerhouse Tether (USDT) and decentralized oracle network ChainLink (LINK).

Tendies relies on a deflationary model and user loyalty to try and establish value. Its tongue-in-cheek name is a reference to a meme about chicken tenders that began on 4chan back in 2014.

?Poloniex is honored to list the future of fried crypto – Tendies ($TEND) will be listed this weekend. ?

Wallets will open on Sunday, August 2 at 16:00 UTC. Trading of $TEND will be enabled soon after, with a healthy portion of honey mussy on the side. pic.twitter.com/tnbfLIPB2R

— Poloniex Exchange (@Poloniex) August 1, 2020

Of the nearly 9 million TEND stored in the Uniswap liquidity pool, 4% are drained on a daily basis. According to the Tendies website, any user can start the draining process. The user who makes the call gets 1% of the drained tokens.

The remaining drained TEND are sent to two addresses. One address burns 51% of the drained tokens. The second address receives 48% of the drained tokens which would be distributed to the top 50 TEND holders every three days. The process is designed to incentivize investors to hold more TEND in order to qualify for bonuses.

The anonymous developers of the cryptocurrency themselves say Tendies is nothing more than a social experiment and warn it comes with considerable risk.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Oleksandr Nagaiets