The idea of cryptocurrency trading platforms has been around for a few years now, but rarely do they offer much flexibility for their users. Recently unveiling a redesigned, next generation platform that lets users connect their account with 30+ top crypto exchanges, Bitsgap provides clients with top-notch automated crypto trading bots, opening a vast opportunity to start both trading and earning money passively.

Trading

This is the main trading screen for exchanges connected to Bitsgap by the user via exchange API. It basically allows users to conduct trades on all their exchanges at once instead of having to manually log in to all of them. It features an orderbook, interactive chart screen, list of coin pairings, recent trades, order screen, and open orders, along with the user’s balance on the exchange, open positions, and trade history. The current exchange can be changed by clicking on the name of the exchange found above the chart screen. This will bring up a list of the 30+ exchanges that can currently be connected to Bitsgap.

In addition to the basic market and limit order types, some of the more advanced orders that can be placed through Bitsgap include:

- Stop-loss/take profit orders. Using this type of order will make sure that orders are executed upon reaching a certain price limit. These orders are used to minimize losses or maximize gains.

- Shadow orders. This allows users to place orders that are not reflected in the exchange order book. The order still exists per instructions sent via API connection but cannot be seen by other traders.

- Smart orders. This is an advanced order which sets a simultaneous combination of stop-loss and take profit orders, available to those with upgraded plans only.

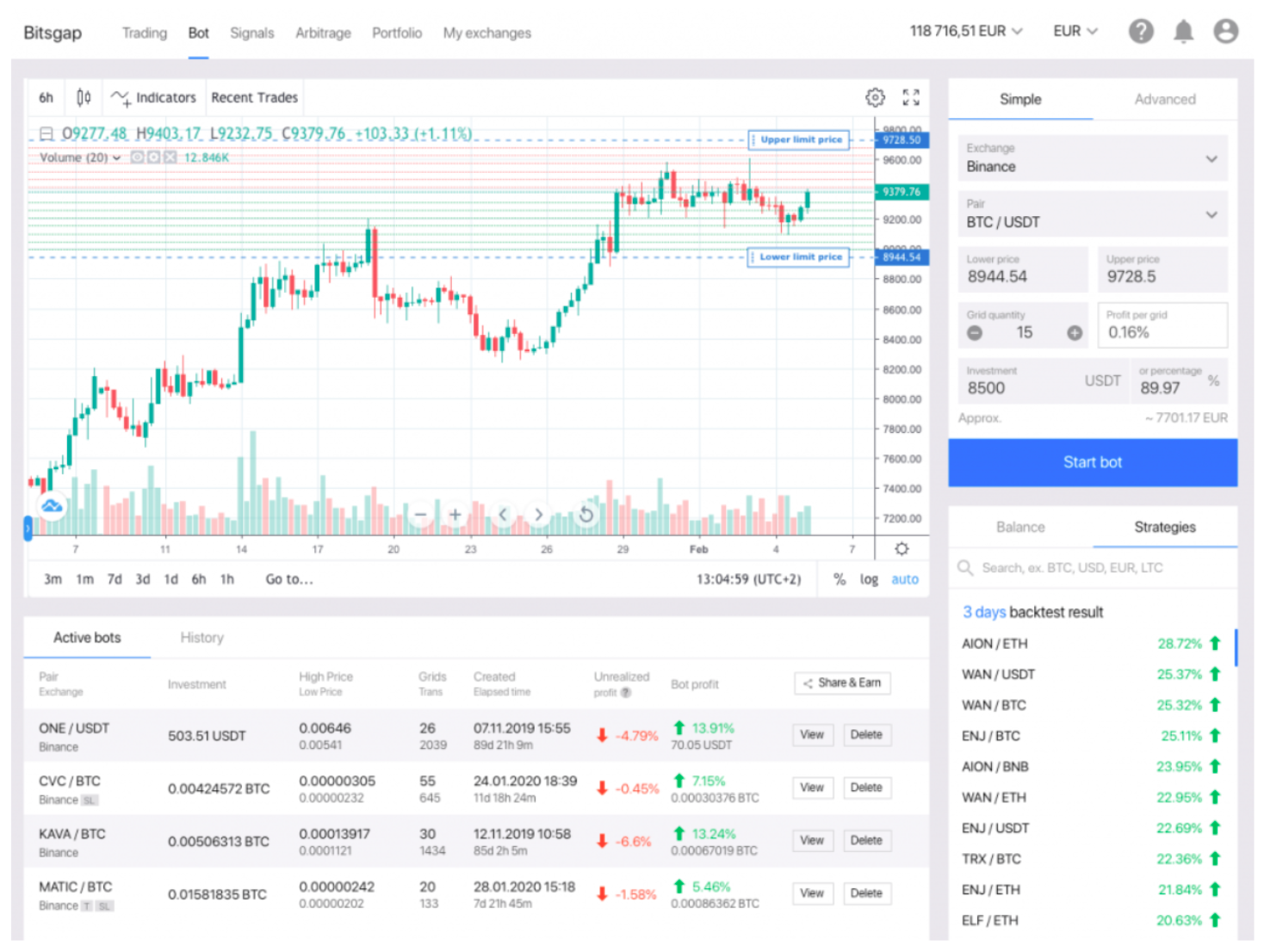

Bots

This is where Bitsgap’s selection of trading bots can be found. Once a platform user has a coin balance on an exchange and has successfully connected that exchange’s API to their Bitsgap account, they can activate the bot of their choice to start making automated trades for them. To the right of the coin pairing chart are different options for selecting the bot, exchange, coin pair, configuration options, and maximum amount to be traded by that bot.

Below that is a list of the most successful trading strategies for the particular bot selected based on backtest data, which is a simulation of how the bot would have performed when trading different coin pairings offered by the selected exchange. The backtest result can be displayed according to returns delivered in the last month, week, or 3 days.

Bitsgap offers a free 14-day trial. You can sign up here.

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on X Facebook Telegram