Trader and analyst Michaël van de Poppe is laying out the possible scenarios for Bitcoin (BTC), Ethereum (ETH), and XRP after the big crypto market correction.

The crypto tells his 75,000 Twitter followers that he expects BTC to stay above a crucial line of support at $10,000.

“Bitcoin – finally, liquidity at the lows taken. Reclaim of $10,000 would mean a S/R flip and a very probable chance we’ll look for liquidity above the range highs. That would suit a bounce towards $10,750-10,900 and majority of the markets bounce 25-40%.”

As for Ethereum, Van de Poppe still believes in the coin’s long-term bullish potential even amid the heavy correction.

“ETH is one of the coins you’d want to hold for the coming years. The lower, the better.”

Although the trader remains optimistic that ETH will eventually regain its bullish tone, he’s not eliminating the possibility that the second-largest cryptocurrency can go below $300.

“What is the level to hold for Ethereum? Clearly, it is the $245 area. If we get into this zone, that might be the long opportunity of a lifetime, if we get anywhere close to the weekly level around $245.”

Should Ethereum hit support at $245, Van de Poppe says the pullback could set up the coin for a major rally to $800.

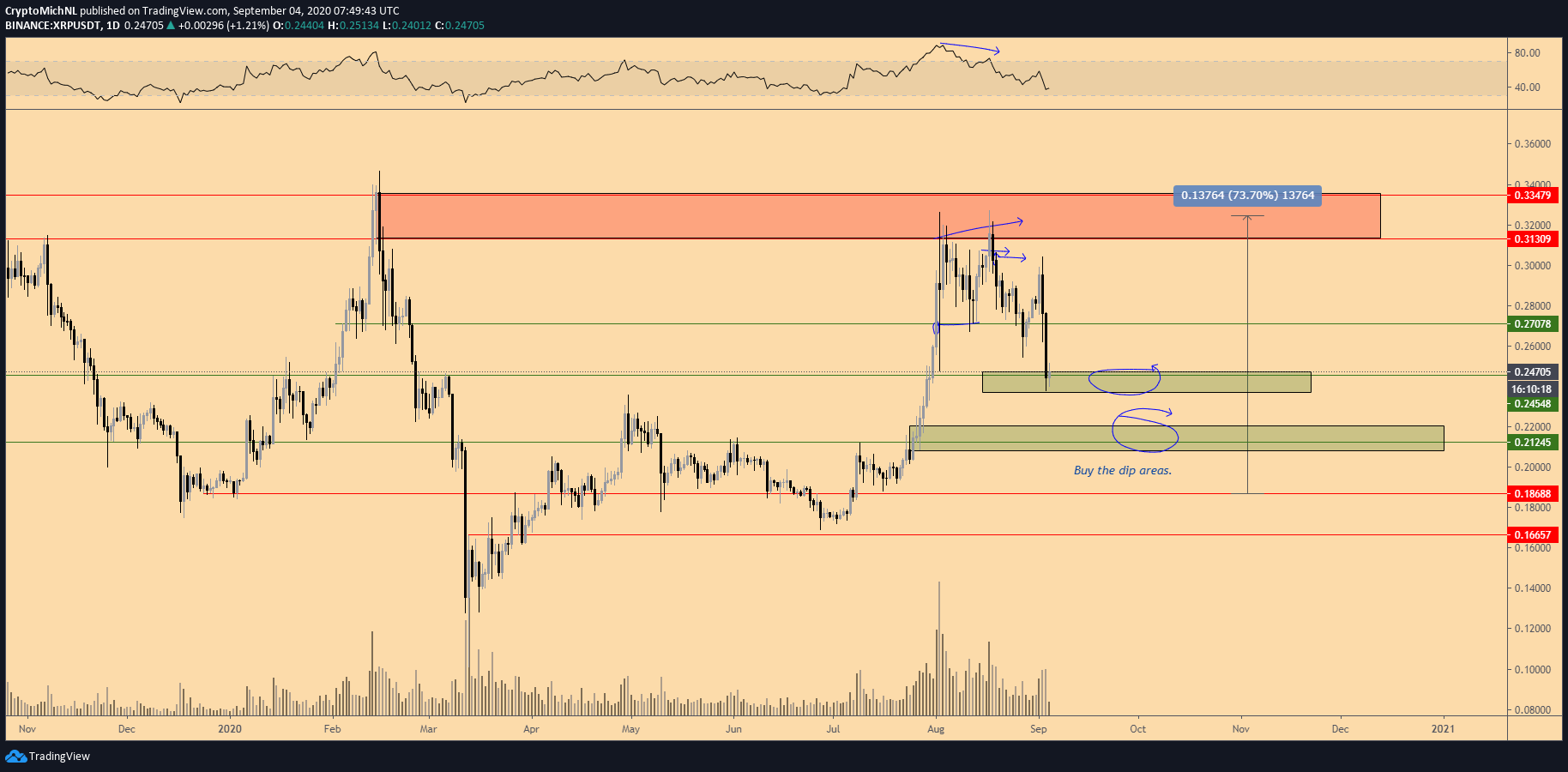

Meanwhile, van de Poppe is looking forward to buying the dip in XRP.

The fourth-largest cryptocurrency has hit his first buy target at $0.2458 in the midst of a retracement, and Van de Poppe is eyeing support at $0.21245.

“XRP Takes ages, but we’ll get there.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/rangizzz