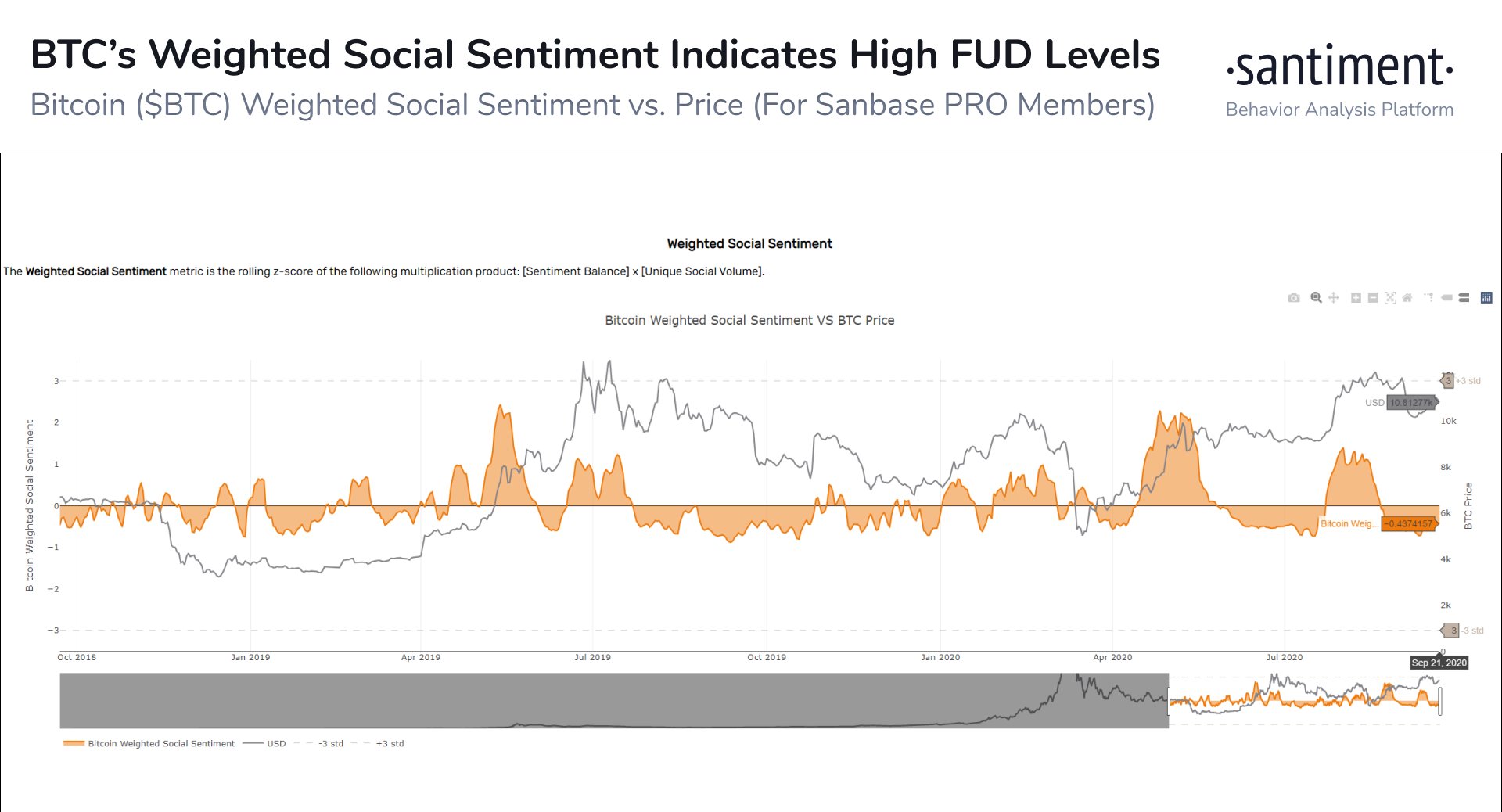

Data from crypto insights platform Santiment says Bitcoin is poised for a steep recovery as the cryptocommunity turns bearish on the number one cryptocurrency.

The crypto market data platform says that sentiment over BTC’s price action has turned increasingly negative following the crypto king’s failure to stay above $11,000.

“Prices of BTC and other crypto assets tend to bounce most precipitously when the crowd is demonstrating a high level of FUD. This is exactly what we’ve been seeing for Bitcoin, Ethereum, and many altcoins following the early September retrace, as well as on a more short-term scale after BTC plummeted to $10,340 hours ago.”

Santiment analysts say they measure social sentiment by using a machine learning model that tracks a large dataset of 1.6 million tweets. Based on Santiment’s chart, BTC has the tendency to make a steep price recovery after the weighted social sentiment metric dips into the level indicating that traders have turned pessimistic.

A number of crypto analysts are also seeing a bullish rally on the horizon. Trader Cantering Clark tells his 28,000 followers that Bitcoin might be staging a bear trap.

“BTC likely sees relief in the near future. Nice selling into the close of yesterday’s session. If you ask me, that looks like an optimal way to set up a trap for any systematic shorts that would get the green light at that point.”

Bitcoin Jack echoes Cantering Clark’s short-term optimism on BTC as he thinks the largest cryptocurrency might be in for a short squeeze.

“This reeks of short sellers being trapped – pretty much similar to March but opposite and with slightly less open interest in the market. Could I be wrong? Sure But this is how I’m seeing it.”

But not all traders are ready to buy the dip. Crypto strategist Michaël van de Poppe believes that Bitcoin may be on its way to fill the gap at $9,600.

“A potential scenario I’m watching. Invalidated if we break above $10,800.”