Crypto insiders are noticing Bitcoin’s resilience as it withstands wave after wave of news events carrying bearish implications.

In a new tweet, Dovey Wan, the founding partner of blockchain-focused investment firm Primitive Ventures, highlights BTC’s relative stability amid an avalanche of negative developments, including the U.S. Commodity Futures Trading Commission (CFTC) going after the Seychelles-based crypto derivatives exchange BitMEX.

and all these add up together didn't tank Bitcoin for even 10%

in the past, it could be easily a 25% dump minimum https://t.co/zxVcYpJoYJ

— Dovey "Rug the fiat" Wan (hiring) (@DoveyWan) October 1, 2020

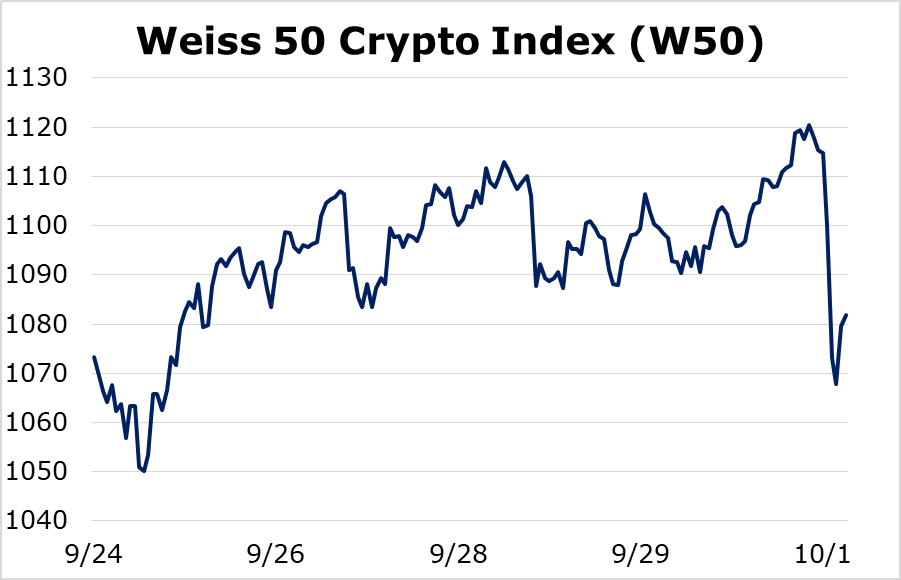

Weiss crypto analyst Juan Villaverde has also taken note of the broader crypto market’s ability to stay afloat in spite of ostensibly bearish headlines. Villaverde emphasizes that the Weiss 50 Crypto Index, a broad measurement of the crypto industry’s performance, has managed to quickly recover after a brief sell-off.

“There is that quick reversal at the far right of the chart. This marks the initial reaction to the CFTC’s announcement of a ‘civil enforcement action’ against BitMEX for operating an unregistered crypto derivatives trading platform and violations of other regulations.

What isn’t shown in this chart is the rally that followed this knee-jerk reaction after crypto traders had time to digest the implications – or lack thereof – of this event.”

In his post, Villaverde also explains why he thinks the legal action against BitMEX has had no significant impact on the crypto market’s price action.

“Crypto is a shelter – perhaps the only viable one – against the monetary insanity that’s taken over the world’s most developed economies.

At the same time, the CFTC and the Department of Justice going after BitMEX – the oldest crypto derivatives exchange – is also a non-event. It’s been known among market participants that BitMEX has been in the crosshairs of U.S. regulators since at least 2019…

And all it accomplishes is to reinforce yet another trend that has also long been in motion: The crypto industry is unable to thrive in the U.S. and most developers and talent are moving offshore to build their products.”

Although Bitcoin has so far been immune to troubling events in the crypto space, popular BTC evangelist Andreas Antonopoulos believes that the largest cryptocurrency is still at the mercy of traditional markets due to its high correlation with other asset classes.

“In the short term, Bitcoin does get sold off just as hard as the other assets and probably harder, because it has this extreme volatility. There are no mechanisms to stop it from dropping just as hard.”