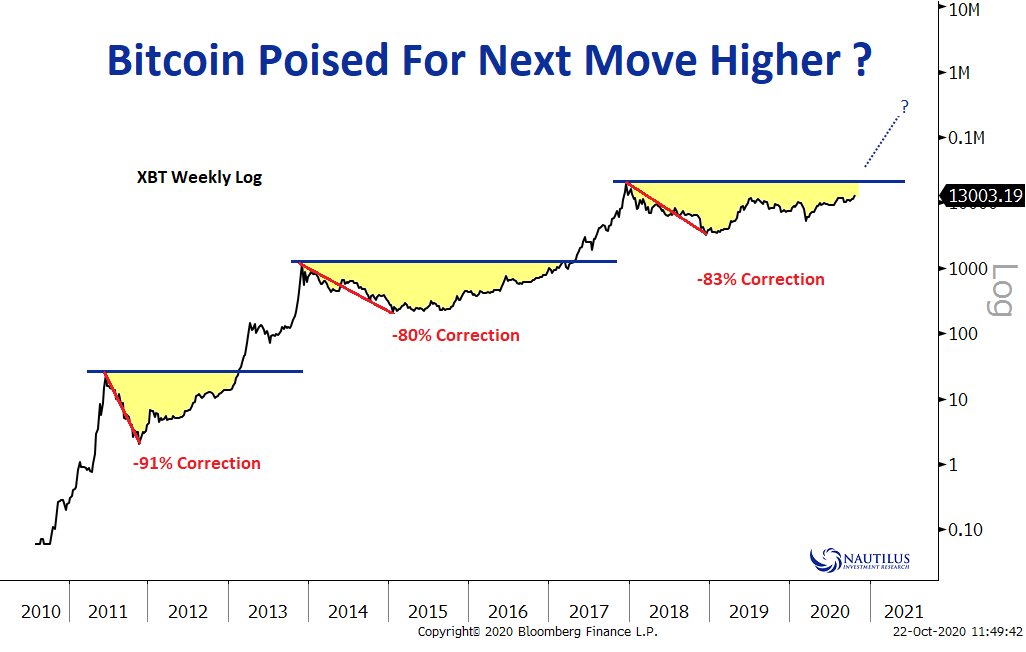

Bitcoin (BTC) is displaying patterns that have historically occurred before massive breakouts, potentially indicating the start of the next exponential bull run, says research agency Nautilus Research.

In a Twitter post, Nautilus Research suggests that Bitcoin is currently forming a pattern that has preceded the bull runs of 2012 and 2017.

“Bitcoin echoes of patterns ahead of previous major breakouts.”

According to the independent research boutique’s chart, Bitcoin has historically corrected at least 80% from boom cycle highs and then consolidated for over a year before launching the ensuing bull market. If history is any indicator, Bitcoin may soon ignite a parabolic rally that could send the most dominant cryptocurrency well above $100,000.

Widely-followed market analyst Peter Brandt offers his own insights on BTC, highlighting the role of growing institutional interest in the largest cryptocurrency.

“Bitcoin – IF the current gains hold through end of Oct – is poised for the second-highest monthly close ever.

Institutions are increasingly involved in Bitcoin ownership. Institutions mark the value of their assets monthly.”

In addition, rating agency Weiss Ratings says Bitcoin is still the “clear leader” in the crypto space as it surged above the key level of $13,000, which is BTC’s 2019 high. Like Brandt, Juan Villaverde of Weiss Ratings credits institutional involvement for the rally.

“Investors piled into Bitcoin this week and this rally spilled over to other crypto assets. At the same time, investors are sticking to high-quality names primarily, as we’re seeing the most strength coming out of the large caps.

Bitcoin is the go-to asset for traditional investors looking to diversify their holdings into cryptocurrency. As such, any time we see Bitcoin take the lead, we can be certain that new money is entering the space. This is a prerequisite for any sustainable crypto bull run.”

As Bitcoin shows signs of bullishness, the Crypto Fear & Greed Index of crypto market sentiment tracker Alternative.me has turned to “extreme greed.” According to Alternative.me, an extreme greed reading suggests that the market is beginning to be overbought and a pullback may be on the horizon.

“When investors are getting too greedy, that means the market is due for a correction.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/MicroOne