A widely-followed crypto trader and influencer says wealthy traders ignited a massive rally in one decentralized finance (DeFi) asset that was the target of big shorts.

In a new tweet, The Crypto Dog tells his 234,000 followers that speculators who are looking to generate instant profits served as the catalyst for one of the most brutal short squeezes in the history of crypto trading.

“This YFI (yearn.finance) squeeze is what happens when you put together hundreds of the richest degens (degenerates) in crypto and point them at one target.”

The decentralized finance darling is grabbing headlines after ascending from a low of $7,716 on November 5th to a high of $16,373 on November 7th, according to CoinGecko. The move represents an increase of over 112% in a span of 48 hours.

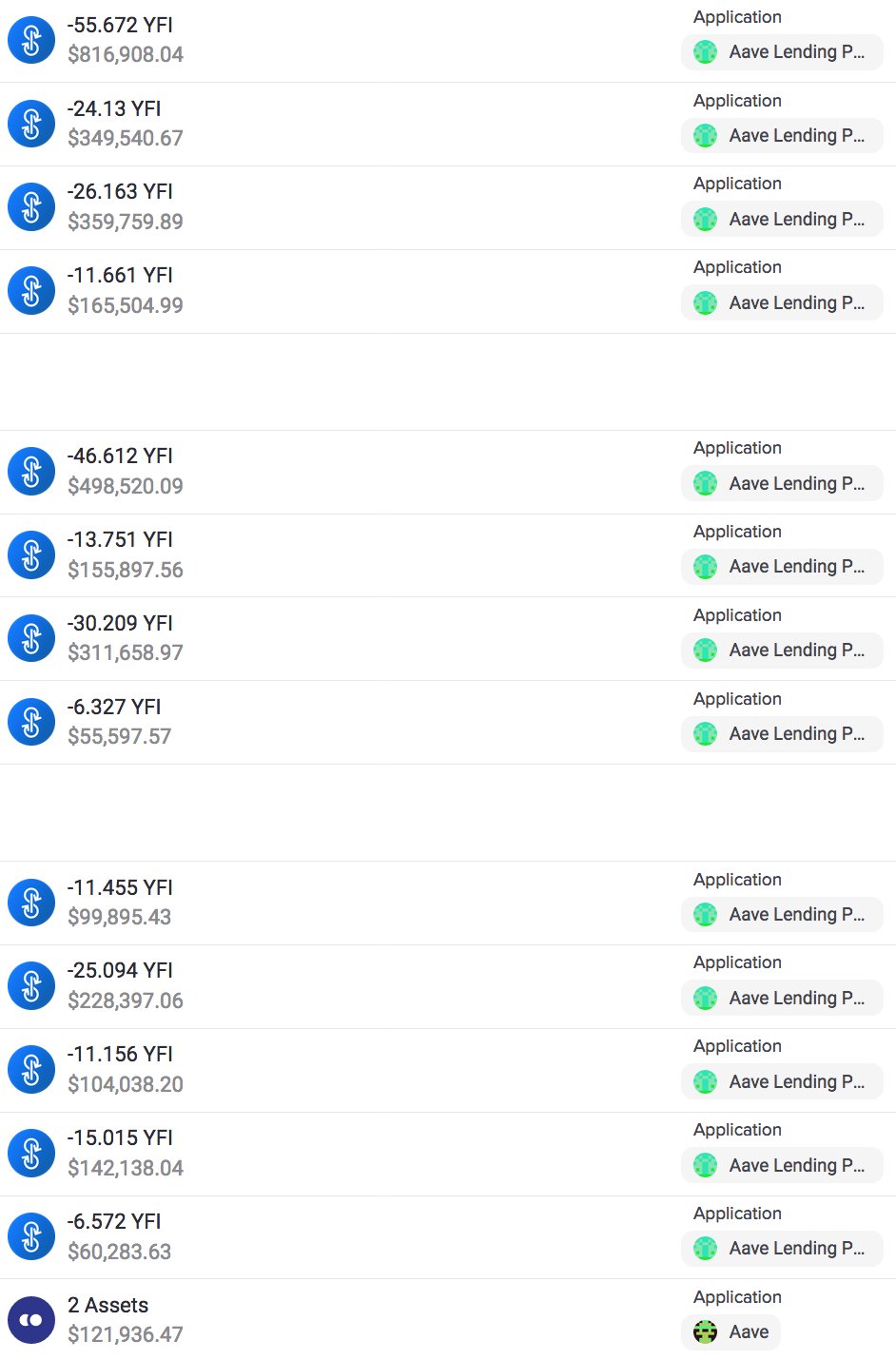

Prior to the strong bounce, YFI shorts were piling up as the DeFi protocol started its downward spiral from the all-time high of $43,678 in mid-September. Traders shorted yearn.finance by using large sums of stablecoins or Wrapped Bitcoin (WBTC) as collateral on DeFi lending platform Aave to borrow YFI tokens in order to sell them to exchanges.

With YFI in a downtrend, traders can buy back the coin at a much lower price, pay back what they owe, and generate profits from the price difference.

The monumental short squeeze dubbed as ySqueeze forced borrowers to buy back YFI at a much higher price and take on losses. A trader known in the industry as Hsaka shows how traders had to settle 290 YFI worth over $3.3 million as the DeFi asset surged in value.

“Looks like the white flag has been waved.

290 YFI repaid over 3 days.

ySqueeze.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/GrandeDuc