A crypto veteran who bought his first batch of BTC at $10 a piece is offering his take on Bitcoin’s trajectory over the next year or two.

Kraken’s head of business development, Dan Held, tells Altcoin Daily that he believes the state of the global economy is creating a perfect storm for BTC.

“The macro, at the very high level, what does the economy look like? It’s pretty bad. Covid is not a good thing for the economy. Tons of businesses got shut down. Governments engaged in massive money printing operations. There’s a lack of faith in the government.

So pretty much a perfect storm for Bitcoin because Bitcoin was built and planted during the 2008 financial crisis to solve a problem of trust and storing value with governments. It removed that from them and gave it to people and you could trust in mathematics and game theory instead of having to trust a politician and their body movements and interpreting that into monetary policy, which is what we do today. We watch an animal. We watch a human being do a random dance on TV and then we interpret that as on, they’re dovish or hawkish on the economy and that economy’s plan for 400 million people, which is absurd.”

Held says the infrastructure built around Bitcoin, adoption from institutional investors and support from companies like PayPal could fuel a BTC supercycle in the months ahead.

“At a macro level, we’ve never been in a worse spot in human history in terms of a macroeconomic enviroment. Never. Never before. Even during world wars, I would say it’s an equivalent sort of experience.

When we look at that and we combine that with Bitcoin’s purpose and where Bitcoin is, Bitcoin just came off a halving cycle. It is being recognized as a global store of value, a gold 2.0. It’s being recognized by institutions. It’s becoming more liquid. More services are being built, a super robust trading infrastructure. You’ve got Kraken and all the other exchanges out there. You’ve got options now. Options and futures markets that are very developed that didn’t really exist in 2017 at all. Then you also have good custody solutions and good reconciliation solutions. Everything’s been built-out and ready to go for a massive amount of money to come in. You’ve also got PayPal. You can buy Bitcoin on PayPal.

A lot of people just like convenient services, so that taps into a huge amount of demand for Bitcoin. You’ve got the Bitcoin halving event, where the issuance of newly minted Bitcoin dropped in half combined with increased demand from institutions and retail traders plus the macro backdrop of the world economy, you’ve got the potential for a Bitcoin supercycle. Bitcoin only went to these 20x to 40x cycles purely on retail speculative demand, but now there’s actually demand to preserve value against governments seizing that value from you or against other citizens voting for the government to seize that value.”

Held says Bitcoin is like earthquake insurance, and everyone considers buying some once an earthquake strikes.

“So Bitcoin’s value proposition, it’s really hard to talk about. Bitcoin is kind of like insurance in a way. When there’s no earthquake, you don’t really think about earthquake insurance… Then an earthquake hits and I bet you anything the insurance company gets a billion phone calls coming in to get earthquake insurance. Same thing with Bitcoin.

It’s really hard to be like hey do you not trust your government in 2015. People are like, ‘Everything’s fine. The economy is great. Why should I have to worry about it?’ But now they’re like, ‘Ok, ya, this makes a lot of sense.’

So what happens to Bitcoin’s price in that? I don’t think we’re going to see what happened before these previous cycles.”

As for exactly where the price of BTC ends up, Held says he thinks BTC will rally to as low as $100,000 and as high as $1 million.

“History rhymes. It doesn’t repeat itself. And so maybe we have a big bull run and almost no dip. Or maybe it’s a super big bull run and then we have a traditional dip too. I don’t know. I just know that it will be different. Or maybe it’s slower than we anticipate and maybe this moves really fast now and it slows down…

In 2021, we could hit $1 million. It could maybe hit it. There’s a crazy chance it could hit a million if the whole world starts to believe in Bitcoin, we could maybe hit that. I think this could be a Bitcoin supercycle to a million if the whole world starts to recognize Bitcoin’s value. If not that, I think a normal cycle could be between $100,000 and $250,000. So either way, I think we’re all going to the moon.”

I

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

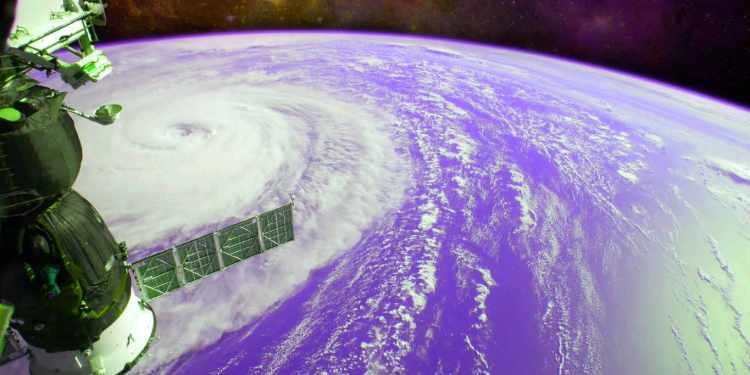

Featured Image: Shutterstock/NASA images