A relatively new crypto asset built on Ethereum soared more than 6,548% within a day after the entity behind the project dropped a bombshell on the industry.

Grap.Finance (GRAP) is a fork of the YAM protocol, which is a decentralized protocol that uses rebasing strategies to achieve price stability. Its supply is designed to expand and contract based on market conditions.

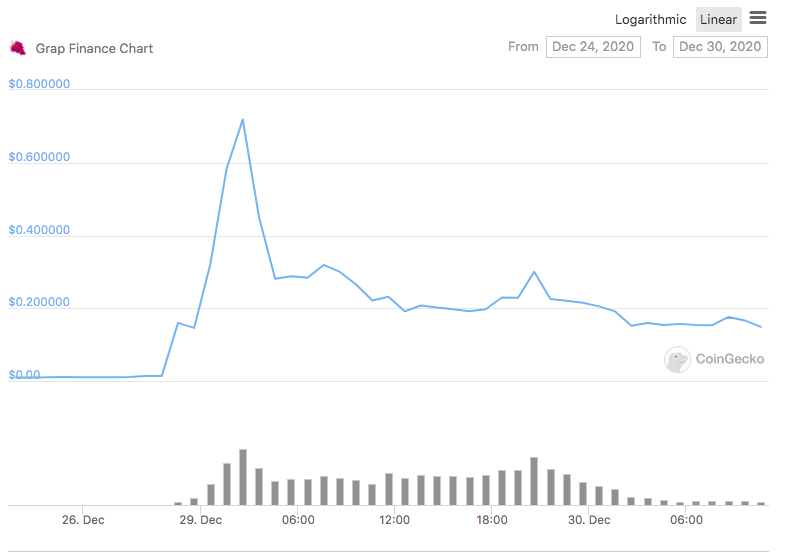

GRAP’s value plumetted to an all-time low of $0.009 on December 11th.

It then skyrocketed to a high of $0.718 on December 29th from a low of $0.0108 on December 28th, representing growth of 66x in less than 24 hours.

GRAP’s ascent comes after the project publicly admitted that it was the white hat hacker that successfully attacked peer-to-peer coverage market for decentralized finance (DeFi) Cover Protocol (COVER).

The hack exploited a bug on the project’s shield mining contract, Blacksmith, and allowed the attacker to mint 40 quintillion COVER and decimate the protocol’s supply.

Next time, take care of your own shit.@CoverProtocol @chefcoverage https://t.co/ks94ucdoRQ

1. No gains.

2. The Obtained Funds from LP has been returned to COVER.— Grap.finance (@GrapFinance) December 28, 2020

Although GRAP returned the funds, Cover says it plans to take a snapshot of the network prior to the attack, launch a new crypto asset, and distribute the coins to token holders.

“Hello everyone, we are exploring providing a NEW COVER token through a snapshot before the minting exploit was abused. The 4,350 ETH that has been returned by the attacker will also be handled through a snapshot to the LP token holders. We are still investigating. Do NOT buy COVER.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/IgorZh