A prominent crypto strategist who made a name for himself after nailing Bitcoin’s collapse to $4,000 in March 2020 is back with another bold call.

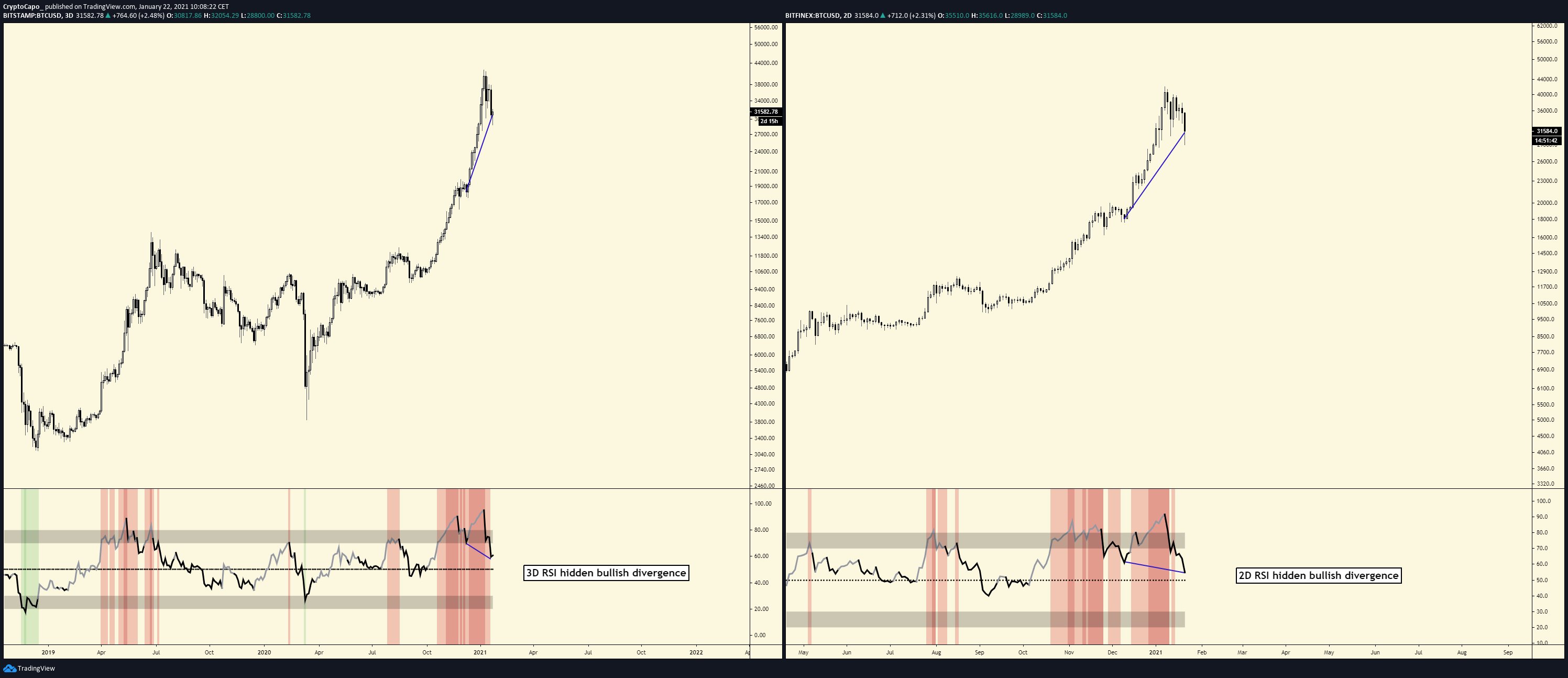

In a new tweetstorm, the analyst known in the industry as Capo looks at a number of technical indicators to show why he believes that the correction in the broader crypto market is over.

The trader explains that the sharp decline in BTC’s open interest, which refers to the number of contracts held by market participants, is a bullish signal.

“Open interest went down with the price. This means that longs have been liquidated or that they have closed their positions, which is healthy for the bullish trend.”

Capo also notes that bulls are making their presence felt as a momentum indicator flashes a signal often seen at the end of a pullback.

“BTC RSI has been reset on all timeframes, forming hidden bullish divergences on high timeframes.”

Looking at altcoins, Capo highlights that many tokens, including Ethereum (ETH), are respecting key levels.

“ETH and many altcoins have bounced from the golden zone, and they have also formed hidden bullish divergences.”

In addition, Capo highlights that sentiment across crypto markets has dropped to levels not seen since Bitcoin started its bull rally.

“Fear & greed index have dropped to 40 (fear). We haven’t seen these levels since May or September, when price was $9,000 – $10,000.“

Capo also says buyers are starting to step up and demand will erupt once prices start to show signs of recovery.

In preparation for the next leg up, the trader reveals that he’s betting heavily on altcoins.

“My portfolio: 60% alts, 30% ETH, 10% BTC, 0% USDT.”

As for which coins the trader could be possibly holding, Capo unveils that he’s closely following the movements of Cardano (ADA), Syntropy (NOIA), and Polkadot (DOT).

With the crypto market showing signs of a local bottom, Capo now expects the bull market to resume.

“I haven’t sold anything and I have reaccumulated everything I could in this great opportunity. Let the bull market continue.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Liu zishan