Investors with large amounts of capital appear to be stockpiling one decentralized finance (DeFi) asset in particular at a rapid rate.

New data from crypto analytics firm Santiment shows the number of whales buying Uniswap (UNI) has skyrocketed since the start of the month.

“Uniswap has just broken [Sunday’s] all-time high and just crossed $13 for the first time.

New whale addresses are a clear reason! Our whale holders data indicates addresses with 100,000 or more $UNI have inflated to a new high themselves at 237.”

Uniswap is a decentralized exchange built on the Ethereum network. The platform fueled the rise of Automated Market Maker (AMM) protocols, which allow users to trade assets through smart contract technology instead of a central intermediary.

The platform’s exchange token UNI offers holders control over governance, including the token’s treasury reserves, protocol fees, and default list of tokens.

UNI, along with the peer-to-peer lending platform Aave, burst into the top 20 crypto assets by market cap this week.

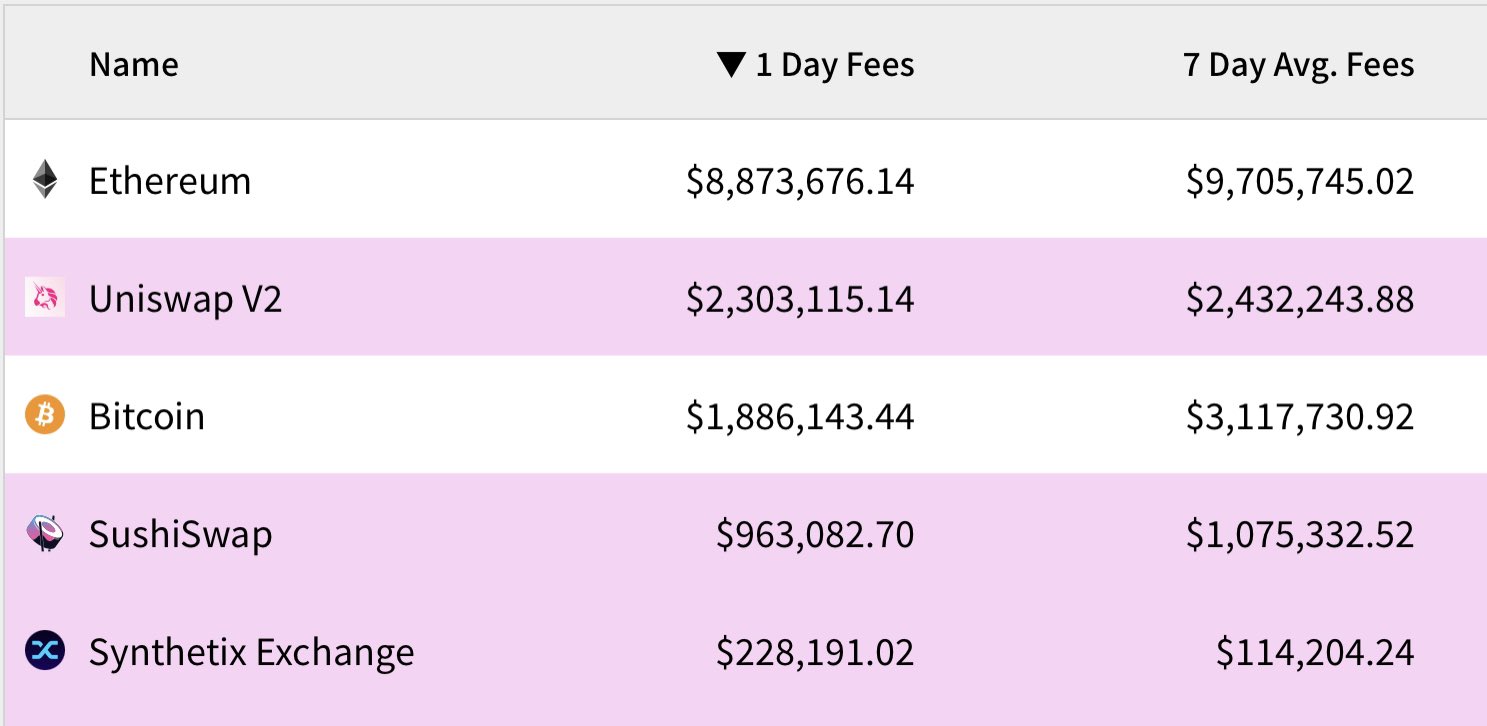

The amount of network fees generated by Uniswap surpassed Bitcoin on Monday. ParaFi Capital partner Santiago R Santos says it’s a sign of what’s to come from the DeFi movement.

“The great DeFi flippening. Today, Uniswap generated more network fees than Bitcoin.

It’s the first DeFi protocol, but not the last. The key feature here is that fees in DeFi not only benefit miners but also LPs (liquidity providers) and token holders. Monitor this.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Elena11/chanchai howharn