Crypto insights platform Santiment unveils a list of five altcoins that are surging on the back of growing interest among crypto traders.

In a new tweet, the analytics firm names XRP, Uniswap (UNI), Voyager Token (VGX), Curve (CRV), and 1inch as the beneficiaries of soaring interest from crypto traders.

“XRP, UNI, and midcaps like VGX, CRV, and 1NCH have led the altcoin charge over the past 24 hours. Crowd interest has (at least temporarily) shifted away from Bitcoin and Ethereum as on-chain fundamentals are being used to identify upcoming pumps.”

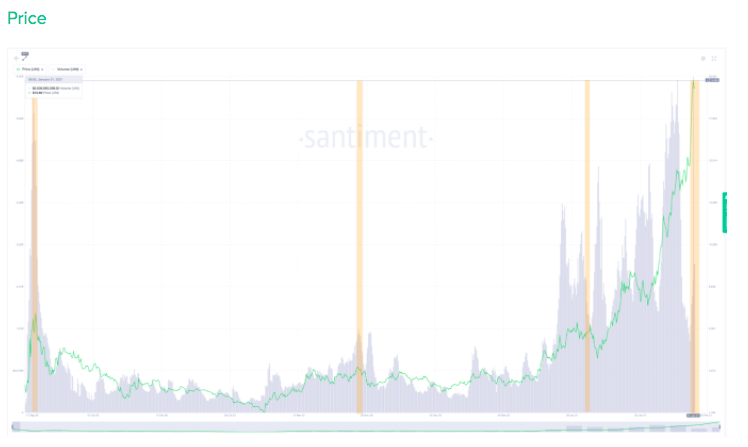

Santiment is also putting the spotlight on UNI after the decentralized exchange (DEX) token printed a new all-time high of $20. The crypto intelligence platform looks at various on-chain signals to determine whether UNI is ripe for a correction.

Santiment says that Uniswap remains the market leader in the (DEX) space in terms of volume and number of trades with no signs of slowing down even if the platform is no longer incentivizing users with yield farming rewards.

While activity on the DEX continues to be strong, Santiment highlights that UNI’s price is surging amid a considerable drop in volume. The firm says the divergence suggests that a price reversal may be on the horizon.

Santiment adds that UNI’s social volume has skyrocketed to its highest level in three months, which is another indication that a short-term top may be in place.

“As usual, the crowd tends to FOMO in at the top, suggesting that this might be a local top forming for UNI.”

The crypto analytics firm also notes that the increasing coin supply on exchanges does not bode well for UNI.

“With the recent price rally, we are seeing a spike in Coin supply on exchanges, this should act as sell pressure for now but the next few days should show us a clearer picture of how things will do.

Price tends to dip following any sharp spikes up in Coin supply on exchanges as observed in the past.”

All in all, Santiment expects UNI to top out and dip as the threat of new supply entering the market could turn the crypto asset bearish.

“A temp top might be forming as the crowd FOMOs in and some market participants sending their UNI to exchanges.

Given the rise in UNI’s price, the community treasury is now a very sizable one (it was previously $500M). It should be more than $1 billion now at their disposal…

Once the warchest is active, we should also see more UNI circulating, which should also result in some sell pressure eventually.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix