The digital asset manager Grayscale just bought $38 million worth of Ethereum (ETH) on behalf of its investors.

The firm temporarily closed the Grayscale Ethereum Trust in late December.

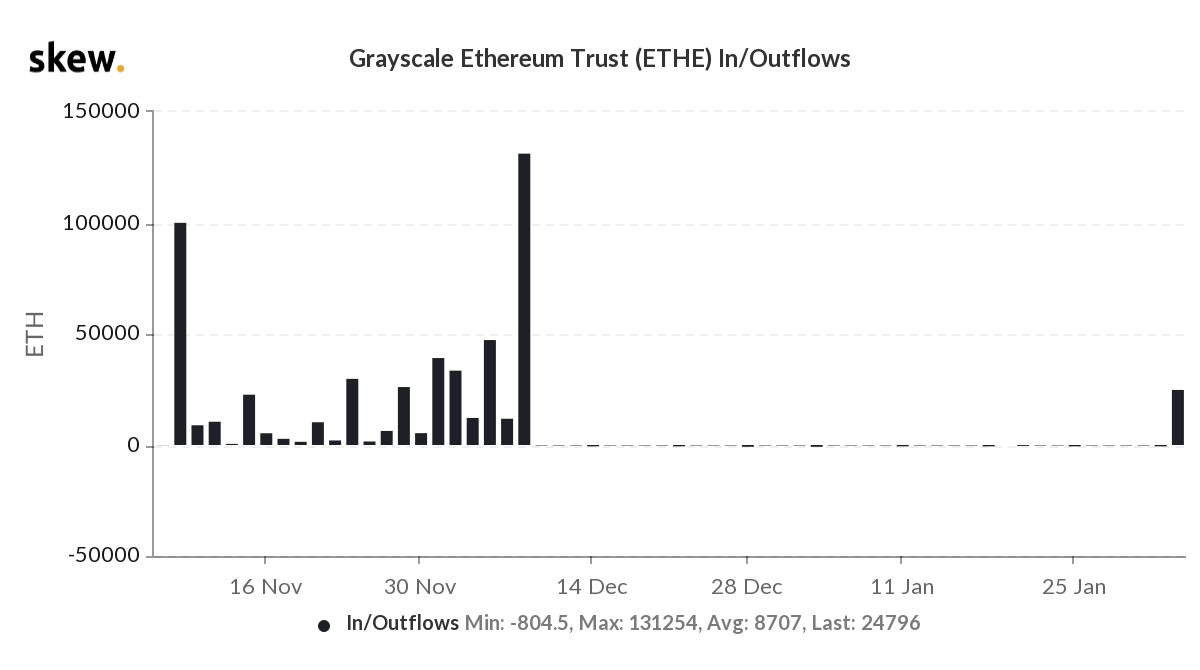

Now that it’s back online, data from the analytics company Skew shows the investment product is up and running.

With the additional 24,796 ETH, Grayscale now manages more than $4 billion worth of the second-largest cryptocurrency.

Grayscale’s recent ETH purchase comes as the crypto asset breaks all-time highs ahead of the launch of the Ethereum futures on the Chicago Mercantile Exchange (CME) on February 8th.

Using data from Ethereum options trading, Skew says about 25% of traders expect ETH to breach the $2,000 mark in the next 90 days.

Ether probability distribution widens as implied vol picks up ahead of the CME listing.

Probability ETH > $2,000 in three months = 25% pic.twitter.com/GgblwYP9Tw

— skew (@skewdotcom) February 3, 2021

At time of writing, ETH is worth $1,681.77, according to CoinMarketCap.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Gleti