Digital asset manager Grayscale has added hundreds of millions of dollars worth of Bitcon (BTC) and Ethereum (ETH) to its crypto portfolio in the last few weeks.

According to crypto trading and intelligence platform Bybt, the crypto behemoth tallied up an additional 7,280 BTC worth $348.28 million and 240,000 Ethereum worth $361.5 million to its crypto holdings from February 1st to February 26th. In total, Grayscale pushed its total GBTC and ETHE holdings by $709.2 million this month.

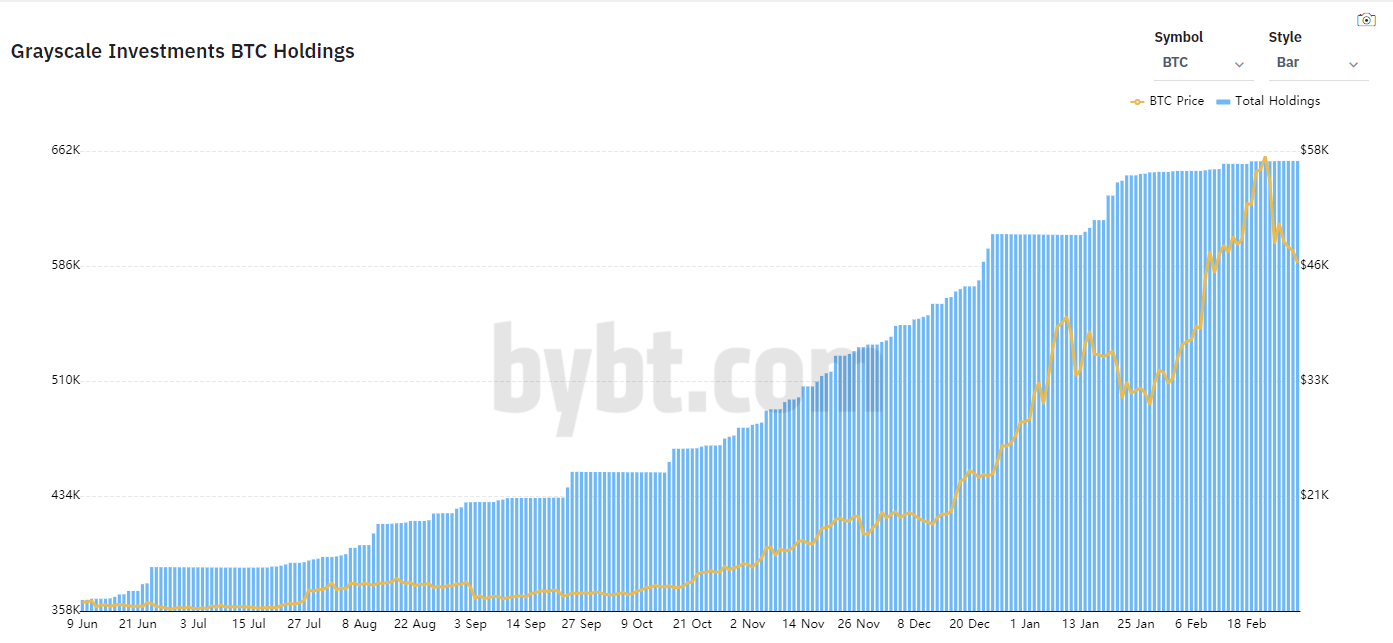

Bybt shows that Grayscale had 648,470 BTC in its Grayscale Bitcoin Trust (GBTC) on February 1st and it grew its trove of the largest crypto asset to around 655,750 by February 26th.

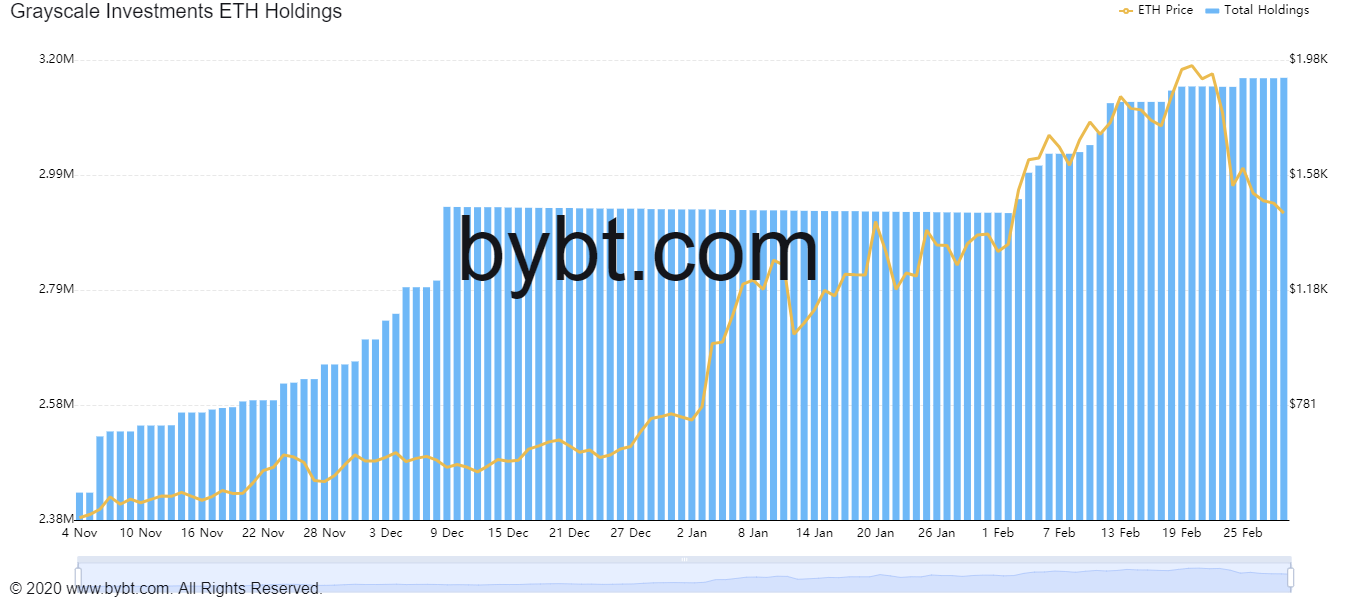

As for the company’s Ethereum Trust (ETHE), Grayscale started the month of February with 2.93 million ETH in its portfolio. By February 26th, the company pushed up its total ETH holdings to 3.17 million.

Grayscale’s accumulation of the two largest crypto assets brings the investment firm’s total assets under management (AUM) to $35.38 billion, according to Bybt.

In 2020, the Grayscale Bitcoin Trust grew from $1.8 billion to a whopping $17.5 billion in AUM.

While Bitcoin and Ethereum make up the bulk of the digital asset manager’s portfolio, they also offer products that allow exposure to Litecoin (LTC), Bitcoin Cash (BCH), Ethereum Classic (ETC), Zcash (ZEC), Horizen (ZEN), and Stellar (XLM).

Additionally, Grayscale turned heads in January when they registered a sizeable list of new altcoin trusts. These trusts include Aave (AAVE), Cardano (ADA), Cosmos, (ATOM), EOS (EOS), Monero (XMR), Uniswap (UNI), and Polkadot (DOT).

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/jamesteohart