Data from crypto intelligence platform Santiment reveals that big-money players are quietly accumulating Ethereum (ETH) as the second-largest cryptocurrency bounces from its 30-day low of $1,300.

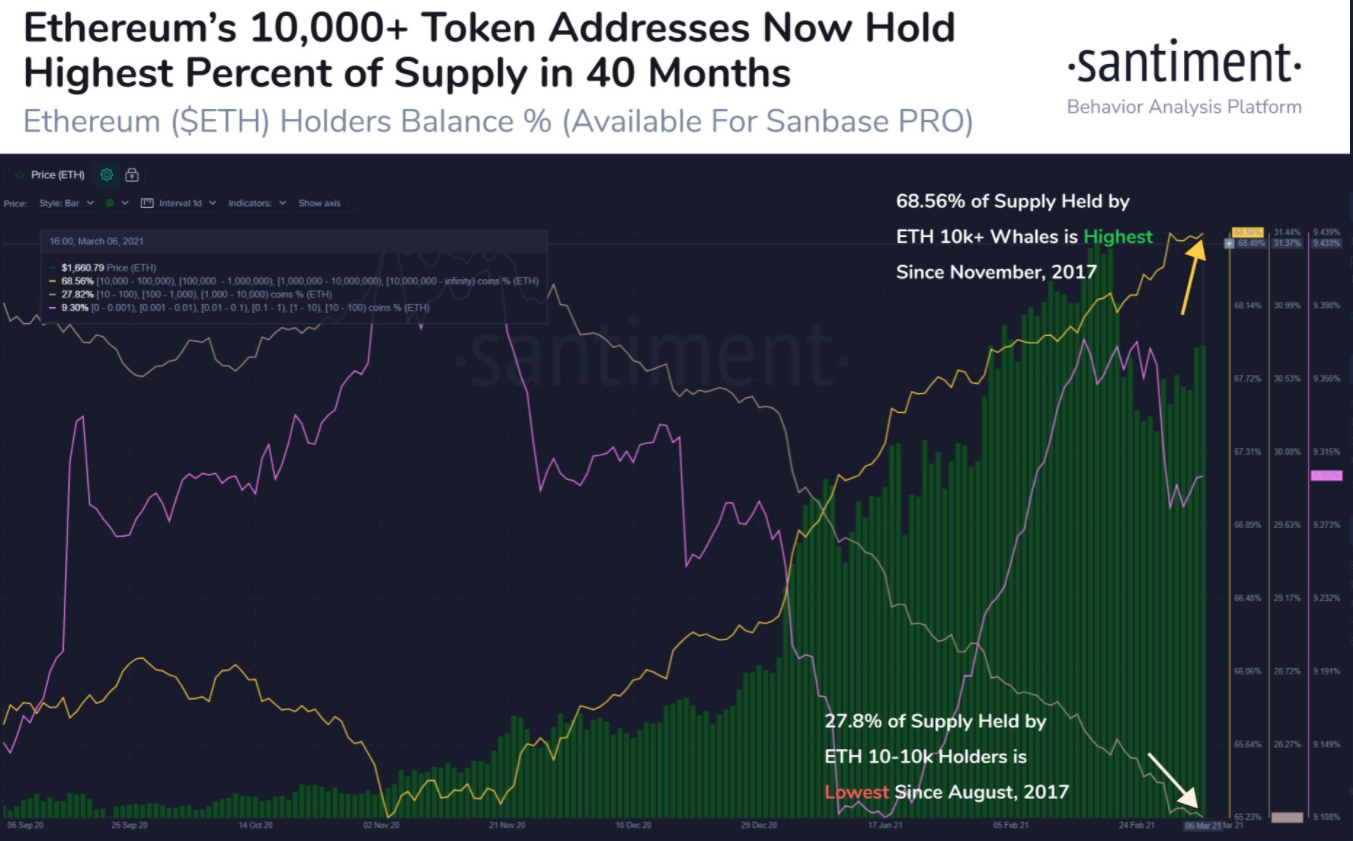

In a new tweet, Santiment tells its 50,500 followers that the percentage of Ethereum’s supply owned by whales that hold over 10,000 ETH has reached a level not seen since the 2017 bull market.

“As Ethereum rebounded above $1,685 today for the first time in 10 days, whales (owning 10k+ ETH) now own 68.6% of the total supply. This is the highest percentage owned by whales since Nov, 2017.”

As mega whales gobble up Ethereum’s supply, Santiment notes that the percentage of addresses that own 10,000 ETH or less has plummeted in the last three months.

“10-10k addresses meanwhile, own the lowest percentage since [August], 2017.”

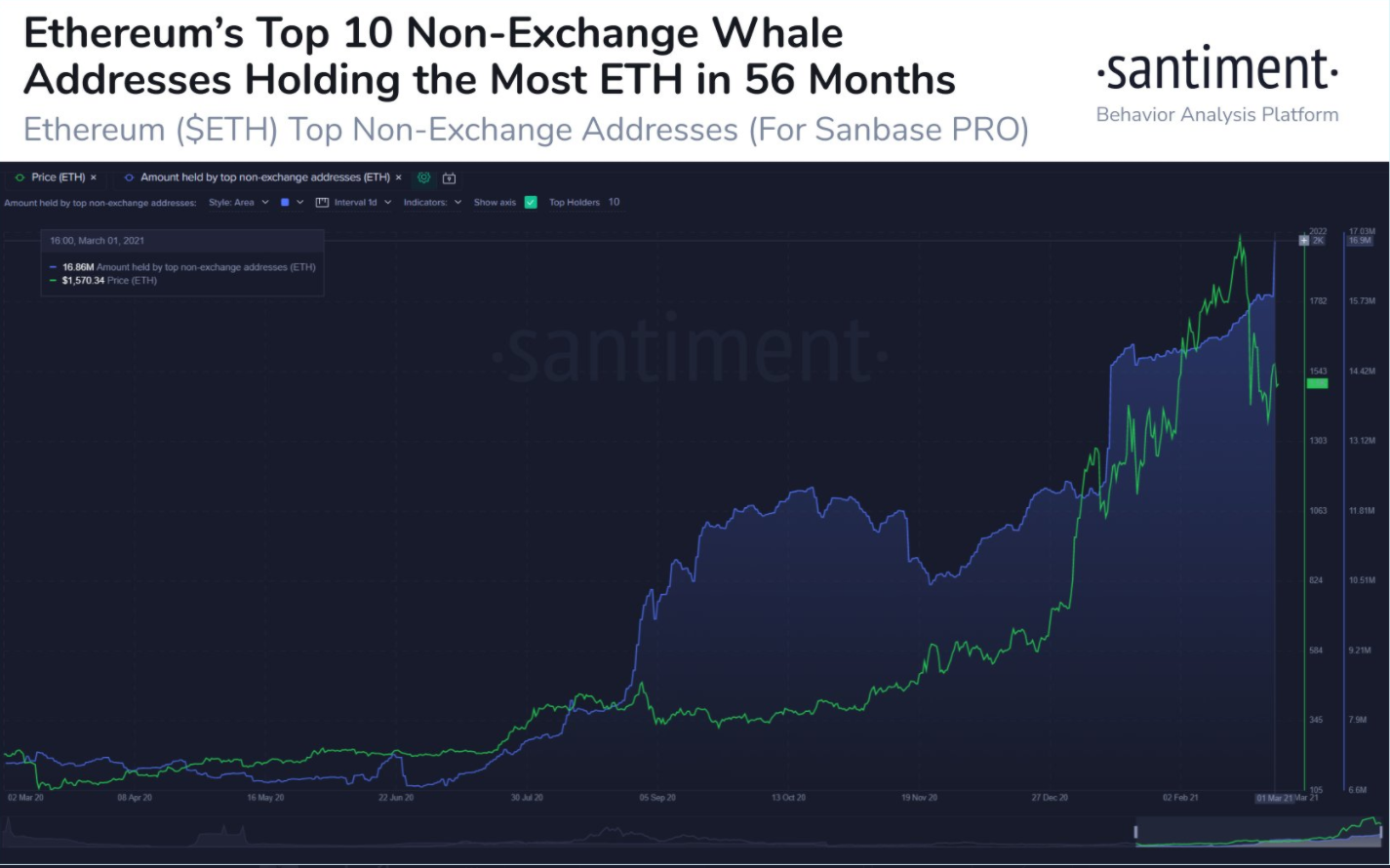

The crypto insights platform takes its analysis a step further as it reveals that the 10 largest Ethereum whales are snapping up the second-largest cryptocurrency.

“Ethereum’s top 10 non-exchange whale addresses are now holding the most combined supply of ETH tokens (16.86 million) since July, 2016. On March 1st, a single-day addition of 1.03 million tokens was added among these addresses, the highest one-day jump in 6 weeks!”

With whales accumulating ETH at a rapid rate, crypto analyst and influencer Lark Davis believes the second-largest cryptocurrency is poised to ignite the next leg of its bull cycle.

“Ethereum break out still moving along nicely. More volume would be nice, but we are now closing above resistance. $2,000 by the end of the week in play.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Maria T Hoffman