Ki Young Ju, chief executive of on-chain insights platform CryptoQuant, says that it’s time to go all-in on Bitcoin.

In a new tweet, Ki Young Ju tells his 124,600 followers that he believes the time has come for him to put all his chips into the world’s largest cryptocurrency.

I think it's time. https://t.co/Do9CZ7BY85

— Ki Young Ju (@ki_young_ju) March 29, 2021

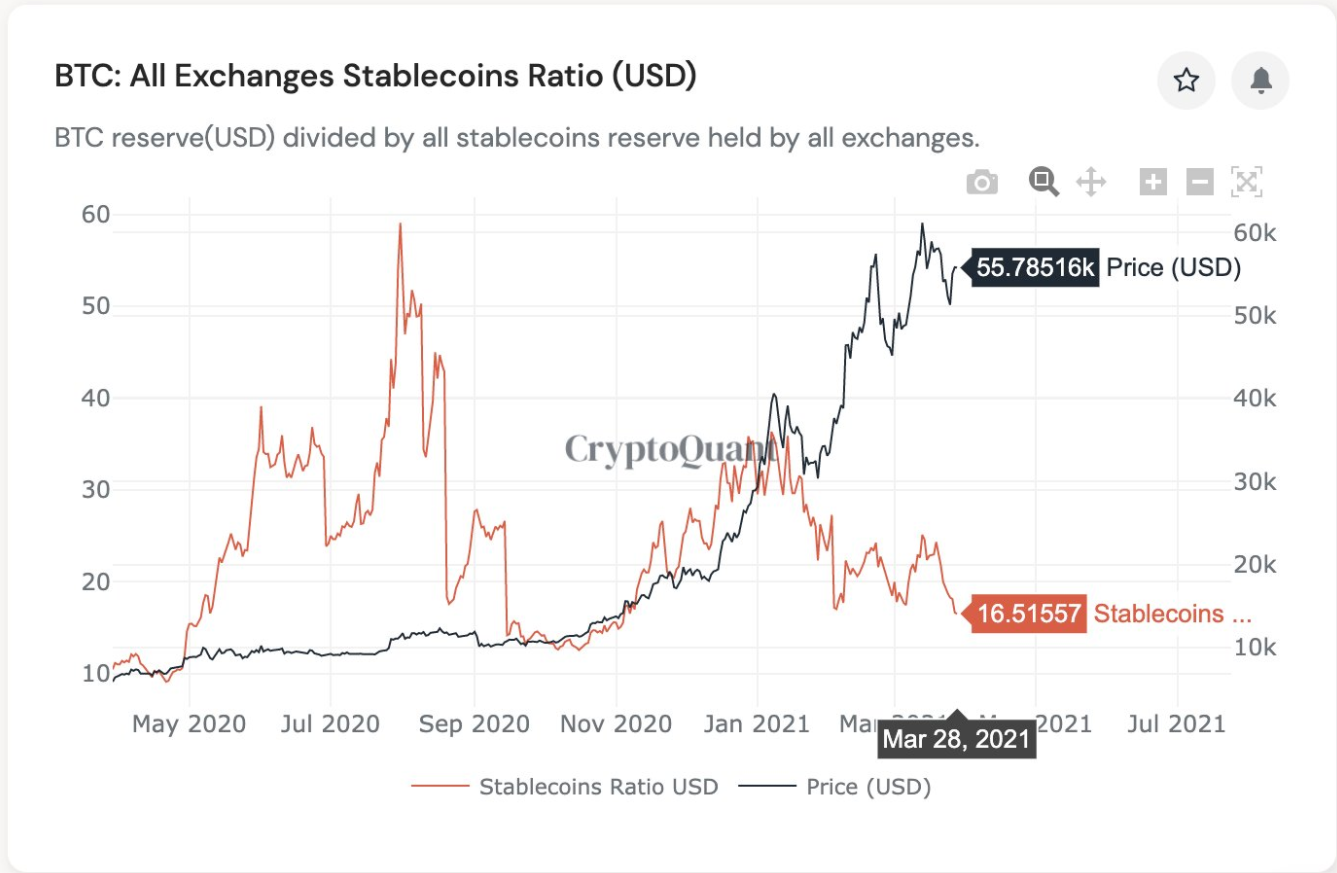

To support his bullish call, Ki Young Ju points to the correlation between the price of Bitcoin and the stablecoins ratio, a metric that divides BTC reserves by all stablecoin reserves stored in exchanges. According to the CryptoQuant executive, a plummeting stablecoin ratio indicates that Bitcoin and the broader crypto market may be gearing up for the next leg up.

“The crypto market is getting better in terms of supply/demand. Relatively many stablecoins across all exchanges thanks to the rise of USDC. BTC holdings are decreasing fast. Here’s the ratio that BTC holdings in USD divided by stablecoins holdings across all exchanges.”

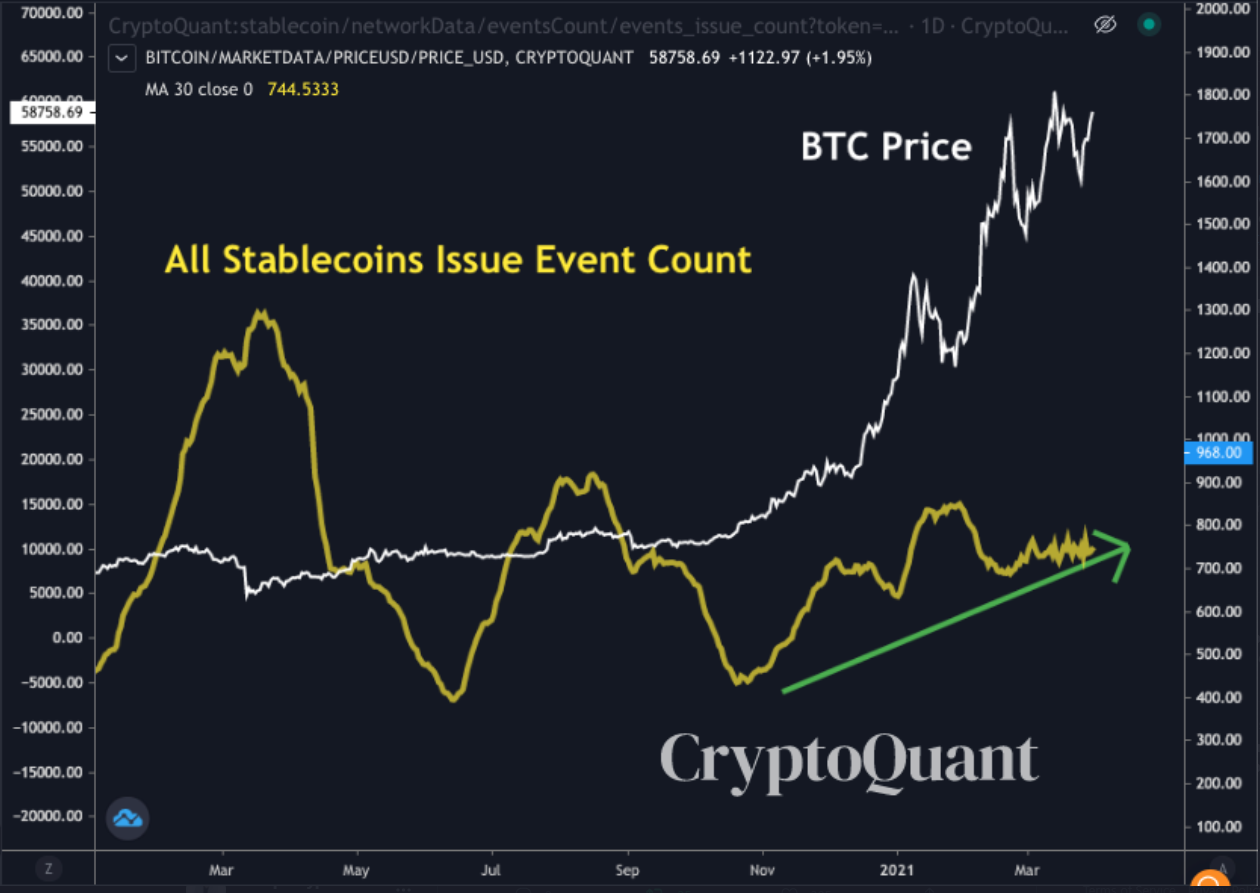

On top of the plunging stablecoins ratio, Ki Young Ju says that the stablecoin market is flashing buy signals.

“For all stablecoins,

Number of issuing event is increasing

Number of redeeming event is decreasing

And stablecoins circulating supply & exchange holdings hit an all-time high yesterday. Fewer people cashing out, more people buying stablecoins through fiat to purchase crypto. It’s bullish.”

On March 17th when Bitcoin was threatening to break $60,000, Ki Young Ju looked at the stablecoin market and tweeted that it would take more time before BTC can kick off another rally as there were “too many BTC holdings in USD compared to stablecoin holdings on spot exchanges.”

Eight days following his tweet, BTC plummeted to a low of $50,858, according to CoinMarketCap.

At time of writing, Bitcoin is trading at $58,997.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Aleksandra Sova