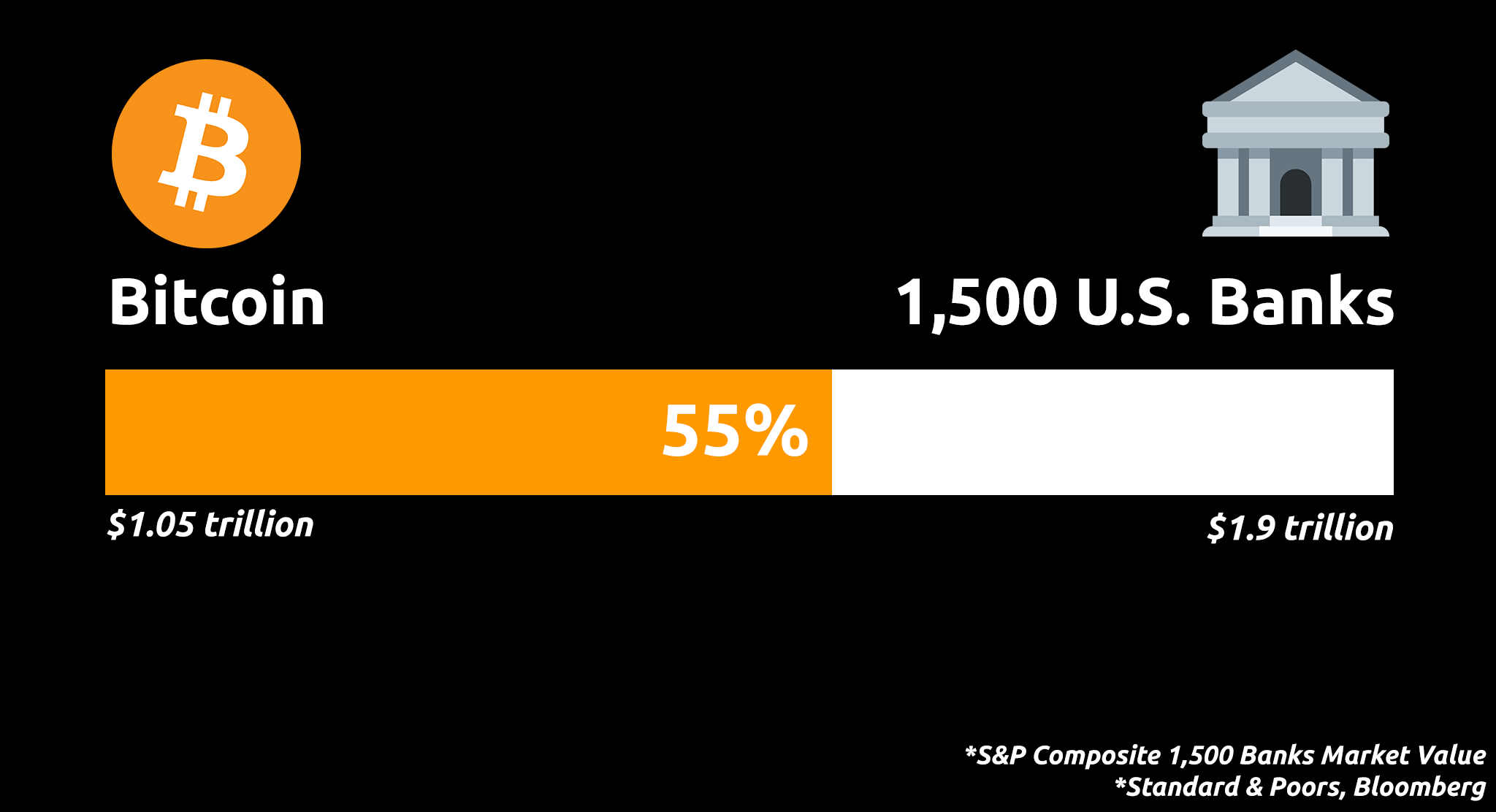

The market capitalization of the flagship crypto asset, Bitcoin, now beats that of more than 50% of all banks in the United States.

The popular pseudonymous crypto influencer DocumentingBTC compiled data from Bloomberg and the S&P.

It shows 1,500 US banks boast a total market capitalization of $1.9 trillion, while Bitcoin alone is valued at $1.05 trillion.

Bankers like JPMorgan Chase CEO Jamie Dimon are noticing the rise of crypto.

In a new letter to the bank’s shareholders, Dimon cites cryptocurrencies as a ‘serious emerging issues’ that should be properly regulated.

“There are serious emerging issues that need to be dealt with – and rather quickly: the growth of shadow banking, the legal and regulatory status of cryptocurrencies, the proper and improper use of financial data, the tremendous risk that cybersecurity poses to the system, the proper and ethical use of AI, the effective regulation of payment systems, disclosures in private markets, and effective regulations around market structure and transparency.”

Last year, the the Office of the Comptroller of the Currency (OCC) gave US banks the green light to offer crypto custody services to their customers. Since then, BNY Mellon has announced it will support Bitcoin and other crypto assets through its new enterprise Digital Assets unit.

As for JPMorgan’s take on Bitcoin, the bank recently revised its long-term price target for Bitcoin from $146,000 to $130,000.

JPMorgan reasons that at the $130,000 price level, Bitcoin’s market cap would rival the total value the private sector has invested in the yellow metal.

“Mechanically, the Bitcoin price would have to rise [to] $130,000 to match the total private sector investment in gold.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mihai_Andritoiu