Widely-followed on-chain data analyst Willy Woo says that Bitcoin will see a time where it’s less volatile than fiat money.

In a series of tweets, the prominent crypto trader counters the argument that Bitcoin is too volatile to be used as money or a stable unit of account.

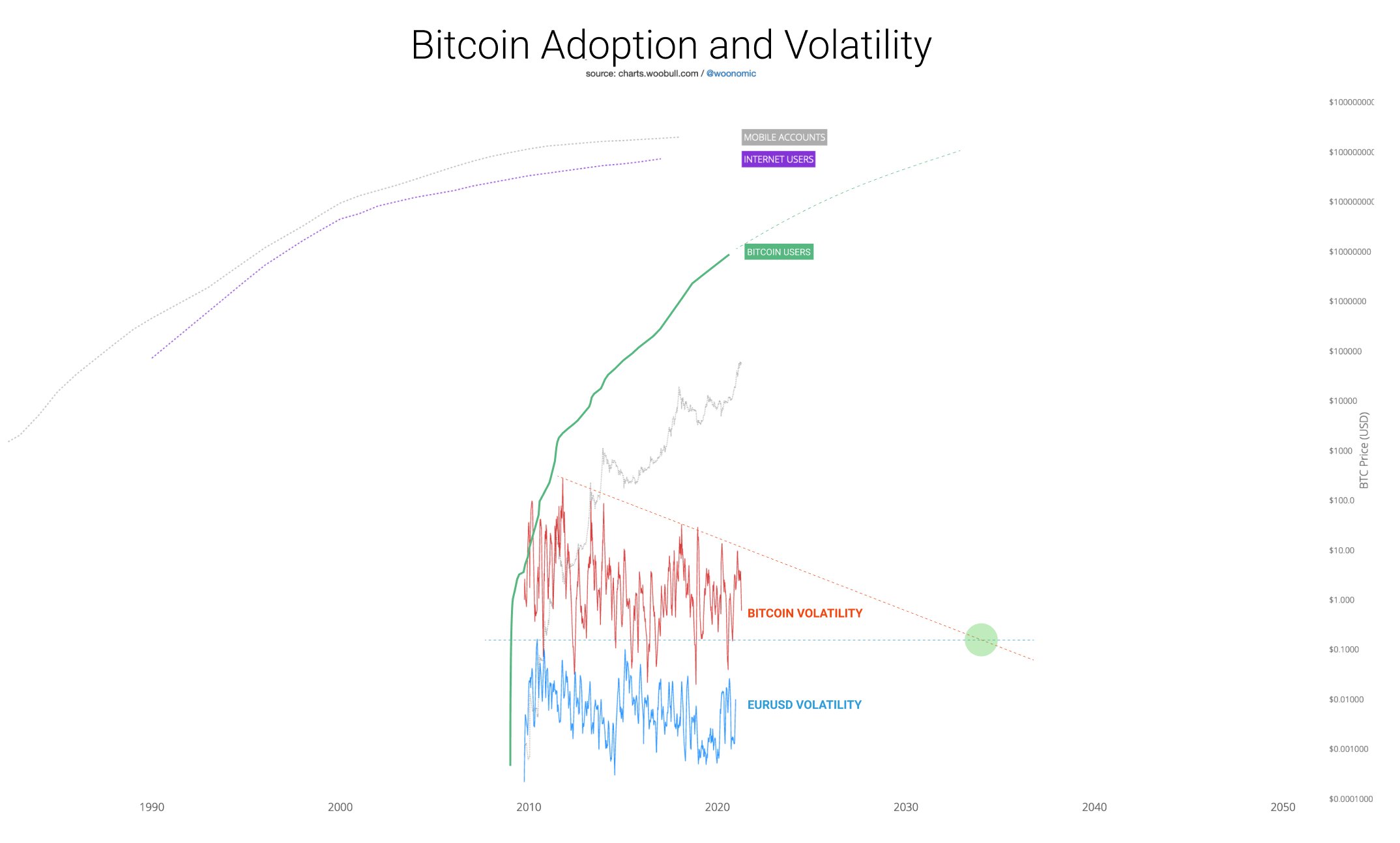

Woo compares the gradual decrease in Bitcoin’s volatility as it experiences widespread adoption to the volatility of the EUR/USD pair. He forecasts that within a decade and a half, BTC will be at the same level of volatility as the euro-dollar pair.

“‘Bitcoin is too volatile to be money.’

In reality, BTC’s peak volatility is on track to drop below fiat volatility (EURUSD) in 13 years, roughly when its adoption base equals that of the Internet.”

The on-chain analyst adds that Bitcoin is volatile now because it is denominated in US dollars, but he says that can change in the coming years.

“It really depends on how the future of money turns out, and who’s on the denominator.

If it flips the current fiat regime, and becomes part of the new monetary base, then the unit of account becomes largely expressed in BTC; everything else becomes volatile against it.

The volatility you see right now is upward volatility associated to its fast exponential climb towards global acceptance. This will become clearer to the world once 1 billion people find exposure to this asset. At current growth, that’s less than four years away.”

The closely-followed analyst also highlights that Bitcoin’s volatility encourages valuable participation in the market that ultimately sparks exponential growth.

“Volatility brings traders, traders bring liquidity, liquidity unlocks institutions, institutions unlock sovereigns.

At a certain scale, money is redefined. But it starts with volatility.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/arleksey