Macro guru Raoul Pal notes Bitcoin (BTC) is flashing the same bullish signal as it was before some of its big price explosions in the boom cycle of 2017.

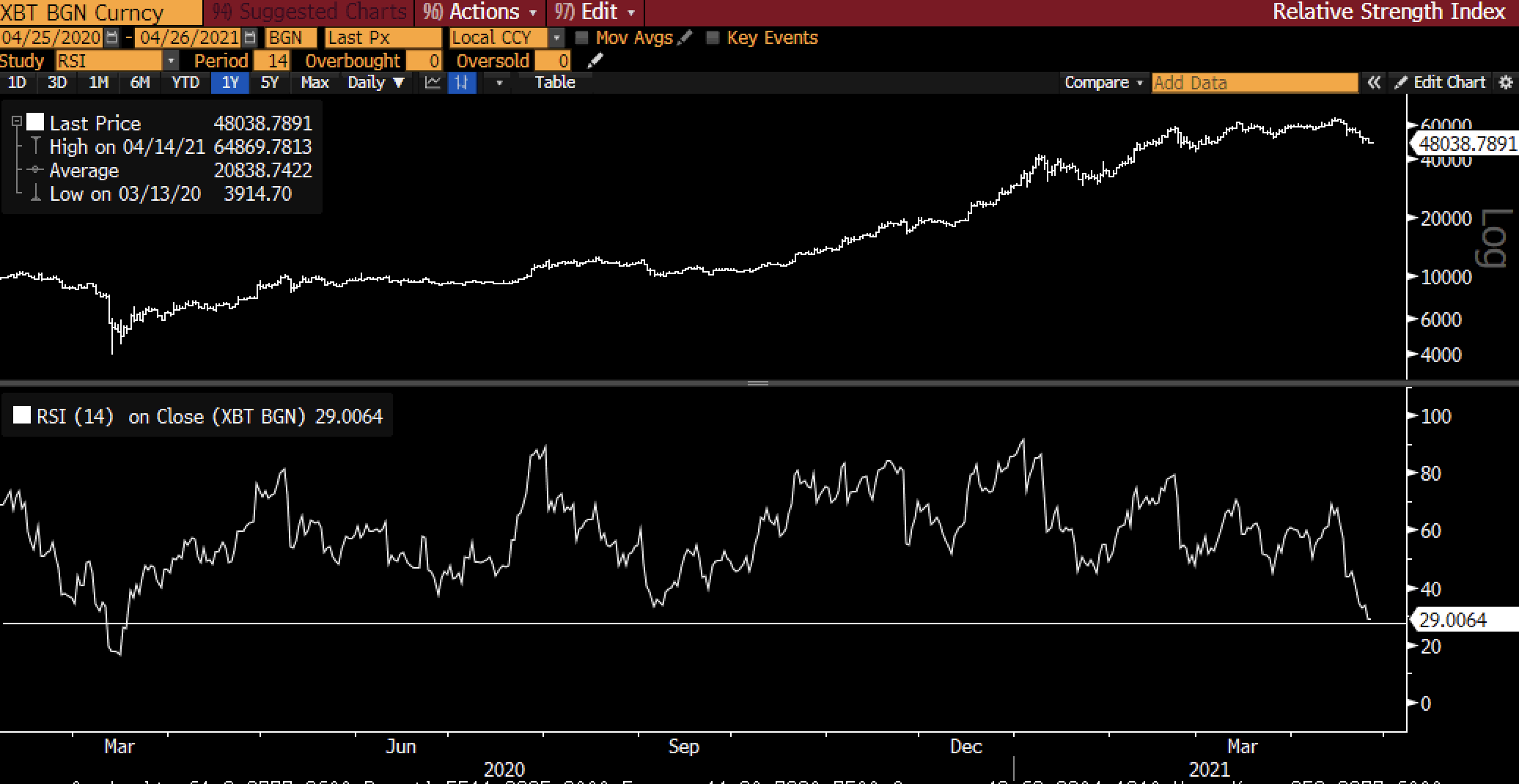

The former Goldman Sachs executive tells his 467,500 Twitter followers that Bitcoin’s relative strength index (RSI), is hovering at similar levels to what it displayed in the early stages of its massive 2017 bull run.

“The weekly RSI is close to the levels that we saw in corrections in the first part of the 2017 bull run, before Bitcoin hit hyperspace. These are the pauses that refresh a bull market.”

Pal, co-founder and chief executive of Real Vision Group & Global Macro Investor, also notes that Bitcoin is almost as oversold as it was during the coronavirus-induced sell-off last year, based on the RSI.

“Bitcoin is nearly as oversold as it was in March 2020.”

Last week, the longtime BTC bull said that he was battling the urge to sell off all of his BTC in order to buy more Ethereum (ETH).

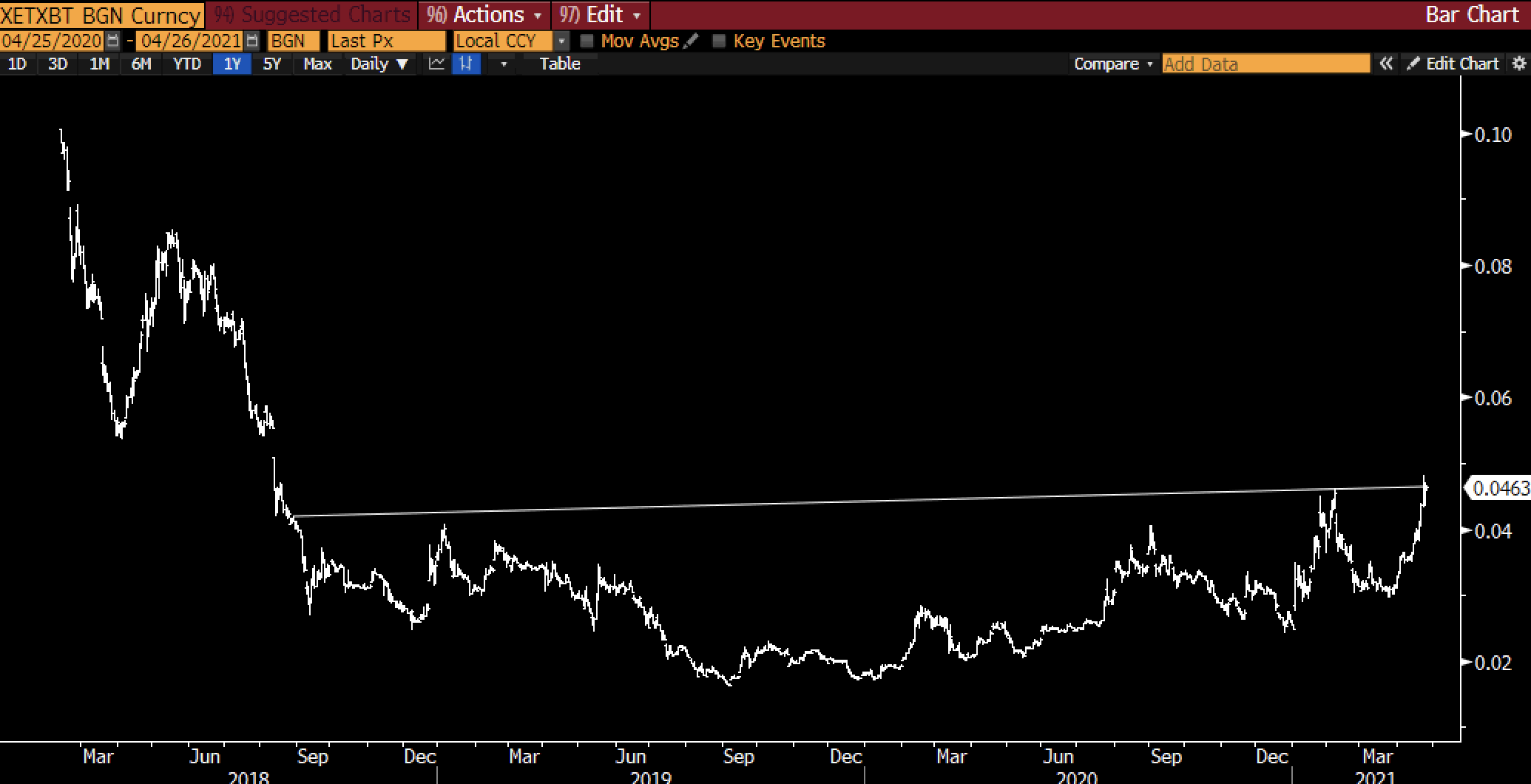

Pal updated those thoughts on Sunday, noting that the ETH/BTC pair is on the verge of a huge reversal that will end a multi-year downtrend.

“Also, the ETH/BTC cross is likely to correct a bit first, before breaking out. It is a spectacular base pattern.”

Overall, the macro guru says investors should take advantage of this current dip in the market.

“Corrections in a bull market are opportunities and not threats. Good luck. It’s going to be quite the year…”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Gehrke