Crypto intelligence company Glassnode is analyzing the behavior of long-term Bitcoin investors as the leading crypto asset continues to consolidate below $60,000.

In a new tweet, Glassnode highlights to its 193,100 followers the importance of tracking the movement of long-term holders (LTH).

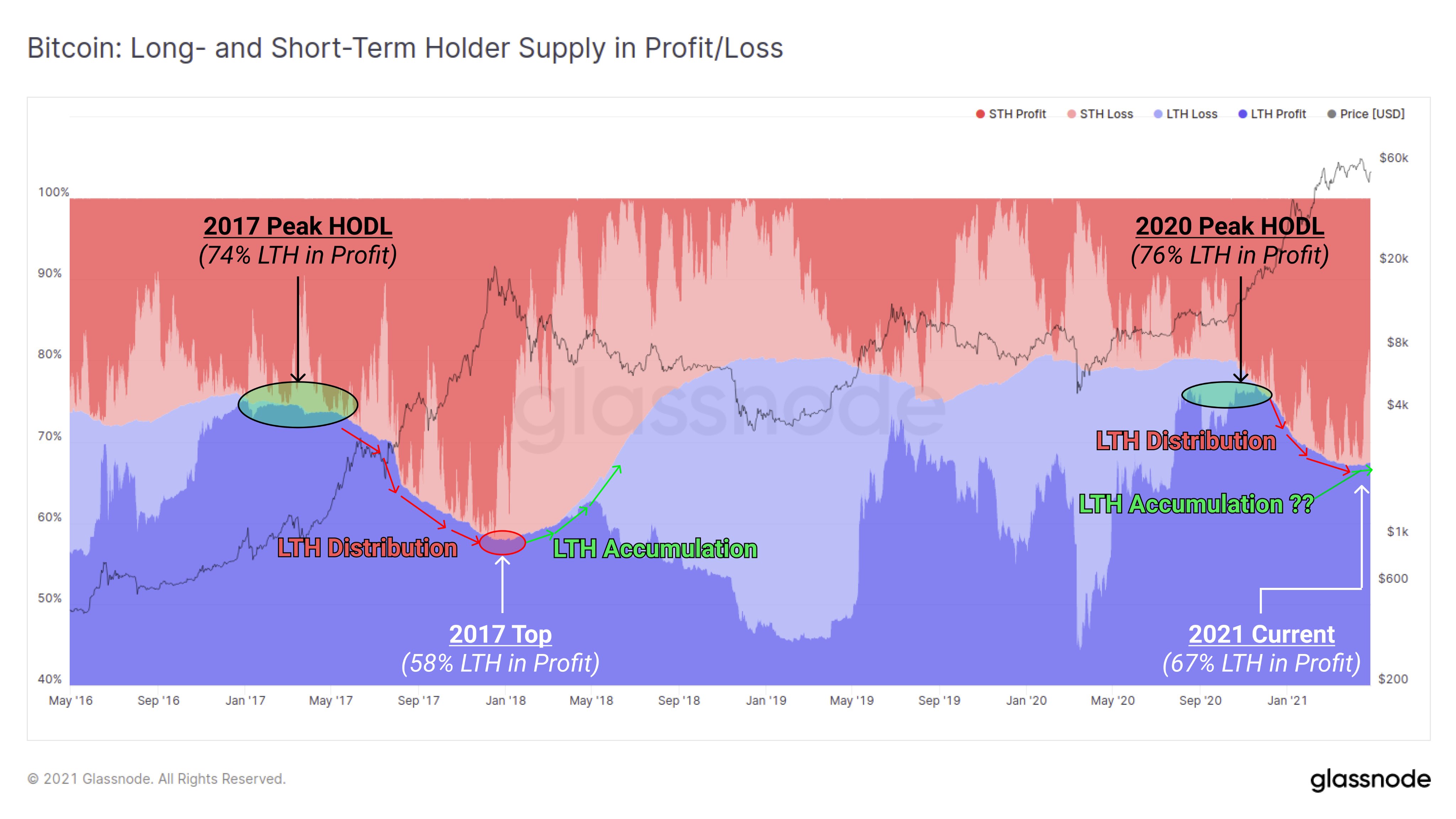

According to the data analytics firm, when long-term holders spend their BTC stash, it is a signal indicating that the boom cycle is nearing its conclusion. While the cohort took profits as Bitcoin rose from $10,000 to over $50,000, Glassnode says that a new batch of long-term holders is accumulating BTC at current levels.

“At 2017 top, LTHs had reduced their holdings from 74% to 58% of circulating supply. Currently, coins accumulated in late 2020 are maturing and LTH-owned supply is actually increasing > 67%.”

Another indicator that Glassnode keeps a close eye on to track the behavior of long-term holders is the coin days destroyed metric, which looks at the value of each Bitcoin transaction while giving weight to the number of days since the coins were last moved.

The crypto insights platform says that the 90D coin days destroyed metric, which quantifies the amount of coin days destroyed in the last three months, has returned to a level suggesting that long-term investors are holding on to their Bitcoin troves.

“After an initial increase towards the beginning of the year, [90D coin days destroyed] has reset back close to baseline levels – indicating increased hodling from long-term investors.”

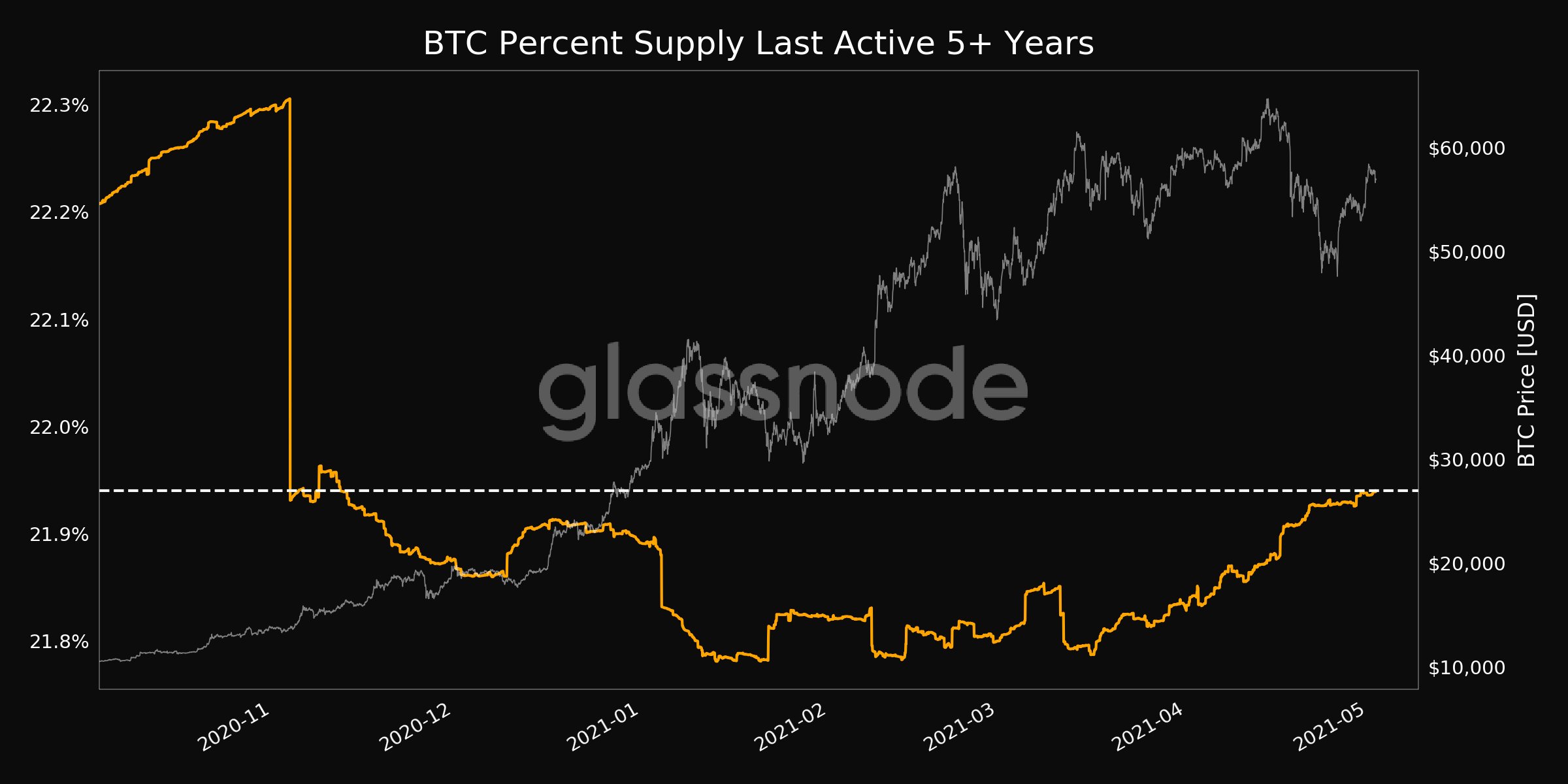

Looking at a multi-year timeframe, Glassnode shows increased hodling behavior from long-term investors as the percentage of circulating supply that has not moved in at least 5 years continues to surge.

“Bitcoin BTC Percent Supply Last Active 5+ Years just reached a 5-month high of 21.94%”

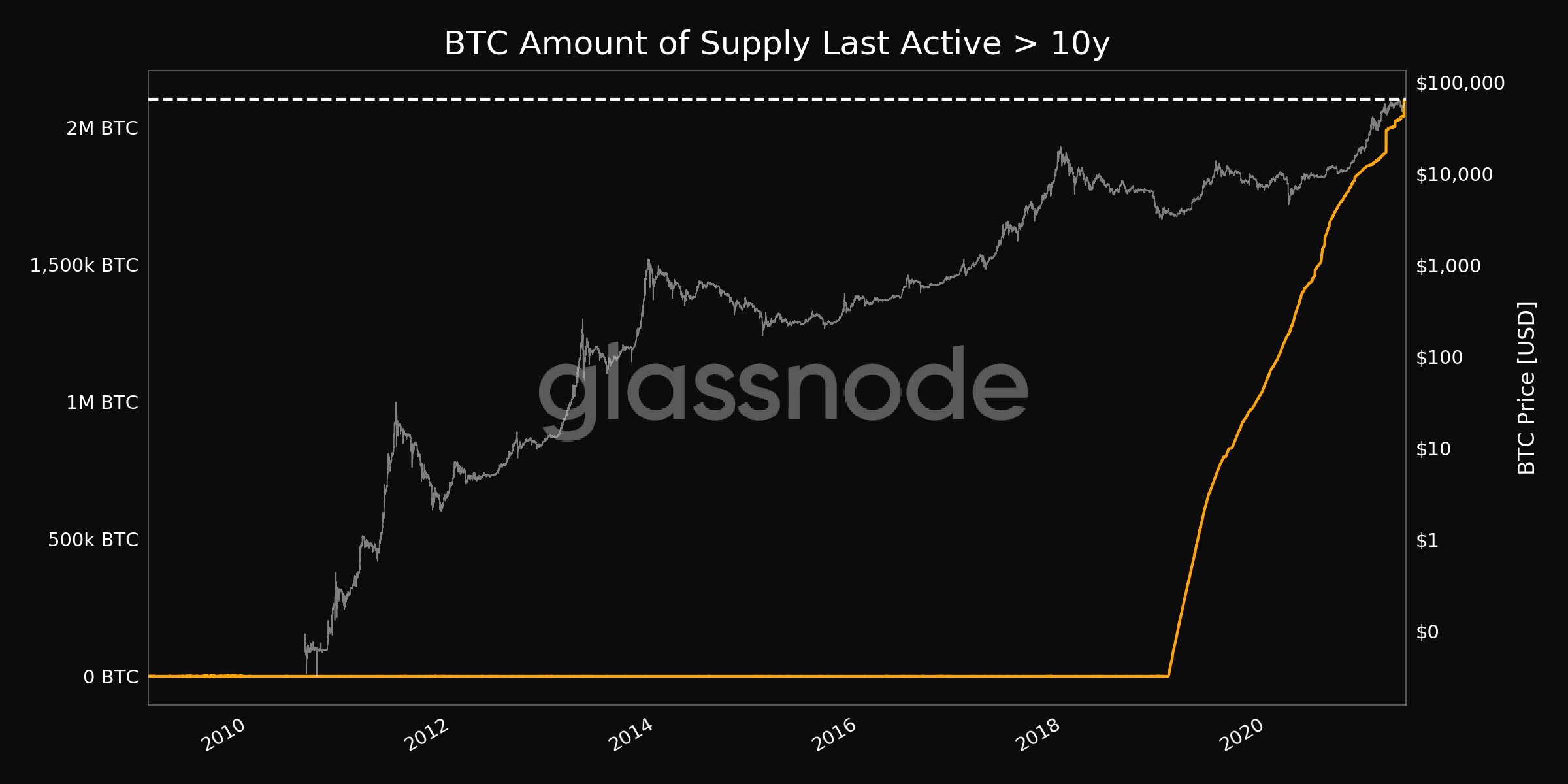

Over an even longer timeframe, Glassnode notes that the amount of coins that have not moved in over 10 years has hit a new all-time high (ATH).

“Bitcoin BTC Amount of Supply Last Active > 10 years just reached an ATH of 2,102,437.584 BTC.”

The surge in hodling behavior comes as on-chain analyst Willy Woo predicts that a BTC supply crunch is looming. Woo says that the supply crisis will be more drastic than the one that pushed Bitcoin to rise 2,000% in 2017.

“We can see this from tracking the flows of coins out of the exchanges, where typically people speculate or buy and sell their coins, and they have a set inventory, some of which is allocated for speculation. We’ve just seen an unprecedented amount of depletion of that inventory.

If you look back in the 2017 bull market, we saw like a five-month depletion of inventory, and that was enough to propel the bull market of 2017 right up to the $20,000 [mark] from what initially was about $1,000 to $1,500 when the inventory depletion ended, and now we’re in this zone of the Lehman’s 12 months of inventory depletion.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/klyaksun