An emerging on-chain analyst believes that the Bitcoin bull market is intact in spite of the leading crypto asset’s latest crash to $46,000.

In the most recent installment of the Pomp Newsletter, Will Clemente looks at on-chain activity and concludes that the Bitcoin bull market is not yet over.

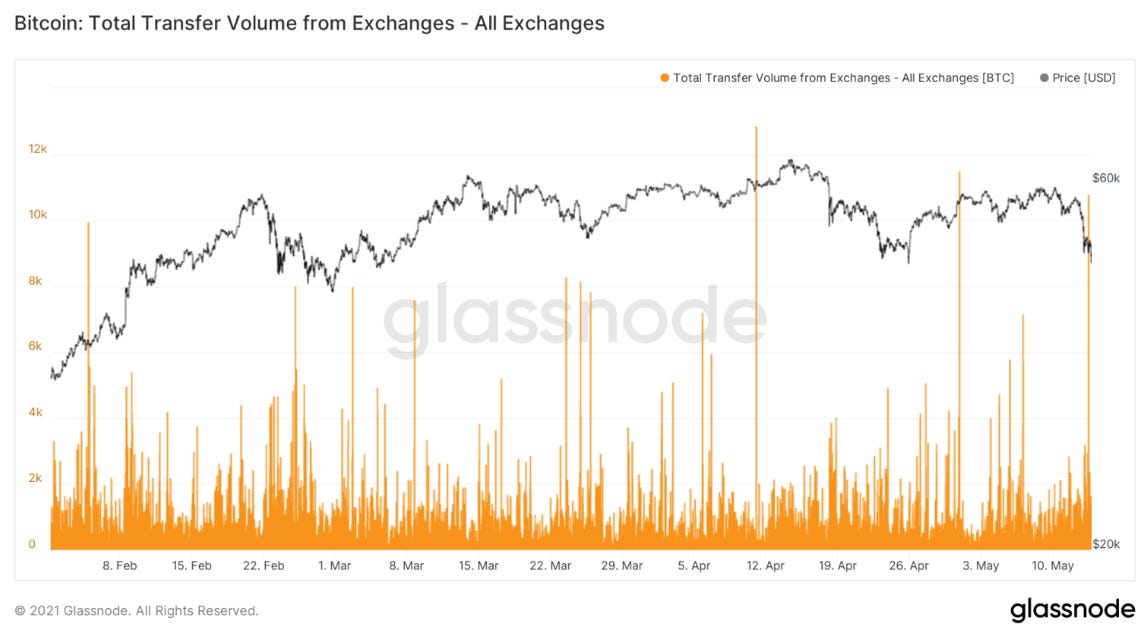

He points to activity on crypto exchanges which he says indicates that deep-pocketed investors bought the BTC dip as fear gripped the market.

“Speaking of exchange flows, one of the largest exchange outflows of the year took place amidst all the panic. OTC outflows also spiked during the dip; it appears big money bought the fear.”

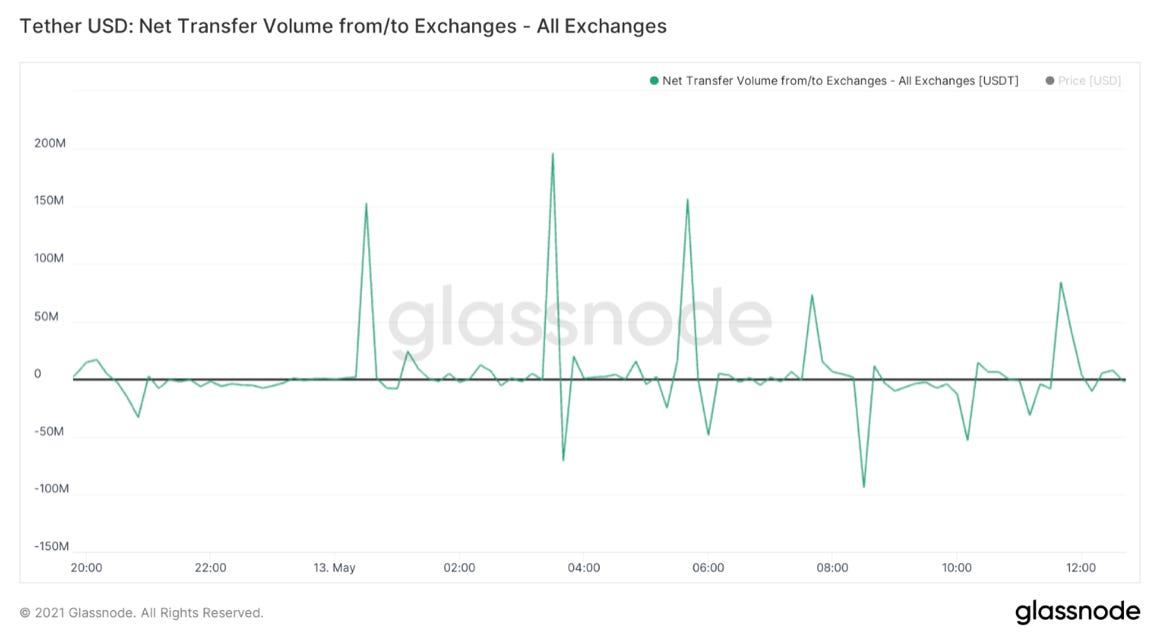

The on-chain analyst notes the large influx of stablecoins onto exchanges as well, suggesting that investors are gearing up to buy the pullback.

“Roughly $460 million of Tether (USDT) was printed following the sell-off. In the chart below showing net transfer volume, over $650 million of Tether was moved onto exchanges Thursday. Tether does not always signal instant buys, but capital is on exchanges waiting to be deployed.”

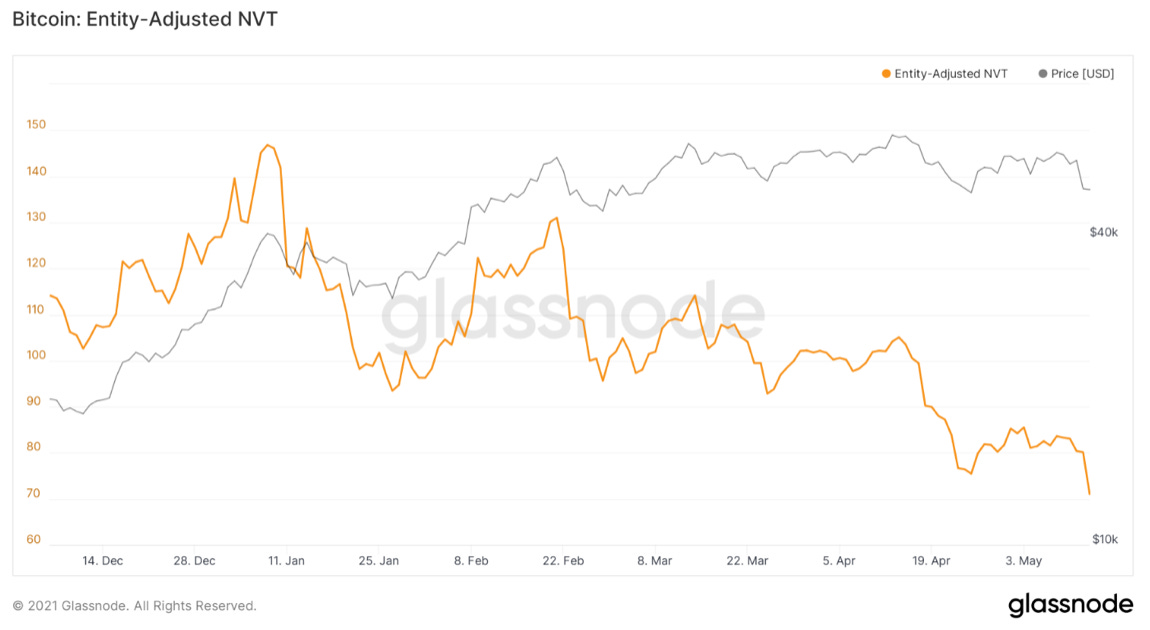

Clemente is also looking at the NVT metric (network value to transaction), which is calculated by dividing the market cap of Bitcoin by on-chain transactional volume. According to the analyst, the NVT is on a downtrend, indicating that underlying investor activity is outperforming the growth of BTC’s market cap.

“This means that this bull run is becoming less overheated as underlying investor activity continues to outpace market cap. This also is a sign of consolidation.”

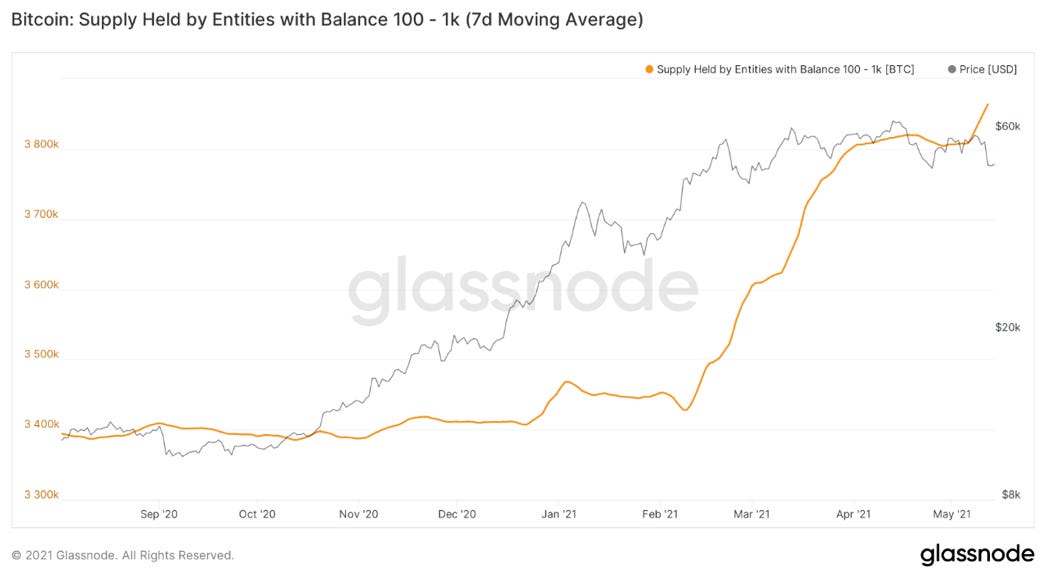

Another on-chain metric that Clemente is keeping an eye on is the number of entities holding large amounts of Bitcoin. While the number of whales or entities with balances of over 1,000 BTC is on a downtrend, Clemente notes that a smaller group is picking up the slack.

“The number of whales (entities with balances over 1,000 BTC) is still trending down. This is not abnormal or anything to be concerned about, as whales usually begin to scale out of their positions mid-way through the bull run. In fact, in 2017 the growth of whales peaked around $675, which of course was far from the top.

Despite the sell-off from the whale cohort, entities with 100-1,000 BTC continues to trend upward, actually offsetting the decrease in the 1,000 -10,000 cohort by 86,160 BTC.”

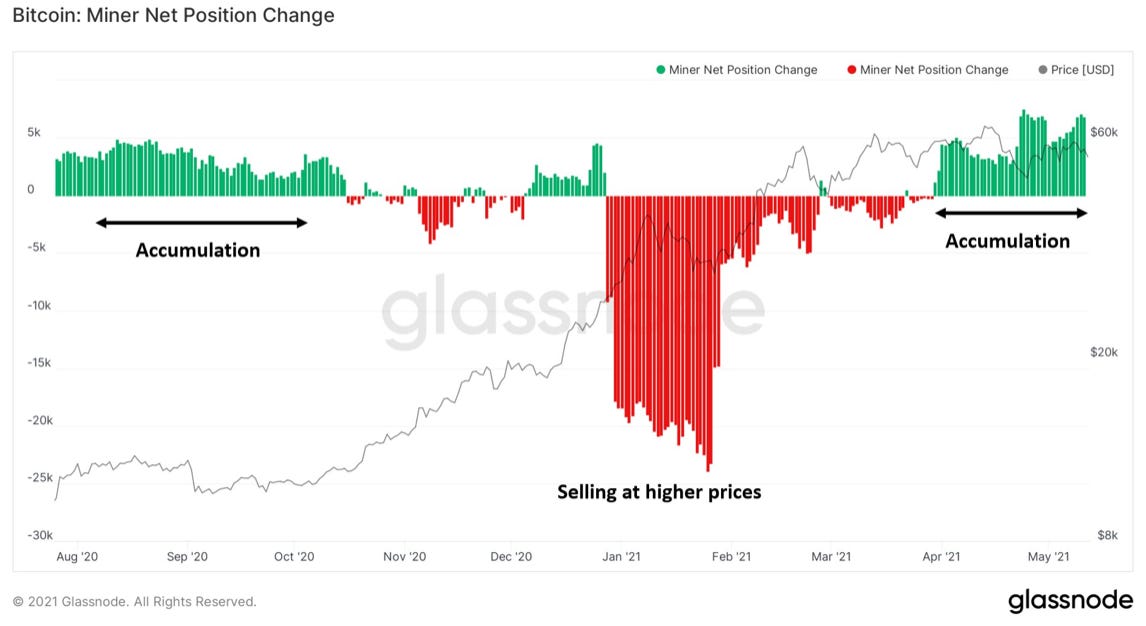

Miner activity is also on Clemente’s radar. According to the on-chain analyst, miners are still heavily accumulating despite the significant drop in Bitcoin’s value.

“Miners still do not seem phased by short-term price action and continue to accumulate as they have throughout this entire consolidation. This can be illustrated by two metrics: the first of which is miner net position change. This measures the trailing 30-day average of miner balance movements. This metric has been in the green for well over a month now. Miner unspent supply is also still trending up and saw a spike during the sell-off.”

Looking at these metrics, Clemente concludes that the bull market remains intact as Bitcoin continues to show signs of reaccumulation.

“Wednesday’s event was unfortunate for short-term price action, but changes nothing in the longer-term bull structure. This does not change the fact that on-chain shows BTC is still consolidating. We continue to build up a large zone of on-chain volume at these levels, shown by unrealized price distribution (URPD). I remain bullish for the coming weeks.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/alphaspirit.it