Career trader Peter Brandt is raising eyebrows after crafting a chart comparing Bitcoin’s current price action to historical precedent.

Brandt took to Twitter to ponder whether Bitcoin’s price action is similar to moments in 2018 and 2019 at the start of major periods of decline and stagnation.

ANALOGs?$BTC pic.twitter.com/4dpJK3FAfd

— Peter Brandt (@PeterLBrandt) May 19, 2021

Shortly after posting the chart, Brandt said he has no plans to discuss crypto for about a month.

“Through 46 years as a trader I have suffered through some tough trades. I know what it is like to worship at the Porcelain (sic) alter. I am not without feelings and will discontinue Tweeting about cryptos for a month or so knowing some of you are experiencing pain.”

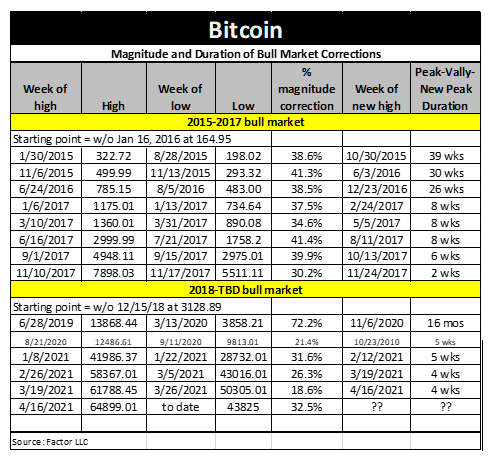

Bitcoin briefly fell more than 50% from its record high in April on Wednesday, to a low of $30,415. While sarcastically noting that the entry of institutional investors was “supposed” to reduce volatility, the career trader points out that the drop is the largest correction since Bitcoin fell 72.2% between June 28th, 2019 and March 13th, 2020.

“Now officially the largest correction since the March 2020 low. But how can this be????? There is supposed to be institutional support. BTC. This was not supposed to happen!!!!!”

On April 23rd, after Bitcoin made a sharp drop overnight from $54,000 to $48,000, Brandt revealed that he had entered buy orders at below the $33,000 mark.

“I have entered orders overnight to buy BTC at $32,501.”

At the time, the flagship crypto asset needed to fall to reach Brandt’s preferred entry price, but his bids may have been filled as Bitcoin plummeted below his order during the recent wild dip.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/GrandeDuc