A widely-followed analyst known for being the first to apply the stock-to-flow model (S2F) to Bitcoin is sharing his thoughts on the state of the BTC market after the leading cryptocurrency sharply fell from its all-time high.

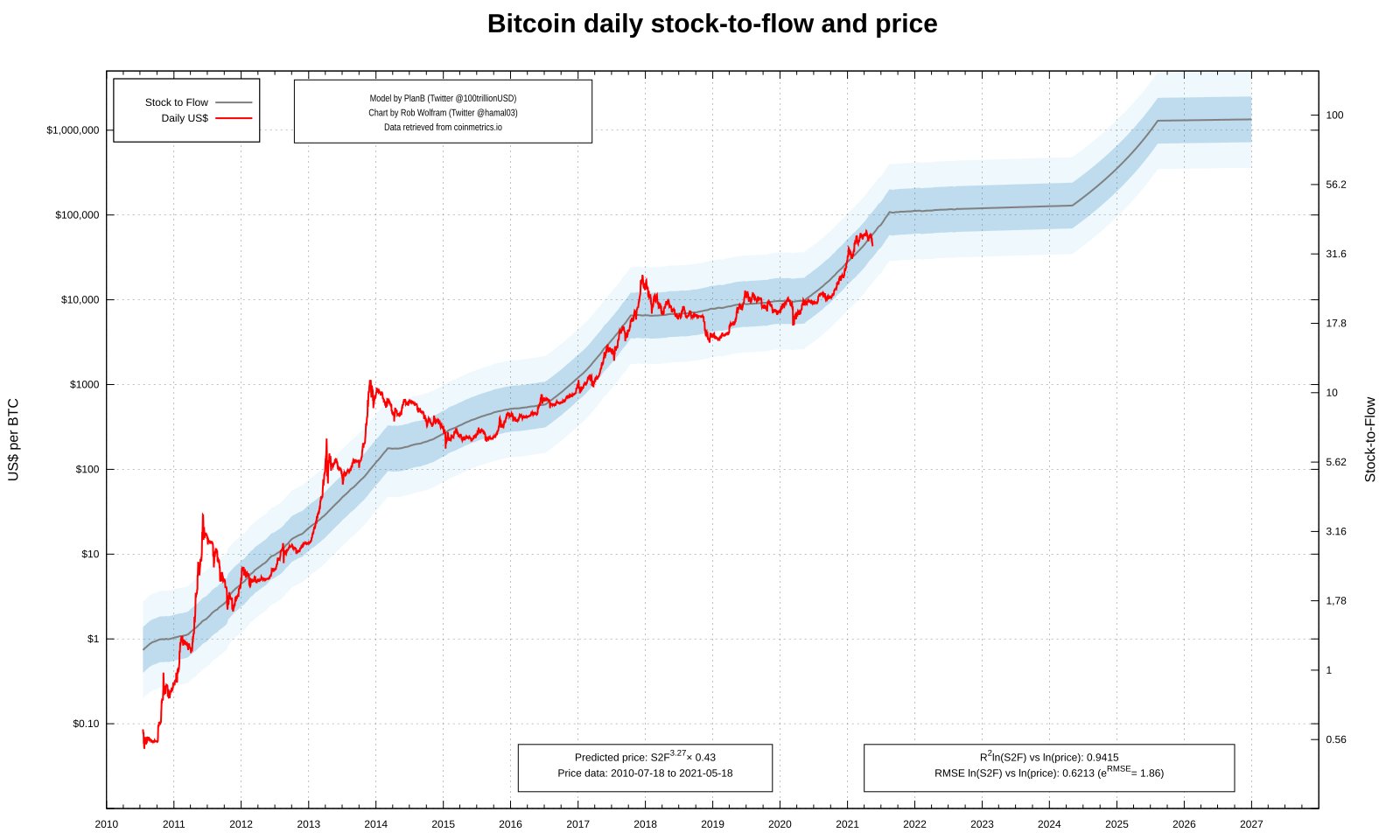

In a new interview with trader Scott Melker on The Wolf of All Streets, PlanB emphasizes he believes that his stock-to-flow models, which predict that Bitcoin will eventually hit $100,000 or $288,000, are still intact.

“The short answer [is] I think we’re somewhere halfway. I’m very data driven so I don’t make that up, but I read in the data… I look to my stock-to-flow models, the stock-to-flow model (S2F) and the stock-to-flow X model (S2FX), and both models actually show we’re certainly not at the end of the cycle. We still have some room to go until $100,000 on average or $288,000 on average if you follow the stock-to-flow X (S2FX) model.”

According to PlanB, data other than his S2F models are suggesting that the Bitcoin bull market is not yet over.

“It’s not only the stock-to-flow models that I look at. I also look at on-chain data and I make my own on-chain indicators. I don’t use the Glassnode or CoinMetrics, which is awesome by the way, but I extract all the data from my node and crunch it. If you look at the on-chain data, which is a treasure for making signals and picking up patterns… it is very clear that we’re somewhere halfway with a shortage in coins building up to levels that were exactly half of the shortage levels in 2017 and 2013. From those two angles, pretty sure that we haven’t seen the top yet.”

In spite of Bitcoin’s collapse from its all-time high of $64,863.10 to a 90-day low of $30,681, PlanB highlights that he sees a supply-side crisis happening under the hood.

“I do see the shortage on-chain as well, not only on the exchanges but also on-chain. The shortage is real and it’s building, building, and building. It has been building for months now and accelerating since December.”

On Wednesday, PlanB reiterated the validity of the S2F and S2FX as he says that Bitcoin is well within the range of his models even after the largest BTC crash since the coronavirus-induced panic.

“Seeing comments like, ‘S2F broke’ or ‘S2F invalidated’ or ‘what does it mean?’ I guess I have to explain: the charts show that BTC is well within the (admittedly wide) S2F model bands. I might start worrying if BTC is below the dark blue band for multiple months (like beginning of 2019).”

I

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/KolyaRobot