Economist and crypto analyst Alex Krüger believes that Bitcoin is poised for a massive rally as market participants turn extremely bearish on the top digital asset.

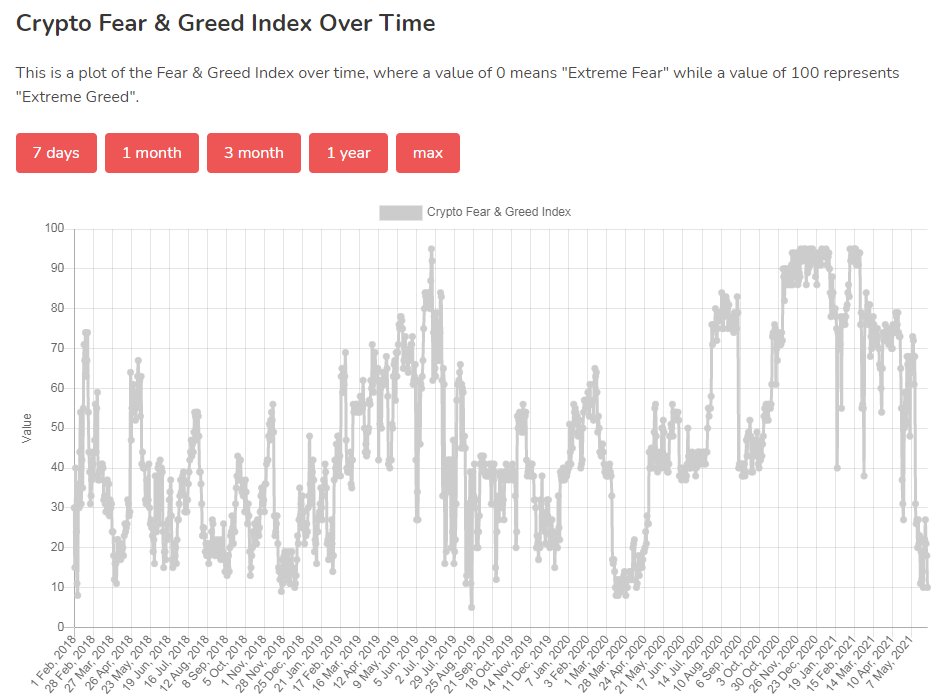

In a new tweet, Krüger tells his 82,900 followers that the Crypto Fear and Greed Index, which measures market sentiment, has plunged to a level not seen since the coronavirus-induced panic last year.

“When the Crypto Fear & Greed Index gets this low, a strong rally often follows. The index is now as low as was the day after Black Thursday in 2020.”

According to Krüger, Bitcoin’s relative strength index (RSI), a technical indicator that tracks an asset’s momentum, is currently hovering at a level that is often followed by a massive move up in price.

“How much more hopium do you need?”

According to the analyst’s chart, Bitcoin has surged in value following an RSI drop to extreme oversold levels and recovery of key support of 30. The correlation happened four times in the last two and half years.

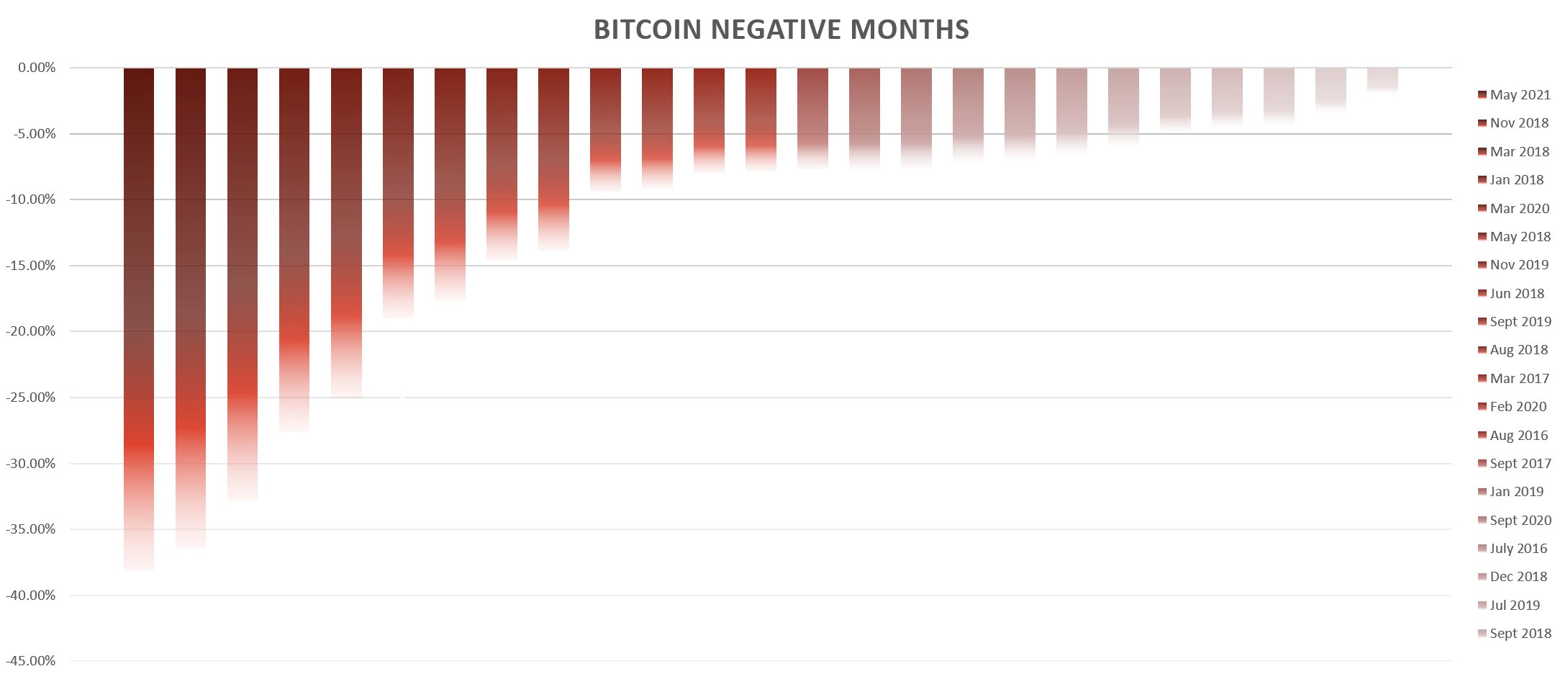

Krüger also reminds his followers that Bitcoin has survived one of its worst months in history. He reiterates a tweet by fellow crypto analyst Luke Martin who keeps tabs on Bitcoin’s deepest monthly sell-offs since 2016.

“May 2021 is the bloodiest month for BTC in its history. Worst monthly returns in last 5 years:

•May 2021: -37%

•Nov 2018: -36%

•Mar 2018: -32%

•Jan 2018: -27%

•Mar 2020: -25%.”

At time of writing, Bitcoin’s trading at $36,568, up 6.15% in the last 24 hours, according to CoinMarketCap.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/ metamorworks