Global macro strategist at Fidelity Investments, Jurrien Timmer, is updating his outlook on Bitcoin’s trajectory after previously calling for a $23,000 bottom.

Timmer first made the $23,000 call on June 1st. His prediction was based on the Elliot Waves Theory, a technical analysis method that forecasts price fluctuations by mapping out repeating patterns of waves.

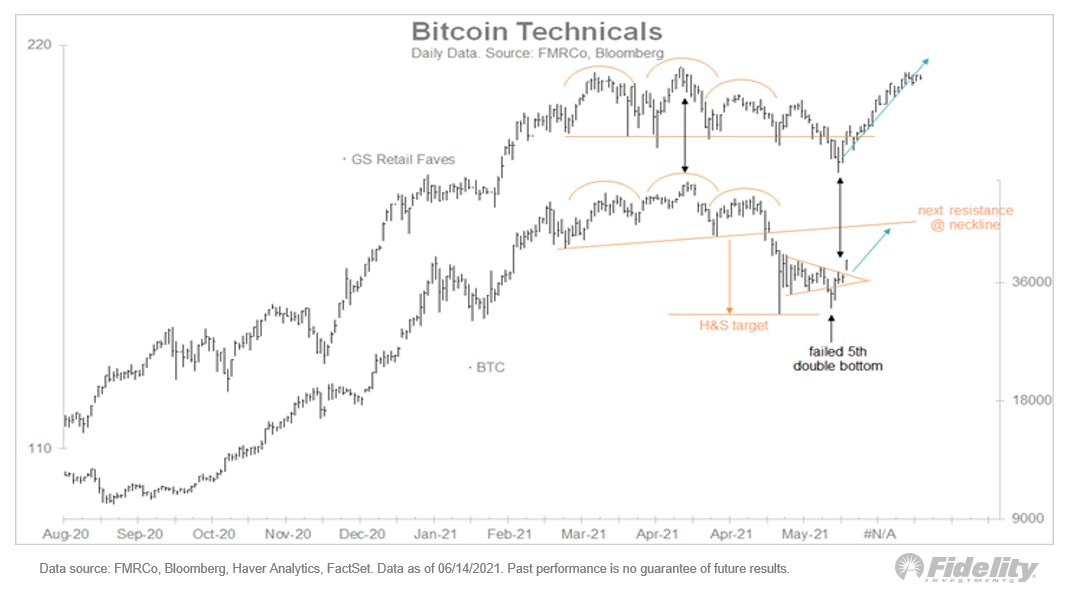

However, Timmer now says the ebbs and flows of Bitcoin’s price action suggest the cryptocurrency has seen its bottom and is ready for another leg up.

“In my view, it looks like the bottom is in.”

Timmer says a push above the $41,000 mark would officially invalidate his call for $23,000. His analysis suggests that Bitcoin is mimicking the price action of GS Retail Faves, or Goldman Sachs Retail Favorites, an index containing 50 commonly-traded stocks for investors, including Tesla, Amazon, and others.

Though Bitcoin’s movements are unpredictable, Timmer believes that technical analysis often works well with the crypto asset. When making his previous call, the charts told him that a correction was actually healthy for the bull run.

“As a ‘lifelong’ technician, I am finding that Bitcoin lends itself well to technical analysis…

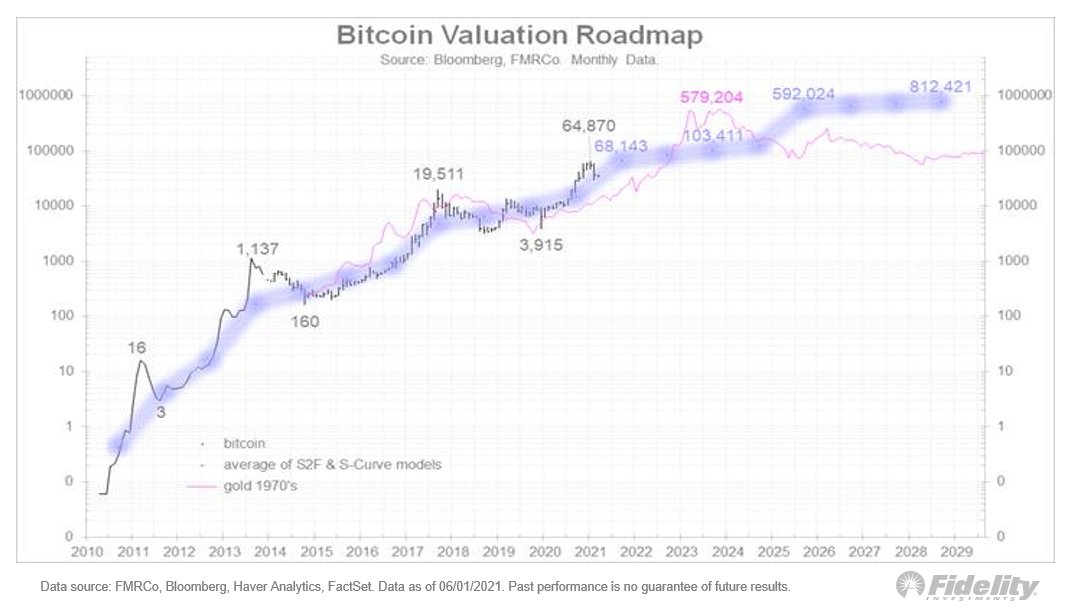

Don’t get me wrong: I remain a secular bull, but according to my version of the S2F model & S-Curve model (& the analog of gold during the 1970s), the trip to 64k was a bit too much too fast, prematurely reaching my year-end target of 68k in April.”

“Bull markets are more sustainable when the tree gets occasionally shaken, and my best guess is that this is what we are seeing now.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix