Several metrics indicate Bitcoin is ripe for a reversal, according to on-chain crypto analyst Will Clemente.

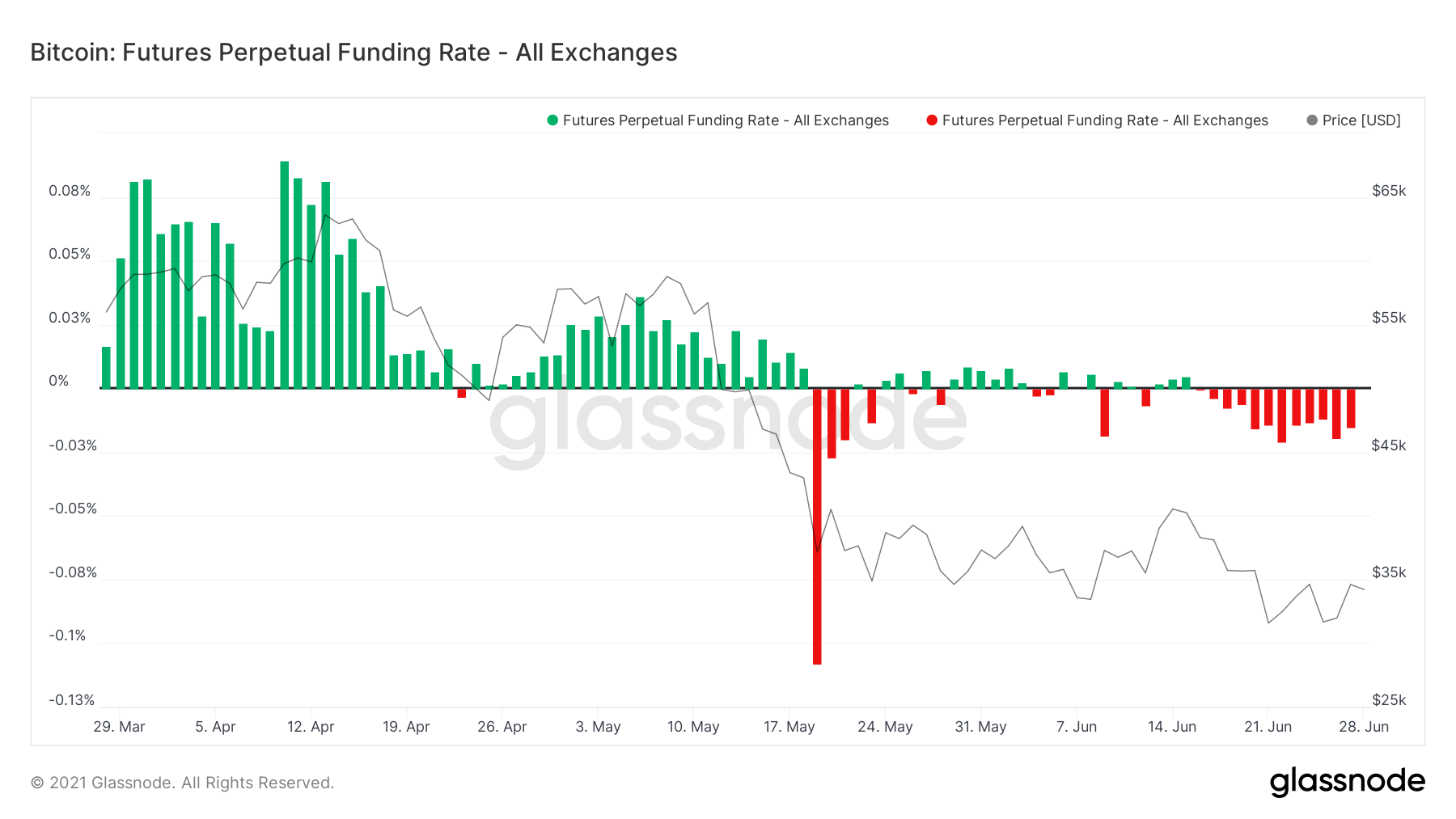

Clemente tells his 126,400 Twitter followers that Bitcoin Perpetual Futures funding has been negative recently, which he says is a bullish signal.

“Funding has now been negative for 11 days straight. Translation: Shorts are paying longs to keep their positions open. As a rule of thumb, for anyone not familiar with how funding works:

Prolonged high funding = Bearish

Prolonged negative funding = Bullish”

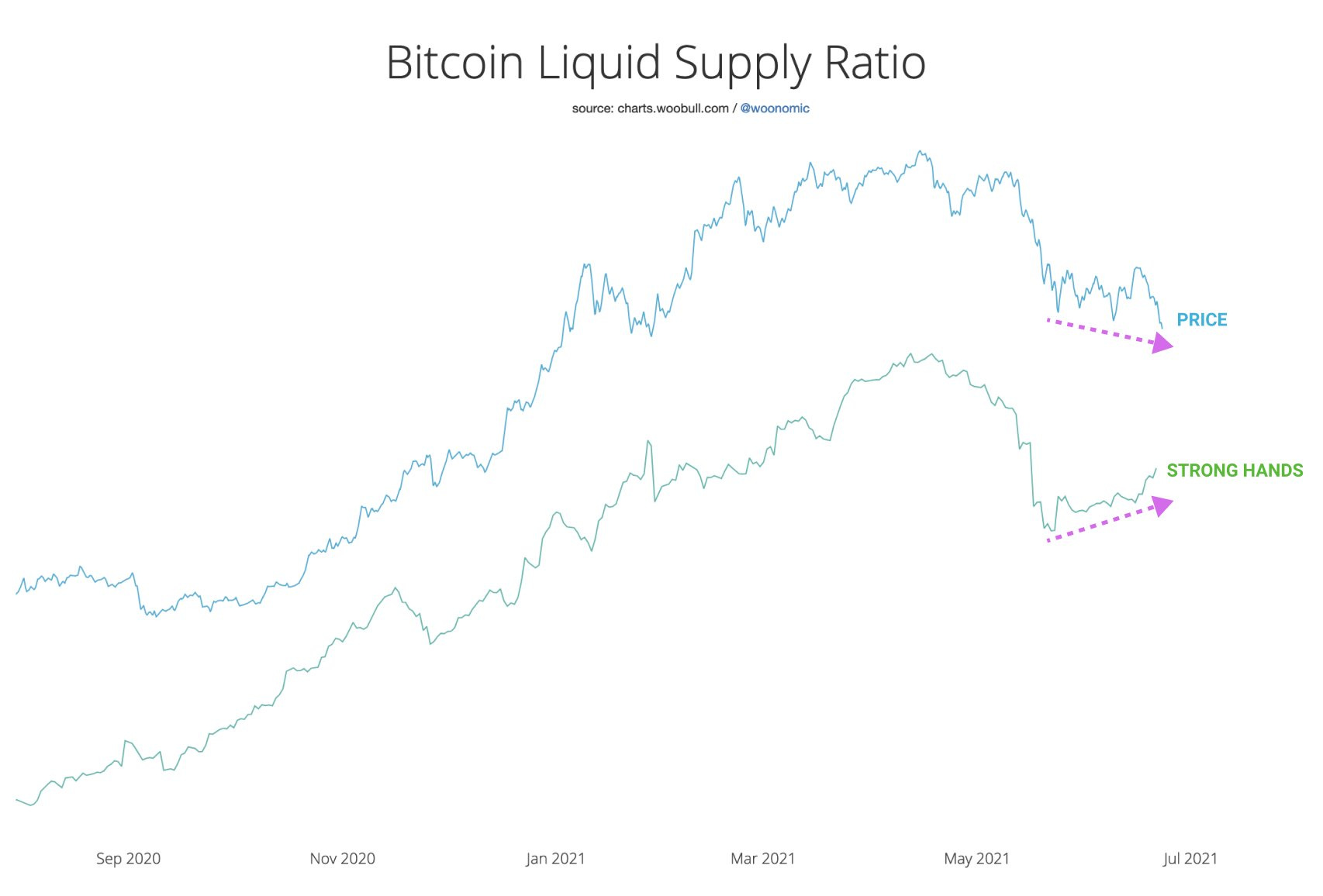

Last week, Clemente penned a blog post noting that Bitcoin’s liquid supply ratio indicated there’s been rotation of BTC from weak to strong hands.

“There is a clear bullish divergence in the ratio, with a lower low made in price and a higher high in the ratio.

AKA strong hands are increasingly buying as price is going down.”

“Once again we have a higher low in the ratio while there’s a lower low in price.

Last time there was a bull div this clear was in late January, when price went on a strong rally following.”

As for the timing of his prediction, Clemente says these metrics indicate Bitcoin’s price could see a reversal in the next few weeks.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/pixelparticle