The largest Ethereum whales in existence are accumulating ETH as the asset’s price continues to tick downwards.

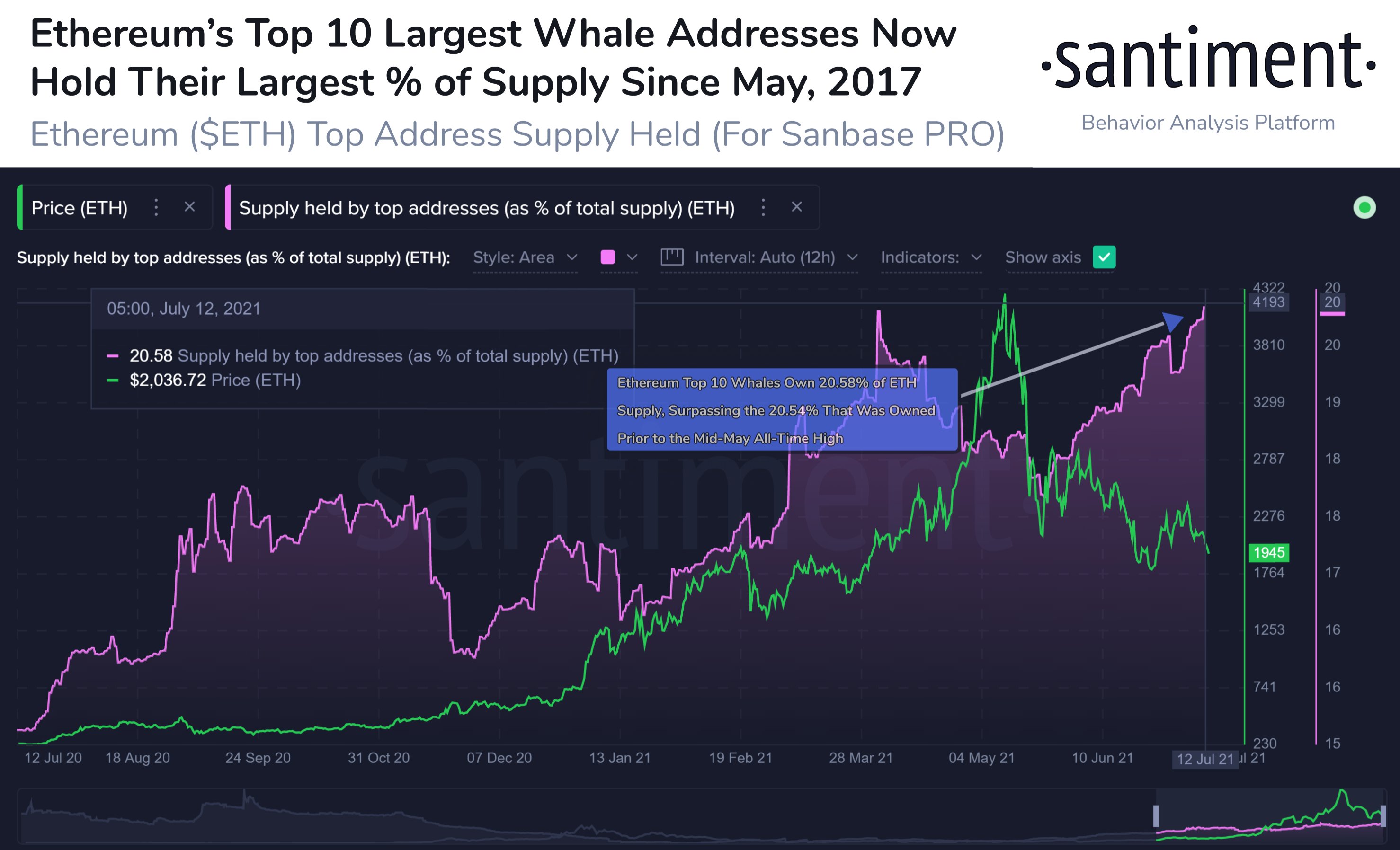

Crypto analytics firm Santiment says Ethereum’s top 10 largest addresses went from owning as low as 18.46% of the total Ethereum supply after mid-May – when ETH achieved its all-time high – to 20.58% by July 13th.

For those top 10 addresses, that’s the highest ETH ownership percentage since May of 2017, according to Santiment.

The analytics firm says that the accumulation of stakeholders is a good sign for Ethereum’s potential price recovery.

“This chart is indicative of the largest stakeholders continuing to accumulate while prices have fallen more than 50% from their AllTimeHigh levels. It is a bode of confidence that prices can and will recover at some point.”

Santiment also notes that miner balances have been rising steadily for the past month, a sign that people who power the network are not inclined to sell.

Ethereum is trading at $1,954.02 at time of writing and is down more than 8% in the past week, according to CoinGecko.

Santiment says if ETH can hold above $1,800, it will have a chance to test the “resistance trend line” at $2,200.

“ETH’s price action continues to linger around a bearish bias, with it hanging on to a very important support now. Bulls really need to step in soon (for a bounce at the very least), else bears shall continue their downward trend.

On-chain metrics are showing some positive signs but it’s still too early to say whether we bottomed out.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Dai Mar Tamarack