Crypto research firm Messari is analyzing the most commonly held altcoins in the portfolios of crypto-focused venture capital firms and hedge funds.

Messari assumes most of the funds hold Bitcoin and Ethereum – and for that reason excludes the top two crypto assets from its report.

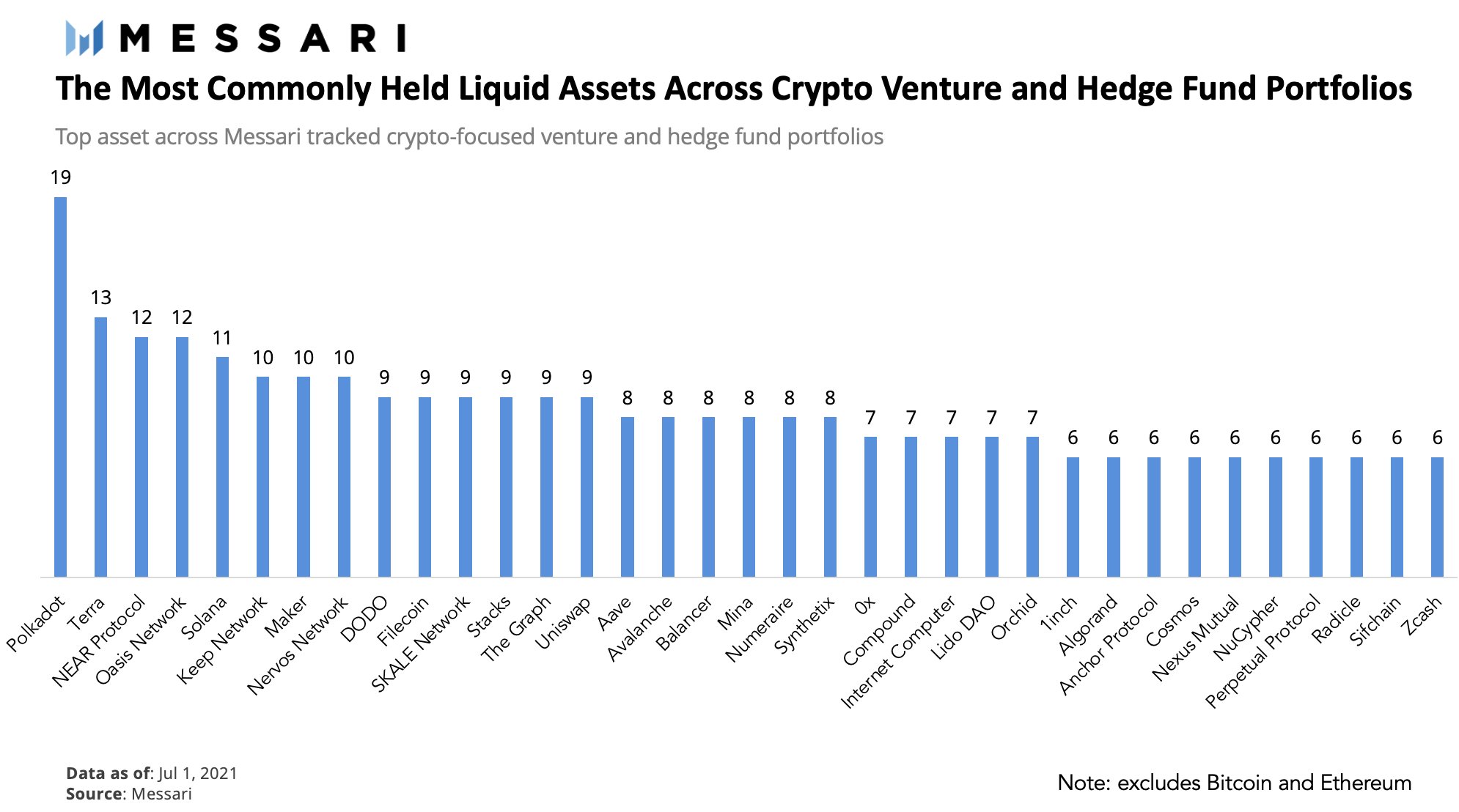

With BTC and ETH aside, the interoperability protocol Polkadot (DOT) is at the top of Messari’s list of 35 crypto assets. Polkadot is held by 19 of the 44 firms tracked by the study.

Coming in at number two is decentralized finance (DeFi) payment network Terra (LUNA). According to Messari, 13 funds have a vested interest in Terra’s success.

Proof-of-stake public blockchain NEAR protocol and privacy-enabled blockchain platform Oasis Network (ROSE) are tied at number three with 12 funds invested in the two crypto assets.

Eleven firms hold scalable blockchain Solana (SOL). Ten hold blockchain privacy layer Keep Network (KEEP), DeFi asset Maker (MKR) and public blockchain ecosystem Nervos Network (CKB).

DODO (the governance token for the DODO exchange), decentralized storage project Filecoin (FIL), layer 2 scaling network Skale (SKL), Bitcoin developer project Stacks (STX), data-fetching protocol The Graph (GRT) and decentralized exchange Uniswap (UNI) are all owned by 9 of the top crypto hedge funds and firms.

The other 21 assets are owned by 8 or less of the surveyed firms.

Messari highlights peer-to-peer software building tool Radical (RAD), liquidity provider Lido DAO (LDO), Oasis, DODO and multi-token automated market maker Balancer (BAL) and calls them diamonds in the VC funded rough. According to the crypto research firm, these digital assets have the lowest market capitalization among the 35 cryptocurrencies with more than six smart money investors.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Titima Ongkantong