Tens of thousands of crypto traders had their positions liquidated as Bitcoin abruptly rallied to above $40,000.

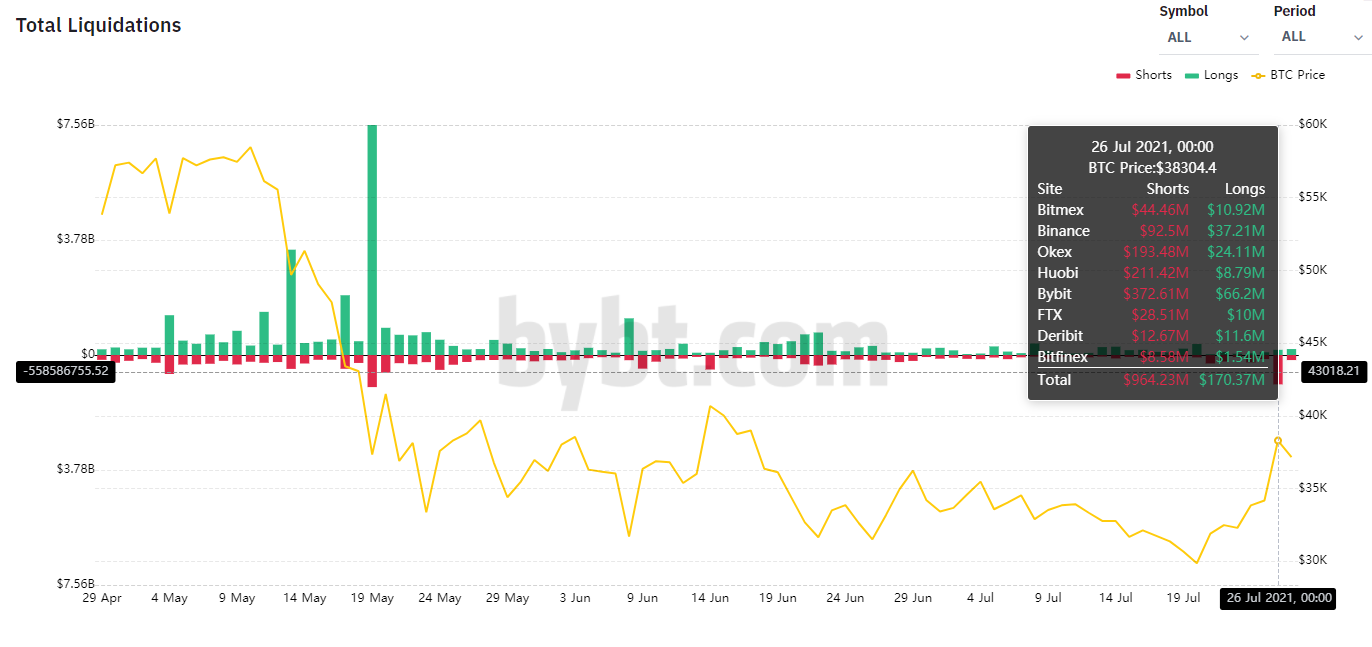

Data from the cryptocurrency futures trading and information platform Bybt reveals that on July 26th, $964.23 million worth of short positions across all crypto assets were liquidated as Bitcoin ignited a strong rally from around $35,000 to above $39,000 within four hours.

Traders who took the other side of the trade were also not spared from the volatility as Bybt shows that over $170 million worth of long positions were liquidated on the same day.

In total, over $1.13 billion worth of long and short positions were liquidated yesterday amid Bitcoin’s rise to a 30-day high of 40,499, according to CoinMarketCap. Bybt’s current data shows that in the last 24 hours, 99,649 traders were liquidated.

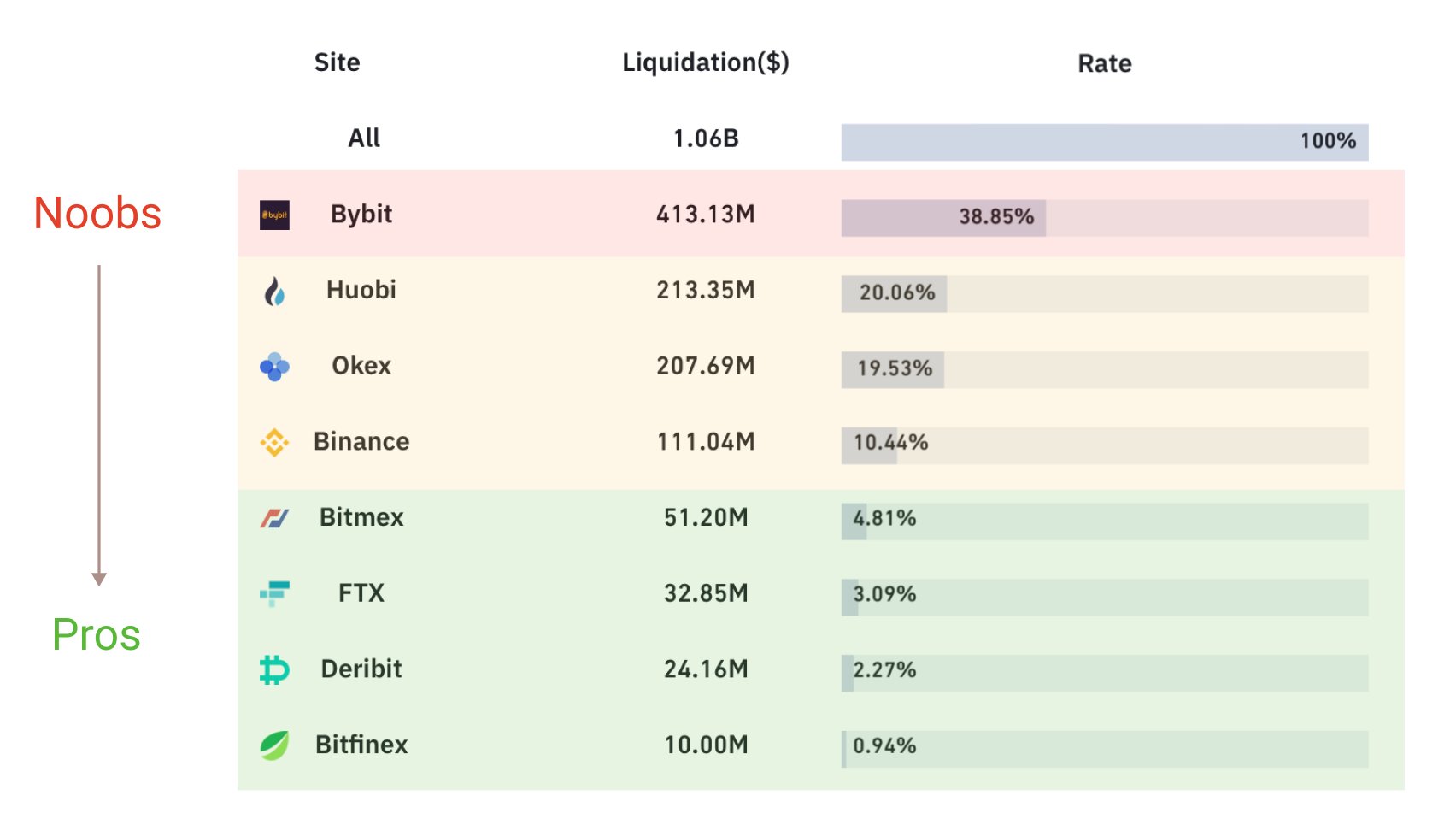

At the height of BTC’s rally, Willy Woo told his 634,800 followers that the bulk of the BTC liquidations happened in a span of 12 hours.

“$1 billion of BTC futures liquidations in the last 12 hours. Here’s where the carnage happened.”

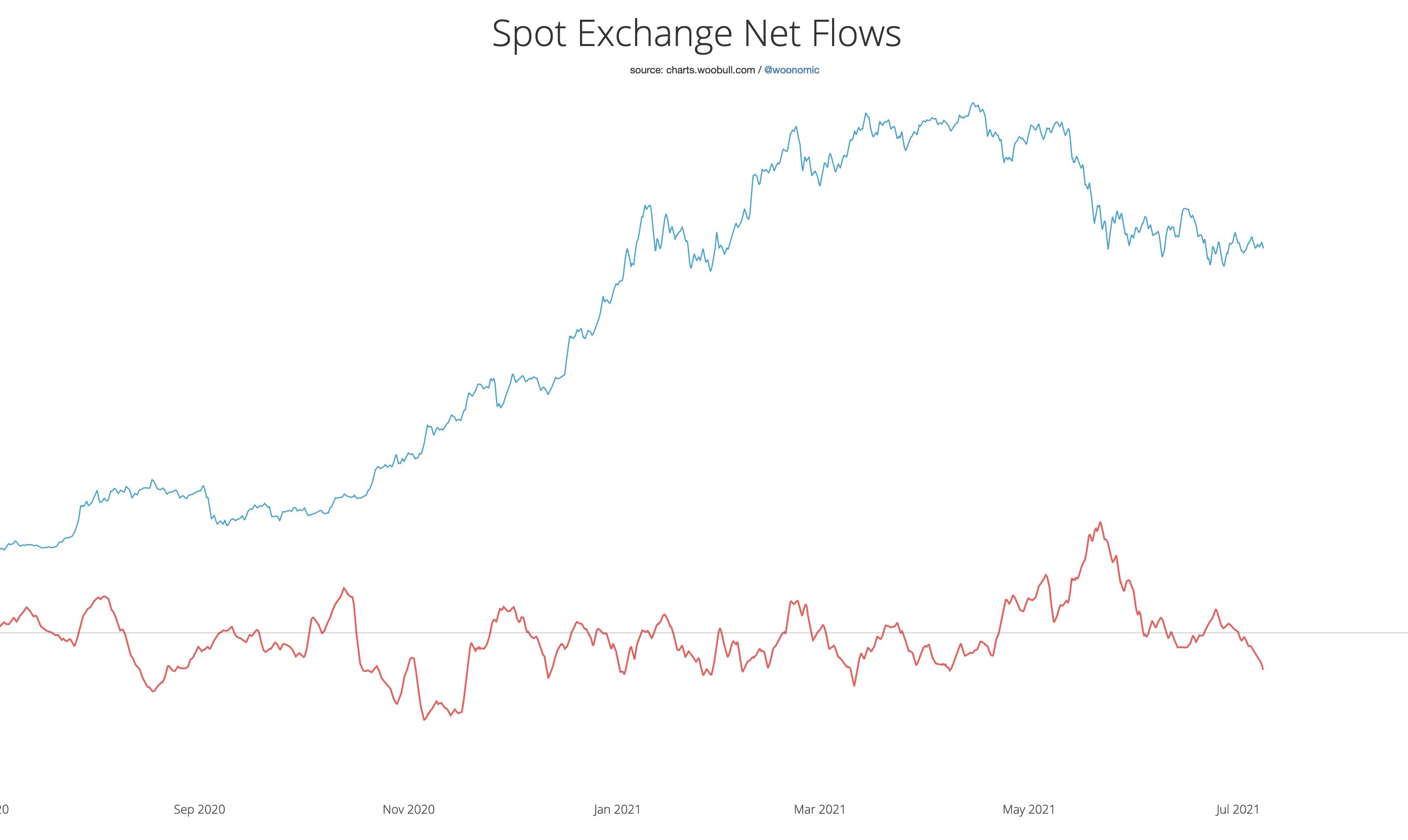

Earlier this month, the popular on-chain analyst said that a BTC supply shock was underway and predicted that traders who short the market will eventually be liquidated as coins were being withdrawn from exchanges at a rapid rate.

“As price grinds sideways-bearish, coins are being scooped off the exchanges at a very bullish rate. The latest sizing of withdrawals vs. deposits are at local highs at levels that signal a bottom, whales are scooping… In my opinion, anyone short this market will get rekt given enough time. It’s just a waiting game until the fundamentals prevail.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/wacomka