Jurrien Timmer, global macro director at financial giant Fidelity, says Bitcoin (BTC) looks primed to resume its uptrend as the leading cryptocurrency threatens to rally above $50,000.

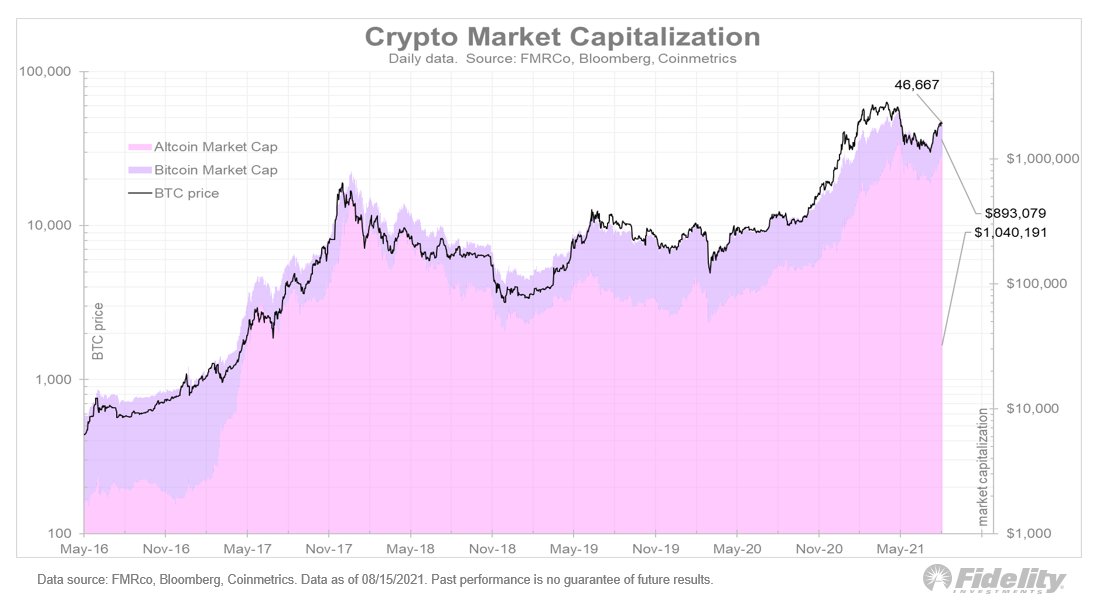

In a new tweetstorm, Timmer tells his 62,800 followers that BTC is “no longer a sideshow” as the king crypto’s market cap inches closer to previous highs.

“With the latest rally, Bitcoin’s market cap is closing in on the old highs. If we add in the rest of the crypto space, we have reclaimed a market cap of $2 trillion. This is no longer a sideshow, folks.”

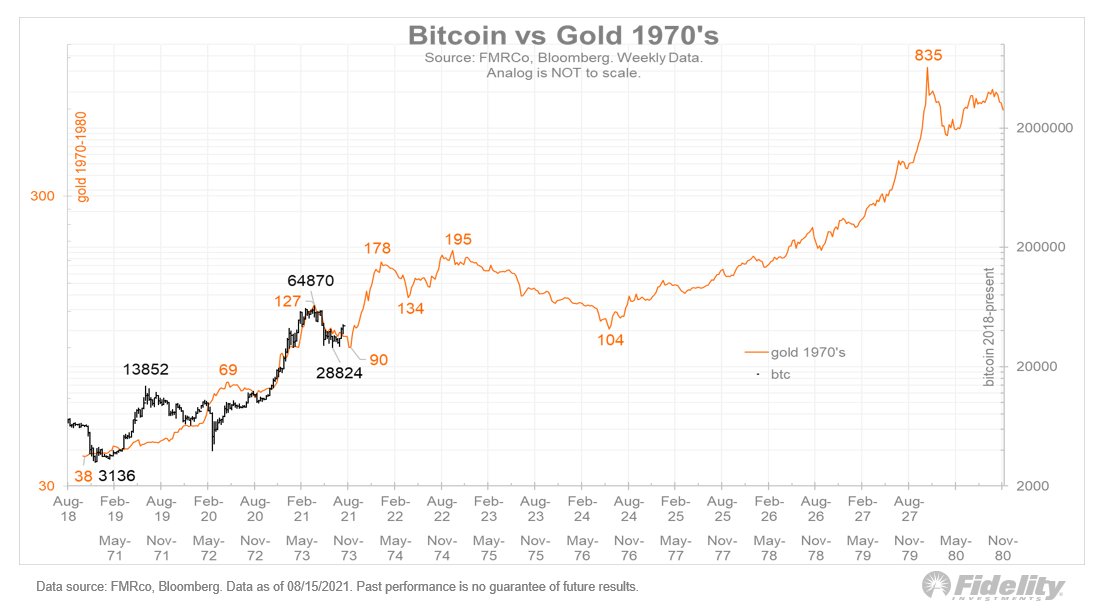

Timmer is also evaluating Bitcoin’s performance in the last two years and says that it closely resembles gold’s price action in the 1970s.

“Based on my (highly subjective) gold analog from the 1970s, Bitcoin looks ready to resume its up-trend.”

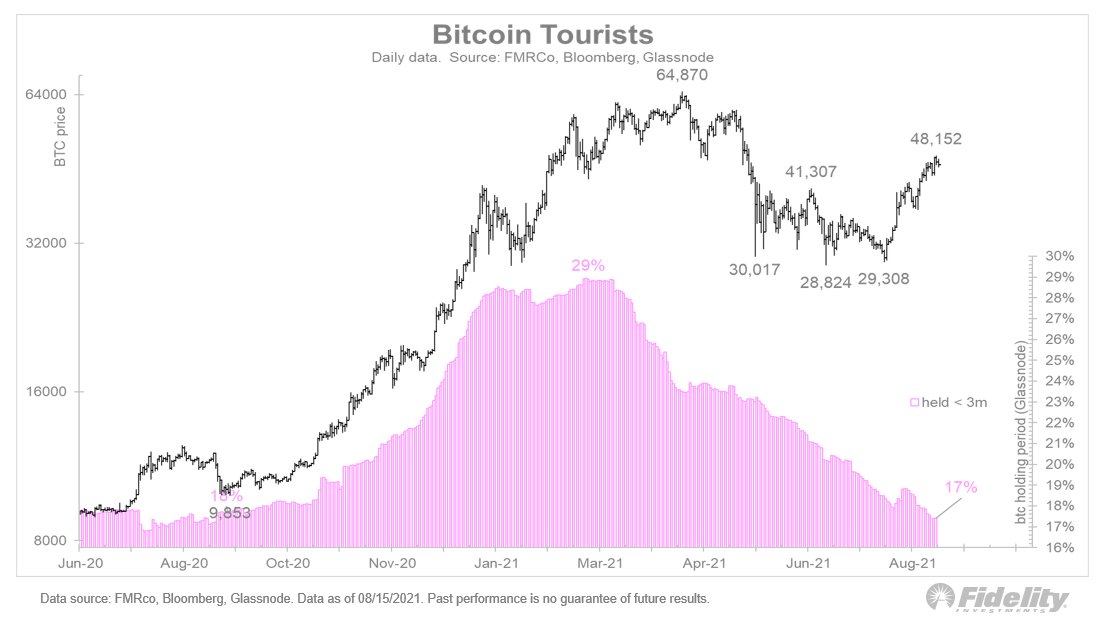

The Fidelity executive says he’s impressed with Bitcoin’s recovery and notes that he’s seeing signals indicating that the leading crypto asset has already placed a bottom.

“I’m impressed how resilient Bitcoin and the crypto space in general have been during this 55% correction. The speculators (tourists) got crushed as they usually do during drawdowns and now make up only 17% of the market. That level is consistent with past bottoms.”

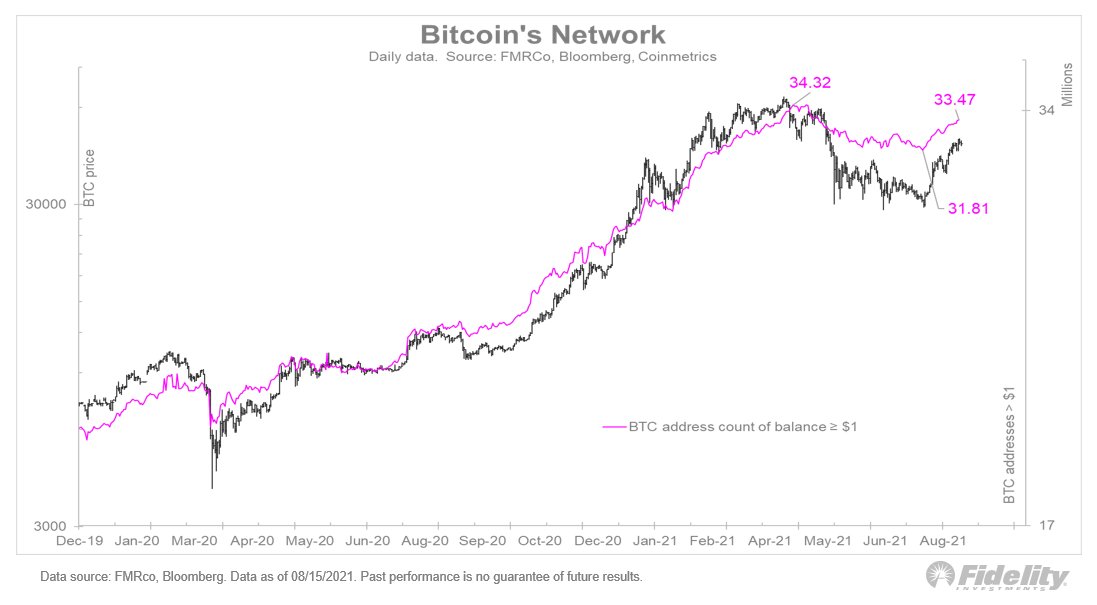

Timmer also takes a look at the fundamentals of Bitcoin to support his analysis. According to the macro strategist, the number of addresses in the BTC network is trending with the asset’s value.

“In fact, Bitcoin’s fundamentals (its network) are steadily improving. At the peak, there were 34.3 million addresses (with at least $1). That number fell to 31.8 million at the low and has now climbed back up to 33.5 million.”

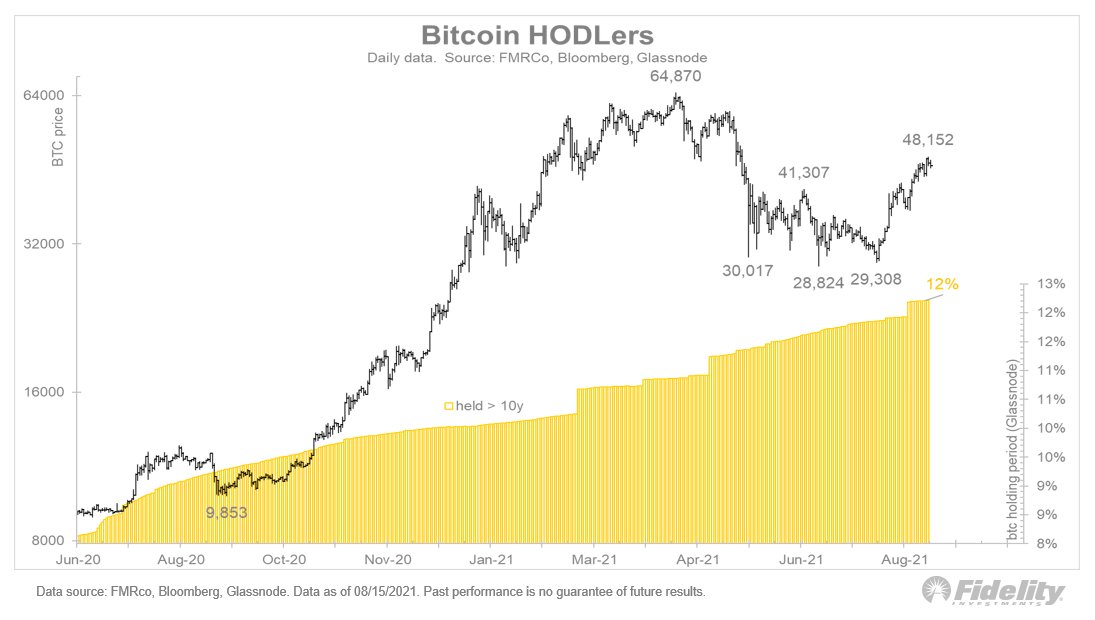

Timmer says that “HODLers,” or entities that have held BTC for over 10 years, now control a significant portion of Bitcoin’s supply.

“Meanwhile, the HODLers continue to accumulate, and now make up 12% of the market.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Elena11