A top executive at CryptoQuant says that he’s bullish on Bitcoin (BTC) despite the leading crypto’s rough week.

Chief executive officer Ki Young Ju of the on-chain analysis firm says that a few of Bitcoin’s fundamental metrics are showing signs of rising after a week that saw the king crypto drop nearly 15% from its high of $52,774.

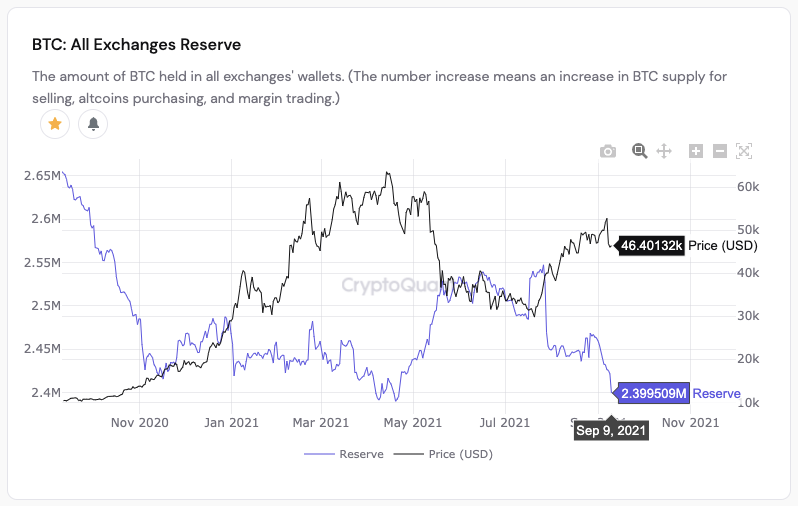

Ki Young Ju tells his 245,600 Twitter followers that Bitcoin’s supply on exchanges is nearing its 2021 lows, which can be interpreted as a bullish signal as it likely decreases the risk of major sell-offs.

“BTC supply on exchanges is about to break its previous low. Hope to see another sell-side liquidity crisis on Bitcoin.”

Source: CryptoQuant

The CryptoQuant head also says crypto whales moving Bitcoin into derivative exchanges, another potentially bullish indicator.

“Whales are sending BTC to derivative exchanges from other exchanges to punt new positions or fill up margins.

If you look at the historical data, the price goes up in the long term after their accumulation. Their positions seem to be long positions.”

Ki Young Ju has previously made a claim that he believes Bitcoin will skyrocket to $100,000 this year.

“No doubt it’ll hit $100,000 this year, but in the short-term, if we wouldn’t see any significant buying pressure from Coinbase Pro, I think BTC would be bearish.”

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DM7