Despite the market correction in the past two weeks, Ethereum (ETH) is displaying a few strong metrics that could be good news for long-term holders of the digital asset, according to crypto analytics firm Santiment.

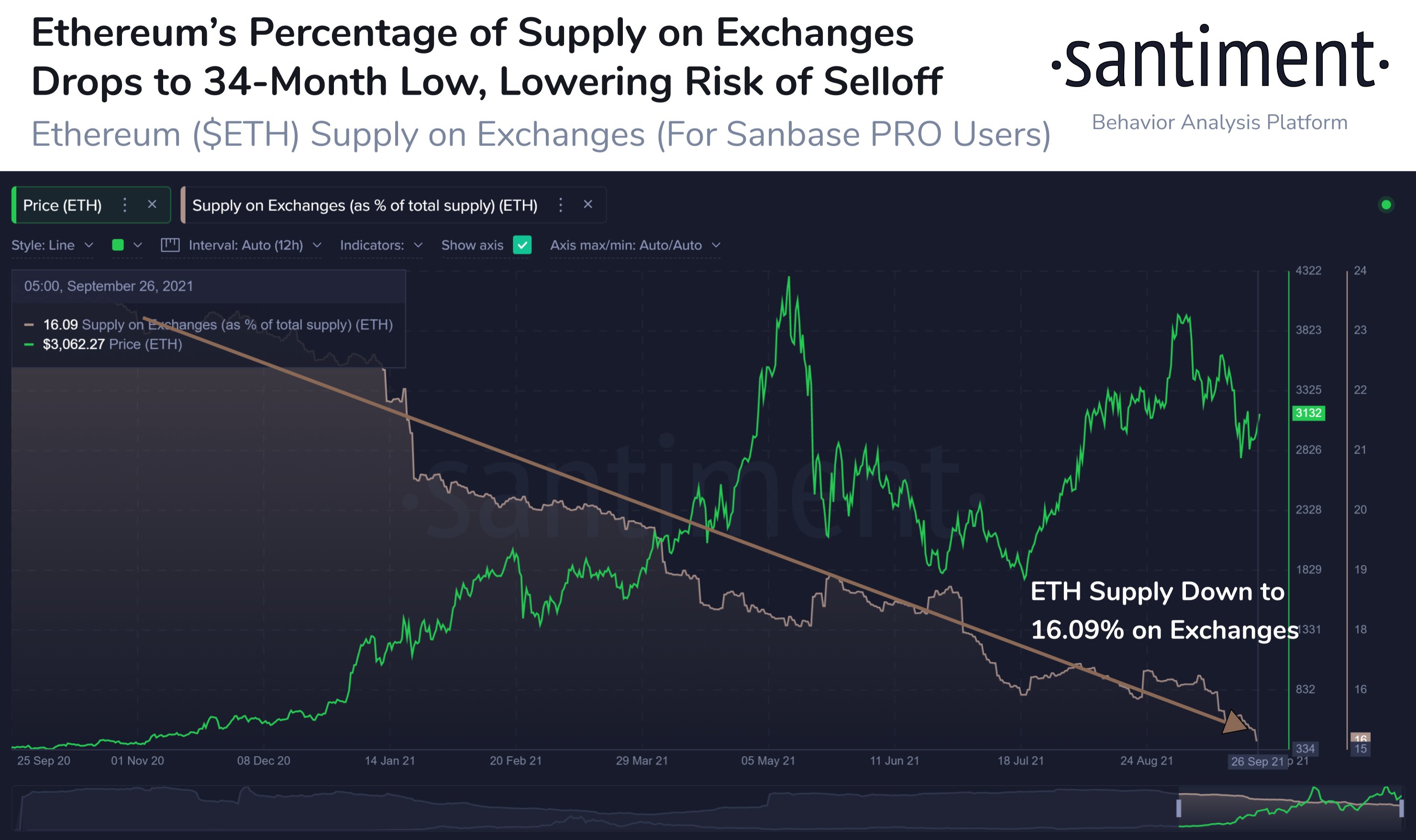

Santiment tells its 95,200 Twitter followers that the amount of Ethereum sitting on crypto exchanges has significantly declined in the past 12 months, indicating that ETH holders are expecting higher prices for the leading smart contract platform.

“Ethereum has rebounded back to $3,163. In the past year, 1/3 of the ETH supply that was on exchanges, has now been moved off. This is a good sign for patient HODLers.

Sep. 26th, 2020 exchange supply: 24.1%

Sep. 26th, 2021 exchange supply: 16.1%.”

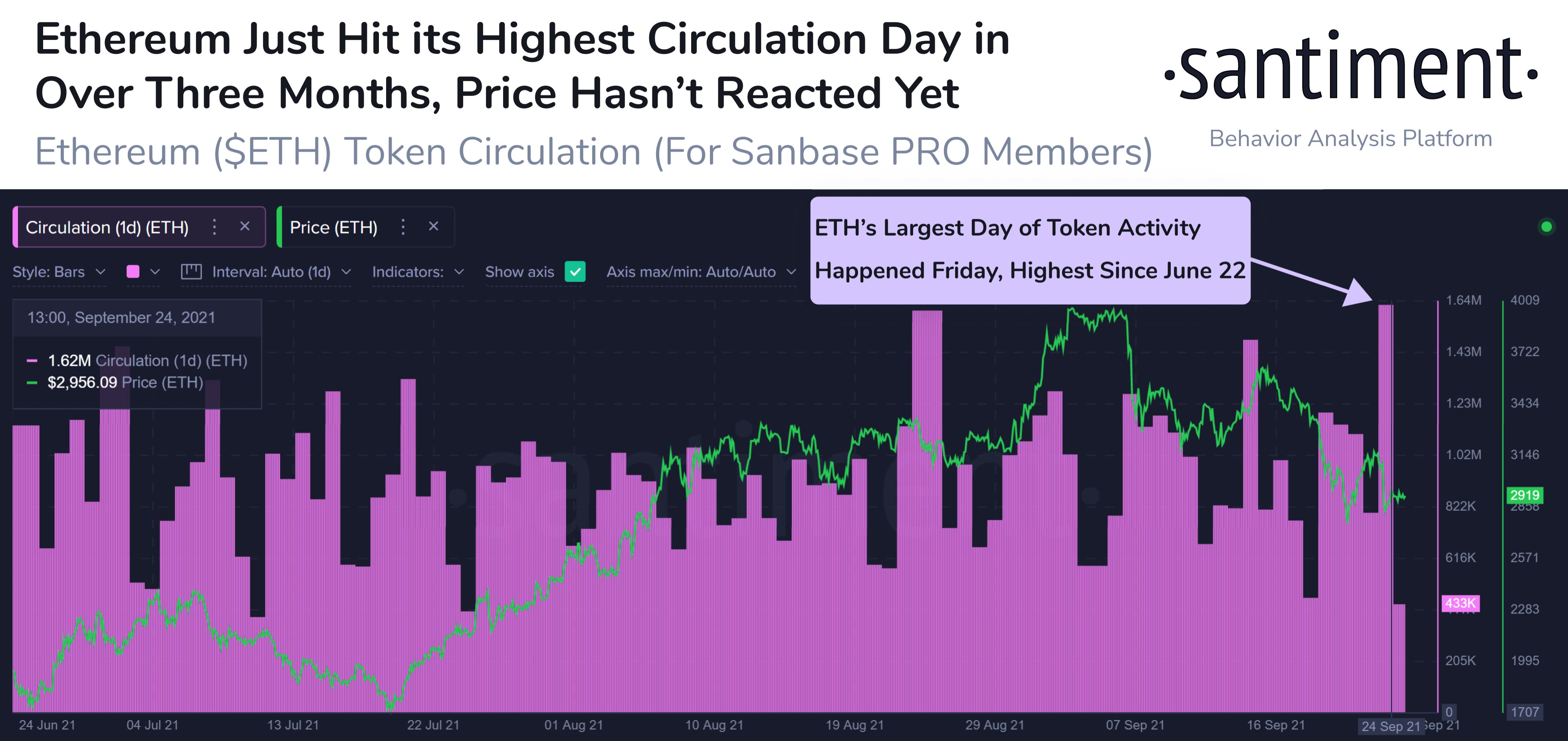

Ethereum’s token circulation has also recently surged to its highest levels since late June, according to the analytics firm. An increase in token circulation shows that holders are using ETH for various transactions in its ecosystem such as payments for non-fungible tokens (NFTs) or investments in decentralized finance (DeFi) applications.

“If signs of ETH utility and tokens being moved continues to rise, the price will generally follow.”

ETH is trading at $3,072.98 at time of writing, according to CoinGecko. The second-largest crypto asset by market cap is down nearly 8% in the past week and more than 10% in the past 14 days.

Santiment also recently ranked a handful of DeFi altcoins based on the level of panic their communities of holders displayed amid the recent market correction. For each asset, the analytics firm examined how many tokens were moved from non-exchange to exchange wallets, and the average profit or loss of all coins that change addresses daily.

Santiment notes that the gaming and non-fungible token (NFT) blockchain platform Enjin (ENJ) displayed the highest level of panic among the analyzed altcoins.

“What do we see here are three strong spikes of ENJ being deposited to exchanges and significant loss drops throughout the dump.”

Second and third belong to the borrowing and lending projects Compound (COMP) and Aave. Santiment says it detected less panic in COMP and AAVE compared to ENJ. The second and third highest panic levels belong to the borrowing and lending projects Compound (COMP) and Aave. Santiment says it detected less panic in COMP and AAVE compared to ENJ.

Fellow DeFi lending project Maker (MKR) demonstrated a few stronger hands, with just one single spike of exchange inflow during the correction, according to the analytics firm.

Holders of UNI, the native token for the decentralized exchange Uniswap, displayed the least amount of panic among the tokens Santiment analyzed.

Explains the analytics firm,

“Exchange inflow is high, but looks like the previous UNI bottom attracted even more tokens to exchanges (one spike vs two spikes). Network Profit Loss dumps a little bit, showing some possible loss related to UNI transactions. Again, previous dump felt harder for UNI. Lessons learned.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Warm_Tail