Bloomberg Intelligence’s senior commodity strategist Mike McGlone says Bitcoin (BTC) could be in for a “price rise” during the fourth quarter thanks to several fundamental catalysts.

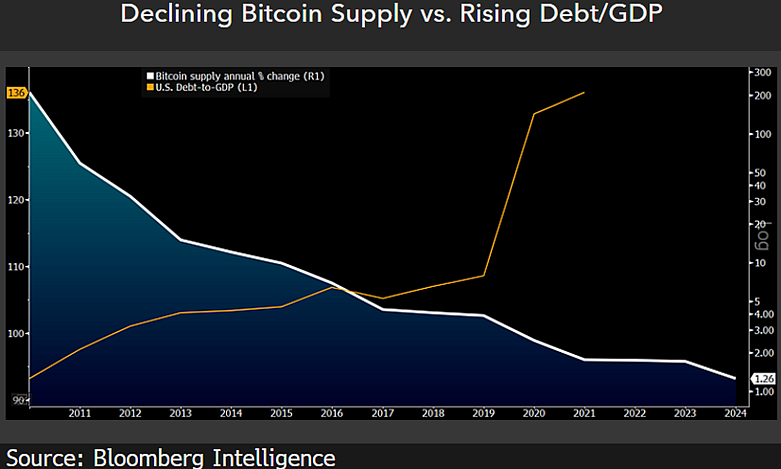

The analyst says a wide swath of investors concerned about debt and inflation may be ready to place their faith in the underlying technology that gives Bitcoin its hard supply.

“Relative to rising US debt and tensions over a potential default, Bitcoin may be entering a unique phase for a 4Q price rise as markets gain trust in the coding that defines the crypto’s supply.

The debt-ceiling drama may work against managers that avoid allocations to Bitcoin.”

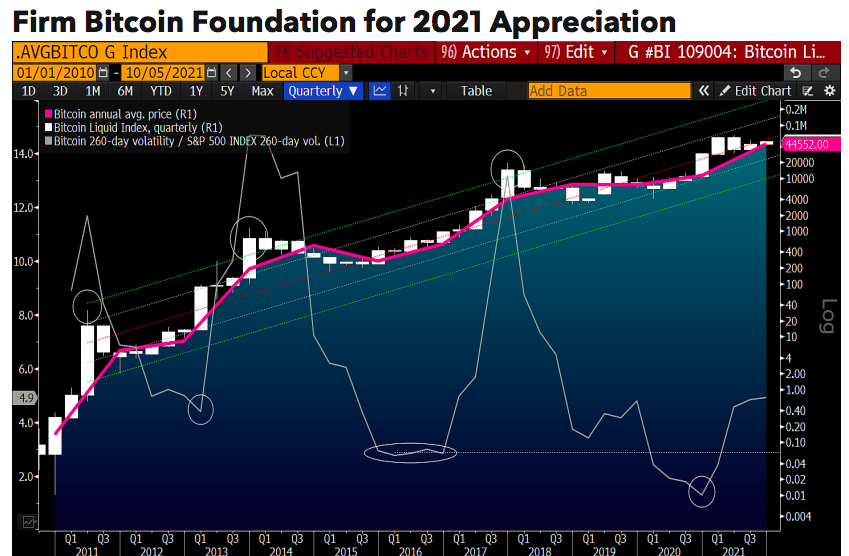

In Bloomberg’s latest Crypto Outlook report, McGlone says that BTC appears to be in the middle of a discounted bull market. He cites Bitcoin’s 260-day volatility versus the S&P 500 as evidence to suggest that the top crypto has a lot further to rise before entering a new bear phase.

“Bitcoin looks like a rested and discounted bull market. The October 4 price at about $49,000 is just below its 10-year regression line and not far above the 2021 average ($44,500). Bitcoin was hot in April before correcting on concerns about energy consumption and a China ban, representing the uniqueness and strength of the world’s largest decentralized network.

Our graphic depicts a key foundational support – 260-day volatility dropped in 2020 to its lowest ever versus most major asset classes, notably the S&P 500.”

Looking at Ethereum, McGlone says the EIP-1559 update which put pressure on the ETH supply is improving the price outlook for the second-largest crypto by market cap.

“A bit overextended in May, Ethereum resembles a consolidating and discounted bull market. Demand and adoption are rising, but our graphic depicts a notable difference from a year ago – plunging supply.”

McGlone says that with ETH already fending off its 20-week moving average near $2,000, the path of least resistance is now up.

“Ethereum’s floor just below $2,000 from May-July appears to have added a handle to $3,000 for 4Q, tilting risk versus reward toward further price appreciation. It’s likely still the early price discovery days for Ethereum.”

The full Bloomberg report can be read here.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Jaswe