Digital asset analytics firm Santiment is looking at a handful of altcoins to gauge crypto’s strength after the global market cap tanked by 8% in less than a day.

In a new Santiment Insights report, the crypto intelligence company analyzes what it calls “blue chips” in the ERC-20 market segment: Shiba Inu (SHIB), Uniswap (UNI), Yearn.Finance (YFI), Aave (AAVE) and Chainlink (LINK).

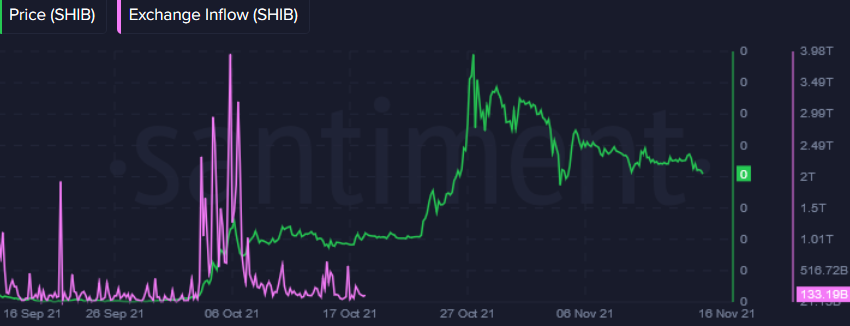

While assessing crypto inflow into exchanges, Santiment highlights meme coin SHIB as a positive metric.

“People seem to be very confident in their holdings. SHIB for example.

A declining trend of SHIB being deposited to exchanges is indicating that traders are not afraid of Shiba going down. They are not going to send tokens to exchanges to sell.”

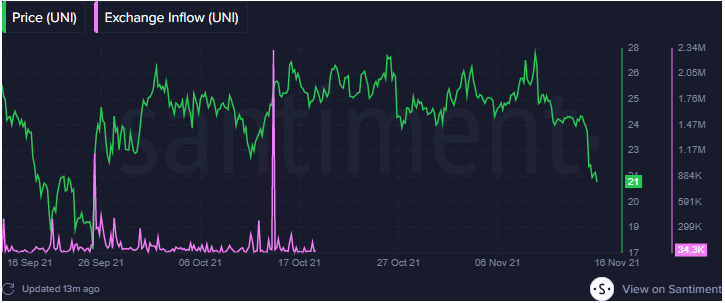

On the topic of exchanges and exchange inflow, Santiment also looks at decentralized exchange (DEX) Uniswap.

“Three increasing spikes might indicate people were looking to take profits just before the dump.

But nothing similar after the dump itself.”

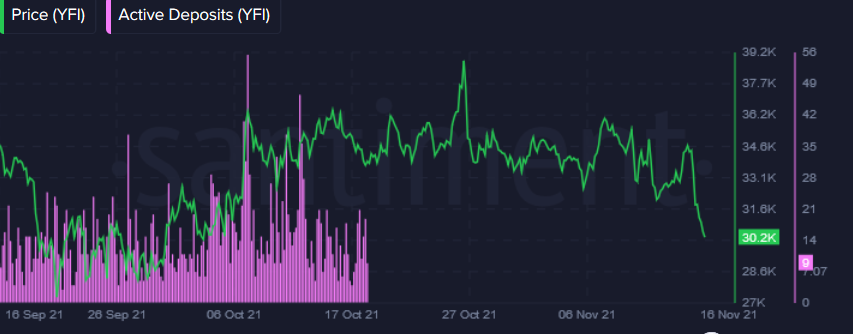

In terms of active deposits, the firm sees only one negative indicator from crypto yield optimizer YFI.

“No worries or minimal worries visible. Except for YFI.”

Moving on to network profit and loss, Santiment says that four of the five altcoins avoided panic sell-offs.

“Interesting that the picture here is completely the same again: almost no panic sells except in YFI.”

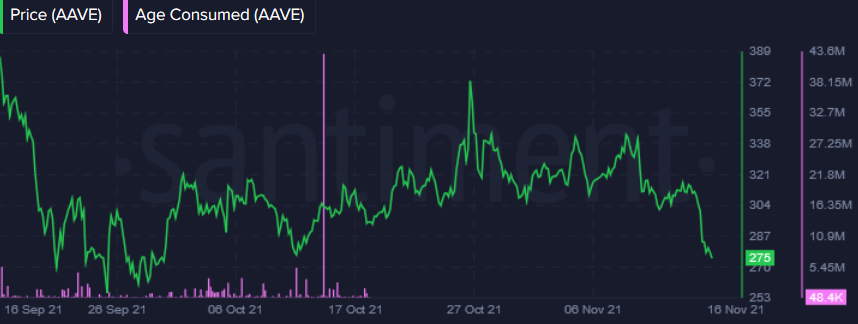

The fourth indicator involves the amount of time since a crypto asset was last moved, known as the age consumed. Santiment says it’s a good sign that long-term holders don’t appear to be moving their tokens onto exchanges.

“All five tokens do not have any significant outliers here. Likely no huge old bags moved or sold. It’s looking like this on charts.”

Finally, the firm looks at what whales holding between $500,000 and $50 million worth of crypto are doing with their bags. Only decentralized price feed service Chainlink shows a downtrend.

“Is it standing still (nothing special) or going down (whales offloading the bags)?

Here we can say that only one token from five is showing a downtrend in whales’ balances [over the] last day. It’s LINK.”

Santiment concludes its analysis by saying,

“We do not see many signs of panic or sell-offs within selected ERC-20 tokens.

People don’t seem to worry about the dump.”

You can read the entire report here.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Dario Lo Presti/karnoff/Bruce Rolff