A new survey from financial insights firm PYMNTS.com reveals that the majority of multinational businesses are now using at least one type of crypto asset.

The study, which explores crypto and blockchain adoption, gathered data from executives of 250 cross-border businesses operating in multiple countries and with annual revenue of at least $10 million. It also surveyed 250 financial institutions (FIs) including banks and fintech firms.

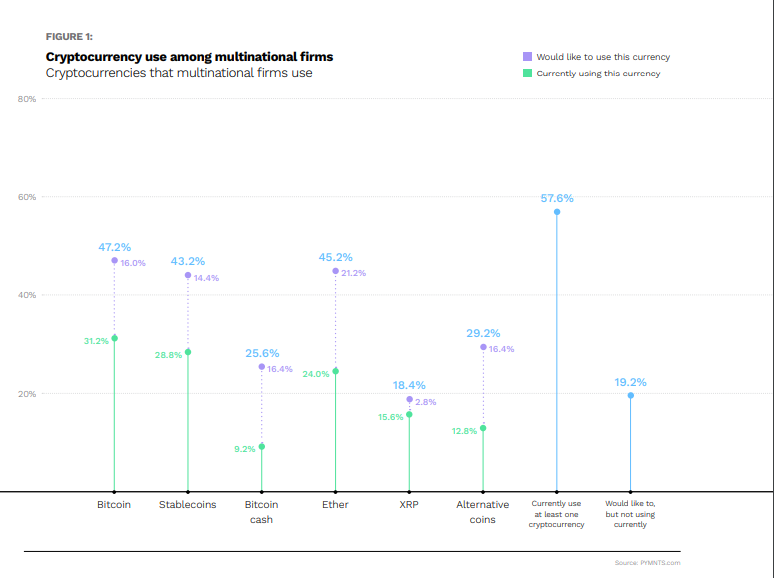

According to the research, cryptocurrency offers numerous advantages to multinational businesses including reduced transaction costs and simpler payment procedures. The survey highlights that 58% of multinational firms use at least one form of cryptocurrency with Bitcoin (BTC) being the most widely used at 31%. Meanwhile, 29% of cross-border businesses use stablecoins and 24% use Ethereum (ETH).

The research also reveals that larger multinational firms are more likely than their smaller counterparts to use digital assets. More than 80% of businesses generating $1 billion in annual revenue use at least one type of cryptocurrency. The figure drops to 7.7% for companies generating between $10 million and $49 million in annual revenue.

In addition, 46% of businesses generating $1 billion in yearly revenue are currently using Bitcoin, followed by Ethereum (36.8%), stablecoins (34.5%) and XRP (32.2%.).

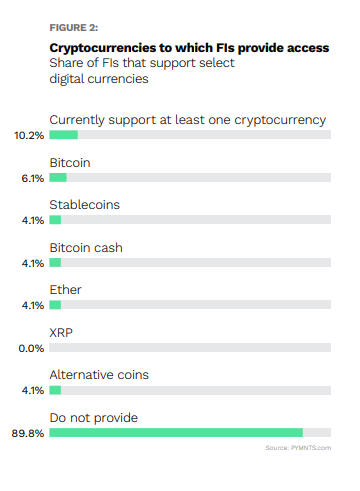

Although multinational businesses are beginning to explore cryptocurrencies, financial institutions appear to be behind the curve.

Says the PYMNTS research,

“Just in one in 10 FIs currently gives its B2B (business to business) customers the ability to use cryptocurrency, despite significant interest among clientele. Businesses that have adopted cryptocurrency frequently encounter friction in leveraging it as a payments tool in absence of a robust, technical, cross-border payments solution, yet only 4% of FIs that do not provide cryptocurrency access to their clients have definite plans to do so.

PYMNTS’ research finds that only 10% of FIs give their customers any cryptocurrency access. Bitcoin is the most commonly offered (6%), with stablecoins, Bitcoin Cash and Ether each at just 4%.”

You can read the full report here.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/kkssr