Leading digital asset manager CoinShares says institutional investors have a strong appetite for Bitcoin (BTC) and three leading smart contract platforms.

According to the firm, the overall crypto market correction has left investors hungry for more.

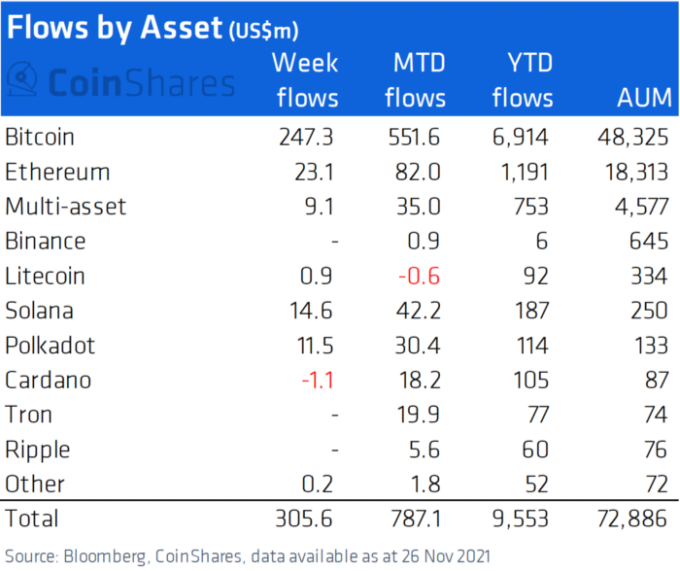

“Digital asset investment products saw inflows of US$306m last week suggesting [a] continued appetite for digital assets.”

As usual, BTC led all digital assets in terms of capital inflows, this time in the wake of a new exchange-traded product (ETP) set to launch on the Deutsche Borse exchange.

“Bitcoin saw the largest inflows in 5 weeks totaling US$247m following the launch of another investment product in Europe. This brings the 11 week run of inflows to US$2.7bn.”

BTC is trading at $58,475 at time of writing, up nearly 6% on the day.

The leading smart contract platform Ethereum (ETH) concluded a strong month of inflows with a week totaling over $23 million.

“Ethereum saw inflows totaling US$23m last week, marking its 5th consecutive week of inflows.”

This week’s big winners in inflows relative to assets under management (AuM) also include the scalable smart contract platform Solana (SOL) and the interoperable blockchain Polkadot, which is designed to support multiple layer-1 smart contract protocols.

“In terms of inflows relative to AuM, Polkadot and Solana continue to be the winners, with inflows representing 8.6% (US$11.5m) and 5.9% (US$14.6m) of AuM respectively last week.”

Ethereum is currently trading at $4,453.79, up 7.5% in the last 24 hours. SOL and DOT are trading at $211.48 and $36.82, respectively, at time of writing.

You can read the full CoinShares report here.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Space creator/monkographic