Bitcoin (BTC) is moving into the hands of long-term holders amid its weak price action, according to an on-chain analyst at the crypto analytics firm Glassnode.

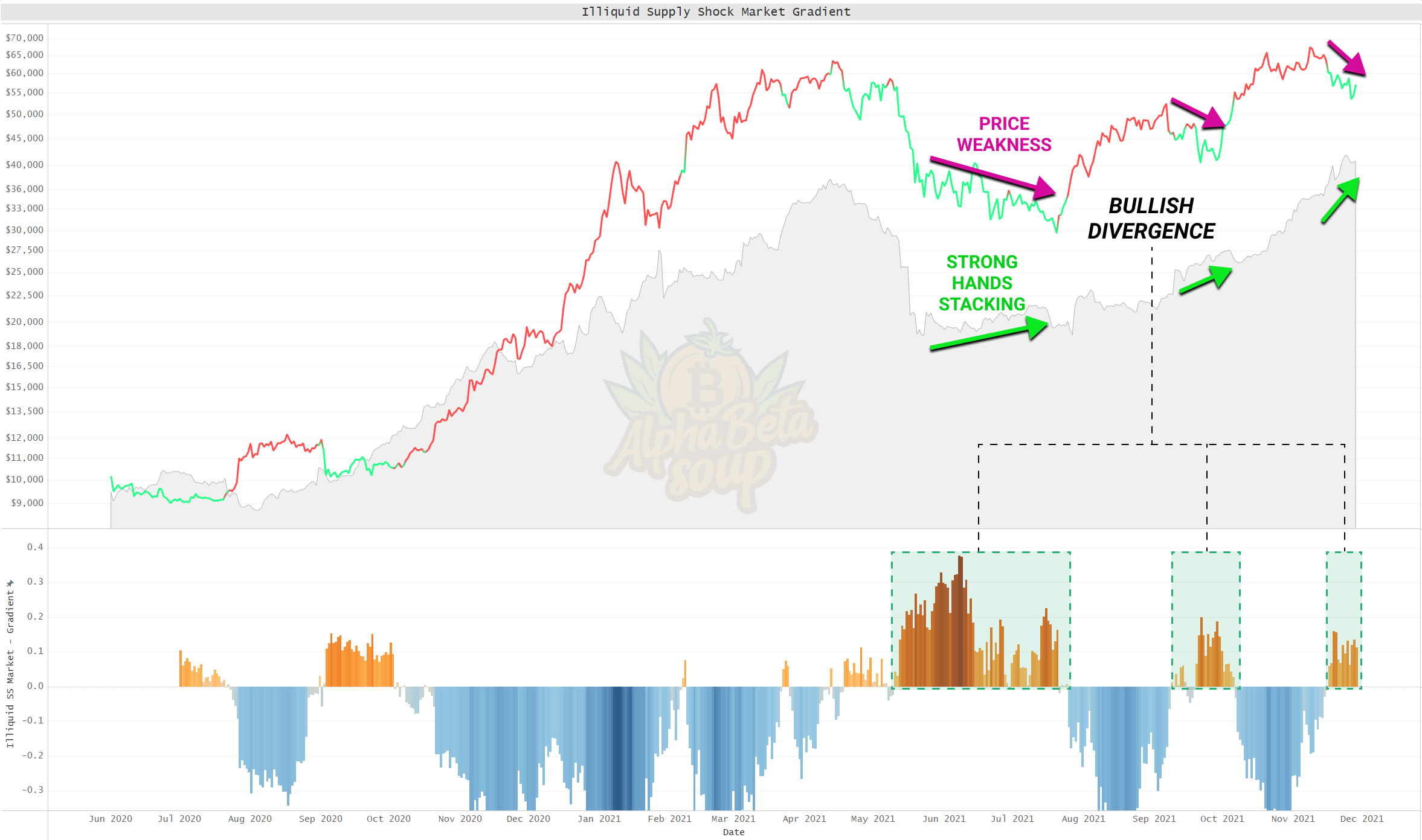

The pseudonymous analyst TXMC tells his 29,200 Twitter followers that BTC’s illiquid supply, the Bitcoin held by “strong-handed HODLers,” is rising even as the largest crypto asset by market cap struggles below $60,000.

“When strong hands stack during sell-offs, a bullish divergence appears.”

Bitcoin is trading at $57,447.06 at time of writing, up about 0.9% from a week ago.

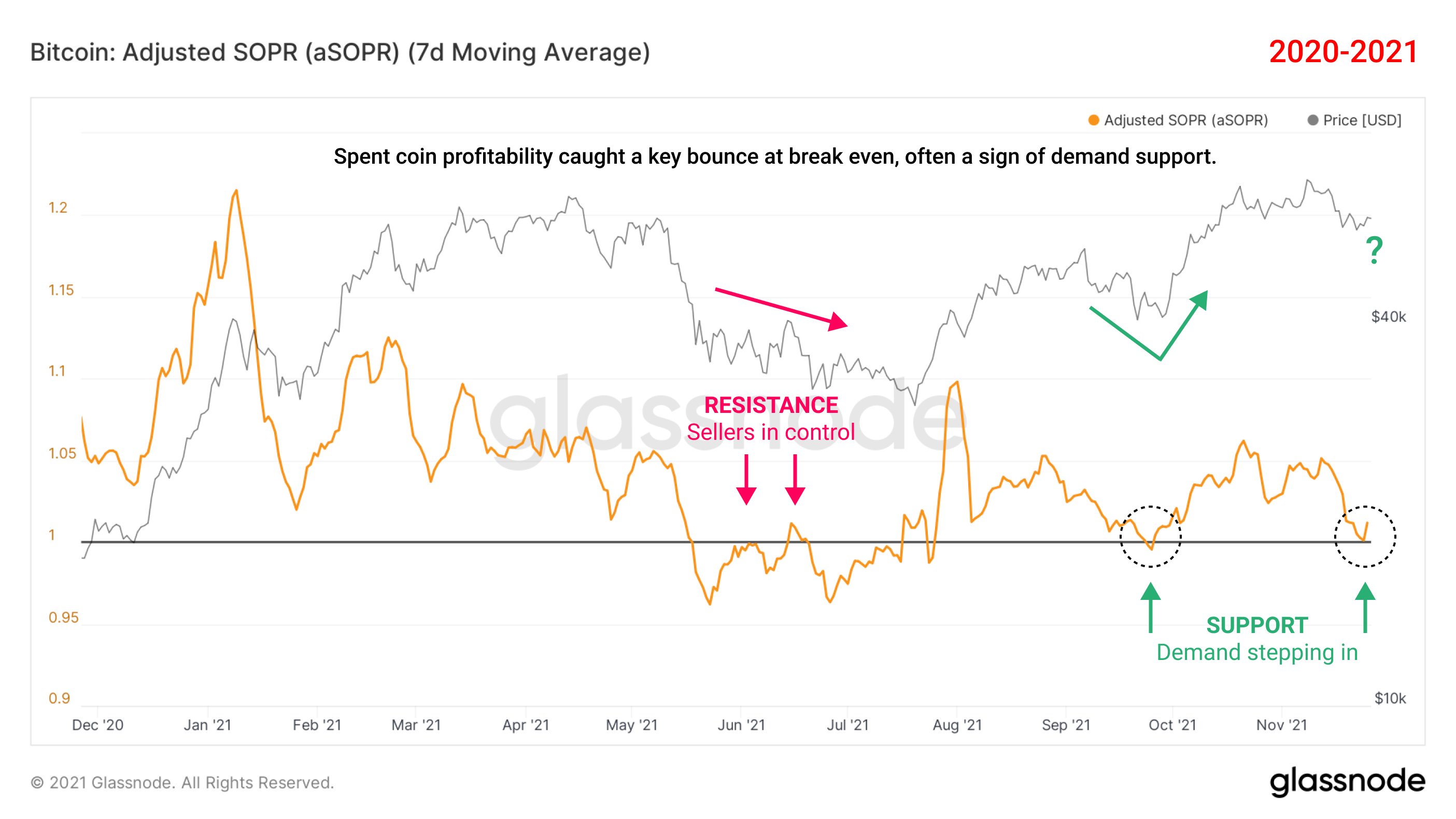

TXMC is also keeping a close watch on the spent output profit ratio (SOPR) metric, which looks at whether market participants are selling at a profit or a loss.

The on-chain analyst notes that Bitcoin’s spent coin profitability also bounced upwards after hitting a break-even point.

“Spending resets occur in the corrections of macro rallies, as lettuce-handed top buyers are shaken from the tree.

A bounce can hint at upside continuation based on history. Similar bouncing was seen in the 2017 bull run.”

Fellow on-chain analyst Will Clemente tweets that Bitcoin also had a “nearly textbook bounce” off its bull market support band. However, he’s not positive Bitcoin is ready to turn bullish yet.

“To check our bullish bias though: Still need to reclaim $61,000, still haven’t closed daily yet, and also need to see how legacy markets react tomorrow. Definitely not out of the woods yet.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/delcarmat/S-Design1689