HodlX Guest Post Submit Your Post

Currently, it can be said quite clearly that BTC has confidently taken its niche in the world of finance in particular among risky assets as the most convenient exchange-traded asset which is most often used by professional players in the market for hedging purposes.

Unlike traditional assets to which we have become accustomed for a long time since they have existed for many decades among us, BTC in my opinion, due to its youth and freshness, is more subject to the human factor than other assets. In other words, traders’ sentiments’ effect on BTC is much stronger. There are several ways to value BTC through market sentiment, which we’ll look at.

But first, let me remind you of the meaning of market sentiment.

Market sentiment is the general prevailing attitude of investors/traders to the expected price increase in a particular market. This attitude combines many fundamental and technical factors, including price history, economic components and local (national) and world events. The most popular indicators for analyzing market sentiment are the Fear and Greed Index, social activity, Google trends and others.

Analyzing Bitcoin with Google Trends

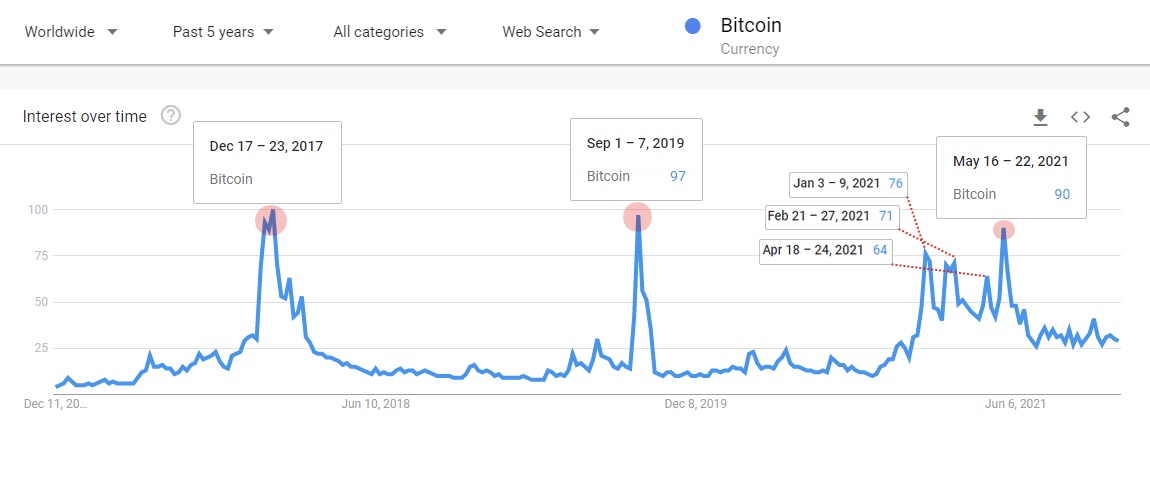

The beauty of any chart is applying a technical analysis method to it. If you go to the Google Trends dashboard and request ‘Bitcoin’ with the settings for global coverage for the last five years, a chart will open, consisting essentially of people’s moods about BTC.

You can check the chart below.

Source: Google Trends

There are several chips for the analysis above the presented Google Trend chart. The zone from 0 to 25 can be considered fear, uncertainty and undervaluation in which Bitcoin should accumulate since, after a specific time, a steady uptrend can begin.

Crossing the line with a value of 50 can be described as the fact that Bitcoin has recovered from the bottom and is ready to continue its strong growth. The zone from 70 to 100 can be called overheating and excessive greed, which indicates that the Bitcoin exchange rate will collapse soon.

Below are two charts with Bitcoin on which you can visually check the corrections that have occurred or significant falls in the rate around the dates when Google Trends were at their maximum.

Source: TradingView

Source: TradingView

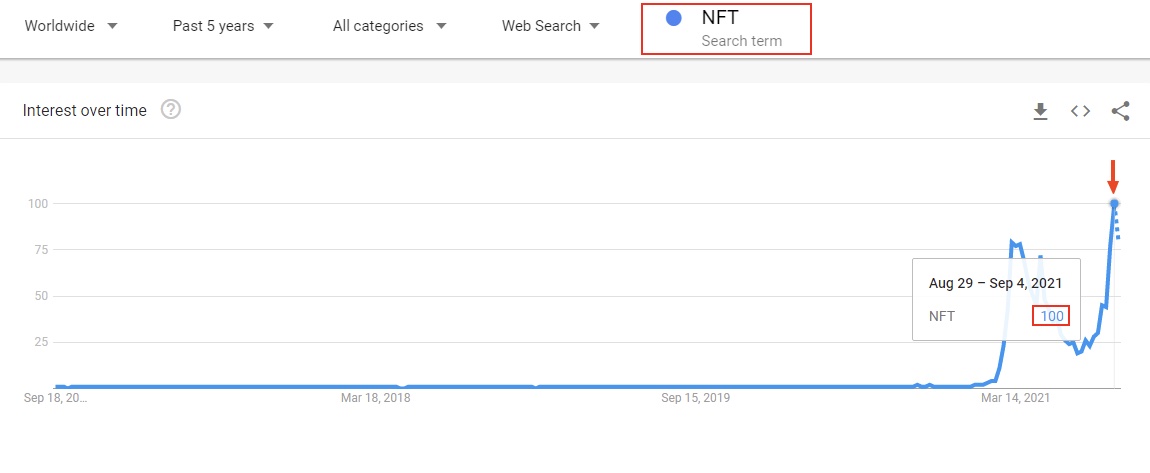

Also exciting is the fact that the rapid development of the NFT industry, which began in April 2021, had a specific effect on the price action of BTC. Ironically, this phenomenon can be tracked through a Google NFT Trends chart and applied to the BTC price chart. For example, excessive social activity in the NFT industry, which was observed between August 29, 2021, and September 4, 2021, led Bitcoin to unexpectedly fall into the clutches of bears on September 7th.

You can check the chart below.

Source: Google Trends

After the Bitcoin price collapse on September 7 of this year, the NFT marketplace ‘OpenSea’ announced their daily trading volume decreased by 99%. The OpenSea administrators also noted that in the total trading volume in the first half of September with the same period in August 2021, the drawdown was at least 50%. So, in any case, it will be interesting for us to observe the development of the relationship between Bitcoin and NFT.

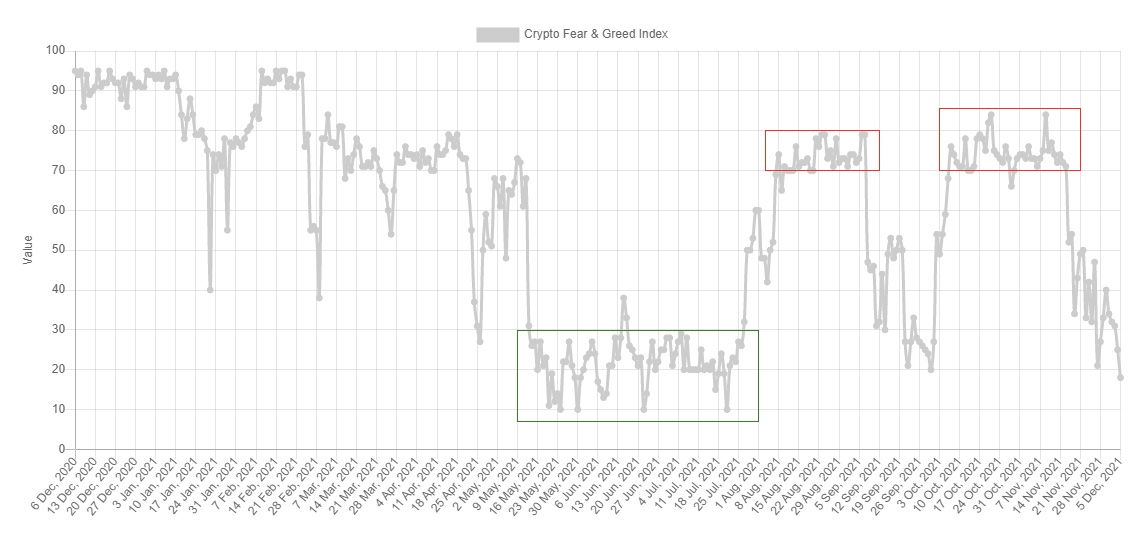

Analyzing Bitcoin with Fear and Greed Index

I want to note the analysis in terms of the Fear and Greed Index, as some people continue to be skeptical about its readings and declare that there can always be much lower and can always be much higher. Let me disagree with their statements since a trader must adhere to the trading concept of a particular indicator.

An area between 0 to 20 is considered fear and oversold, where Bitcoin needs to be accumulated. An area between 70 and 100 is deemed greedy when caution is necessary (i.e., start selling your coins). This method is more suitable for medium and long-term investors.

You can check the chart below.

Source: Alternative.me

In terms of technical analysis, how Bitcoin reacted to the Fear and Greed Index readings, you can check below.

Source: TradingView

Summing up, we can say without a doubt that these methods are of high value since the accuracy of their signals is relatively high. I would also add that the analysis of Bitcoin using social activity and Google Trends generates valuable short-term signals suitable for day traders.

In turn, the Fear and Greed Index is more suitable for swing traders and long-term traders. Feel free to develop and apply your methods for analyzing cryptocurrencies, taking into account the social activity of traders.

Baro Virtual is a family-owned team of enthusiasts who are sincerely passionate about exploring blockchain (on-chain) data and the cryptocurrency industry in general. In addition, our focus is on the analysis of financial markets, mainly using internal compression strategies, and the study of politics, business and economics. Baro Virtual is one of the top authors at CryptoQuant. Also, Baro Virtual is a guest author at Bitcoin Magazine.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sergey Nivens