Quantitative crypto analyst Plan B says that Bitcoin (BTC) has yet to peak this cycle based on the crypto asset’s current value and historical data.

Plan B tells his 1.6 million Twitter followers that he doesn’t think Bitcoin’s all-time high (ATH) around $69,000, reached one month ago, is the top of this cycle.

“I don’t think $69K was the top for this halving cycle.”

The popular analyst then says that a bear market would typically put the price of BTC much lower.

“If $69K were the top, then a typical bear market -80% drawdown would bring the bottom to $14K… below 2017 ATH ($20K) and below 200 weekly moving average ($18K).”

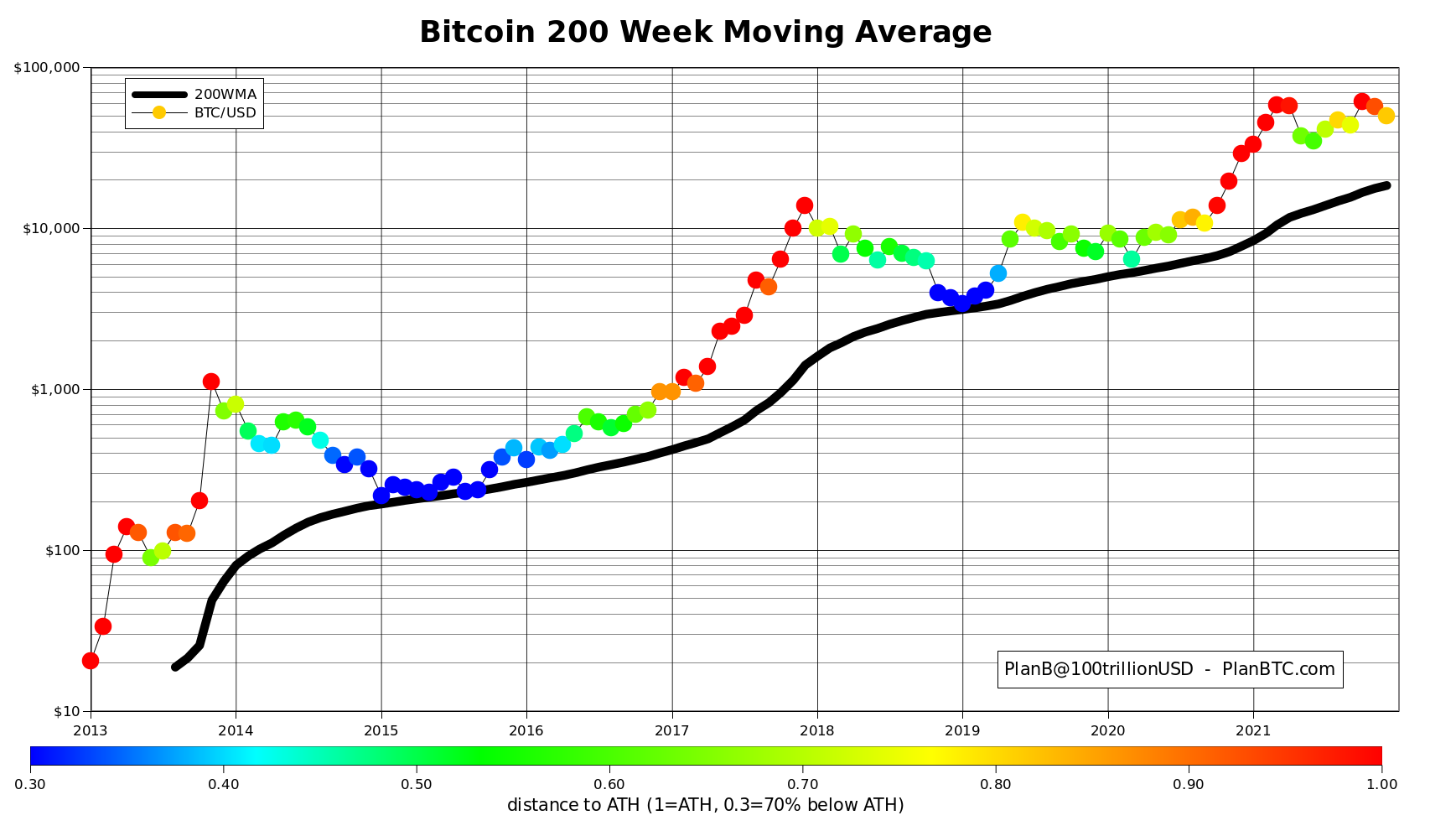

Moving averages are technical indicators that help investors and traders smooth out volatile price data by creating a constantly updated average price.

Looking at Bitcoin’s 200 weekly moving average (WMA) and current value, PlanB does not forecast BTC dropping that low.

“Nah, that has never happened and [in my opinion] will never happen.”

Bitcoin is currently trading at $47,676.65, down nearly 2% on the day.

However, the largest crypto asset by market cap is still trading at approximately 240% above the hypothetical $14,000 bottom and 138% above the 2017 ATH referenced by PlanB in his analysis.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/vectorpouch/Andy Chipus