Leading digital asset manager CoinShares says that institutional investors are in disagreement over the latest crypto correction.

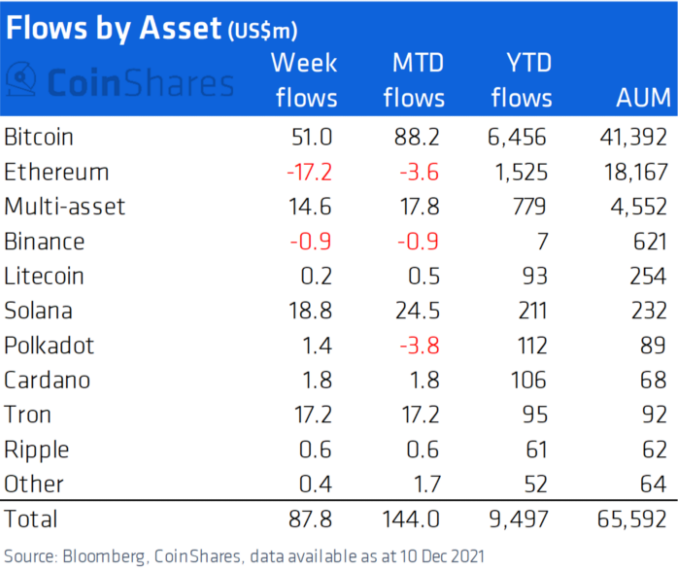

According to CoinShares, crypto investment products saw nearly $88 million worth of inflows last week. However, the numbers may not tell the full story as some investment providers saw more than 10% of their total assets under management (AuM) lost to outflows.

“Some providers saw outflows representing as much as 11% of assets under management (AuM) while others saw inflows representing 14% of AuM.

[These inflows and outflows suggest] extremely polarized opinion amongst investors, with some panic selling during this most recent price decline, while others seeing it as a buying opportunity.”

CoinShares says an example of such polarized opinions can be seen in the inflows and outflows of the two largest crypto assets by market cap, Bitcoin (BTC) and Ethereum (ETH).

“All the panic selling was focused on Bitcoin last week,

Despite this, on an aggregate basis, Bitcoin saw inflows totaling US$51m.

Despite this, trading volumes across [BTC] investment products fell by 13% to US$3.1bn for the week.

Ethereum saw minor outflows totaling US$17m last week, the first time following six weeks of inflows, although it reflects only 0.09% of AuM and is therefore likely not meaningful.”

Despite last week’s crypto polarity, two smart contract platform altcoins, which CoinShares refers to as “world computer” coins, bucked the trend to earn major weekly inflows. The same is true for multi-asset crypto investment products.

“Solana, Tron and Multi-asset investment products bucked the trend with inflows totaling US$19m, US$17m and US$15m, respectively.

The recent price appreciation of Tron, a “world computer” coin, has pushed its total AuM to above that of Cardano.”

At time of writing, Solana (SOL), Tron (TRX) and Cardano (ADA) are trading at $158.90, $0.087 and $1.26, respectively.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/solarseven/Natalia Siiatovskaia