A closely followed crypto strategist is predicting epic rallies for Polkadot (DOT) in 2022 while expecting a sharp recovery for Bitcoin (BTC).

Pseudonymous trader Capo tells his 220,800 Twitter followers that he sees interoperable blockchain Polkadot surging by as much as 2,471% from its current price of $26.25 by May next year.

“DOT chart hasn’t changed, still same bias and targets.”

Capo came up with his prediction using the Elliott Wave theory, a technical analysis approach that forecasts future price action by following crowd psychology that tends to manifest in waves. According to Capo’s chart, DOT is gearing up for a strong wave three rally to $250 before a massive correction that puts Polkadot in a position to ignite a wave five surge to $675.

Looking at Bitcoin (BTC), Capo believes that the bottom is in for the leading crypto asset.

“These two corrections are very similar.

– Same 3 wave move pattern

– Same bottom formation (3 touches)

– Same funding+premium negative rates

– Same hidden bearish divergence before the last leg down.”

According to Capo’s chart, Bitcoin’s corrective move to below $46,000 on December 13th puts BTC in a position to rally above $60,000.

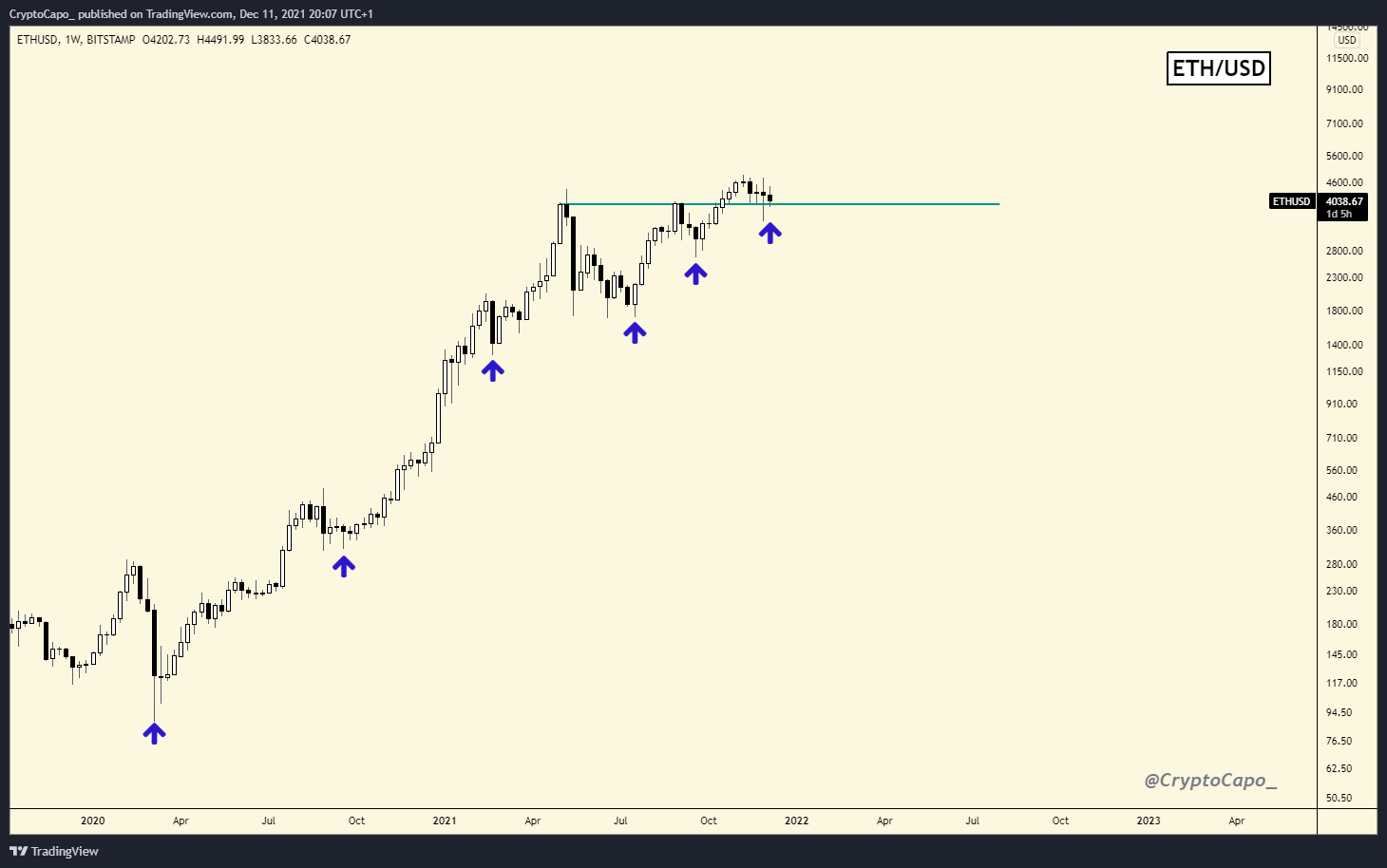

As for Ethereum (ETH), the crypto analyst is bullish on the leading smart contract platform as long as it avoids a weekly close below $3,900.

“ETH has been forming a perfect uptrend with consecutive higher lows since the March 2020 crash, and now it’s retesting the previous highs as support. This is very bullish.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia