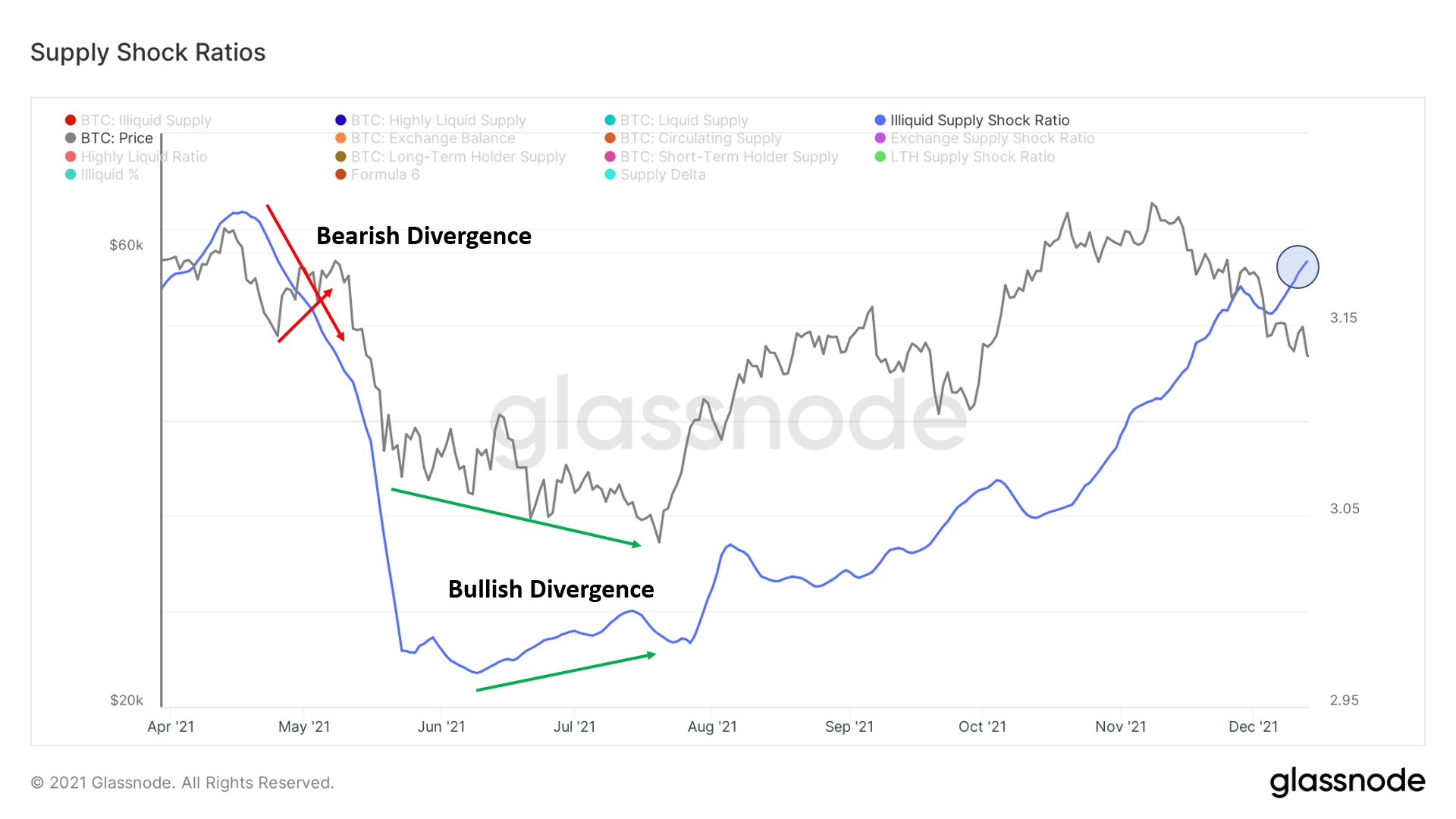

The current bearish price action of Bitcoin (BTC) looks different from BTC’s May collapse in a number of key ways, according to on-chain analyst Will Clemente.

Clemente tells his 470,600 Twitter followers that “strong hands,” meaning entities who historically take in and hold more than 75% of their BTC, are currently buying from “weak hands,” which are entities that take in and hold less than 75%.

The analyst says this contrasts from May’s bear market, which saw the opposite when previously strong hands became weak hands.

Bitcoin is trading at $48,221.01 at time of writing, up 2.33% in the past 24 hours. However, the top-ranked crypto asset by market cap is down more than 24% from a month ago and more than 30% down from its all-time high of $69,044.77, reached on November 10th.

Clemente noted in a recent newsletter that the cost basis, the average price where a certain group of investors entered the market, for short-term holders of Bitcoin is a key metric to watch when determining whether BTC will flip bullish. Bitcoin investors are considered short-term holders if their coins are younger than five months.

Explains Clemente,

“Bitcoin is below the short-term holder cost basis, which currently sits at $53,000. Until this is reclaimed, not bullish. Not saying I am a ‘giga bear,’ just cautious until the market shows me otherwise.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal/Chuenmanuse