A crypto protocol that helps investors earn interest is paving the way for mainstream institutions to enter the world of decentralized finance (DeFi).

In a joint announcement, Aave (AAVE) says it’s partnering with blockchain security outfit Fireblocks to launch the world’s first permissioned DeFi platform.

The new Aave Arc liquidity pool will utilize the firm’s whitelisting framework to comply with anti-money laundering (AML) regulations and screen applicants via Know Your Customer (KYC) verification.

The press release says that regulatory-compliant DeFi could bring trillions of dollars worth of traditional investment capital into the cryptocurrency space.

“While approximately $255.9 billion is currently locked in DeFi, the market has largely remained untapped by institutions due to a lack of support for enterprise-grade risk management and KYC/AML requirements.

Enabling institutional access to DeFi could unlock a trillion-dollar opportunity over the next half-decade.

Aave Arc looks to usher in this paradigm shift by unlocking secure and compliant DeFi access for financial institutions across the globe.”

Fireblocks says it has already approved over two dozen licensed financial institutions for Aave Arc including CoinShares, Anubi Digital and Celsius.

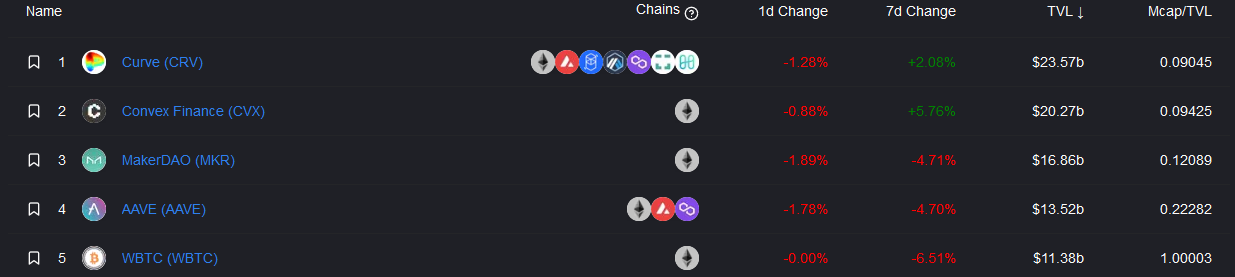

According to DeFi tracker DeFi Llama, Aave ranks fourth among all projects in terms of total value locked (TVL) at $13.52 billion.

The TVL of a DeFi protocol represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

The price of Aave is down 6.50% to $218.06 at time of writing. The altcoin hit a monthly high of $294.74 back on December 28th after experiencing a major surge, shooting up 80.9% from $162.84 in less than two weeks.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Ico Maker/Vladimir Sazonov/Andy Chipus