Macro guru and Real Vision chief executive Raoul Pal is looking at the historical price action of e-commerce titan Amazon and comparing it to the performance of Bitcoin (BTC) since 2013.

The former Goldman Sachs executive tells his 863,300 Twitter followers that Amazon (AMZN) adhered to Metcalfe’s Law, which states that a network grows in value as the number of users on the network gets bigger.

Pal highlights that back in the early 2000s, Amazon was a highly volatile stock with drawdowns as deep as 50%.

“Back in 2003 to 2011, it looked like this.”

According to Pal, Amazon’s price action back then rhymes with Bitcoin’s price action now.

Pal also looks at the market structure of Amazon in 2010, which he says closely resembles the price action of Bitcoin in the last 12 months or so.

“In the short term, 2010 Amazon looked like this…”

“And BTC like this…”

According to the macro guru, if Bitcoin is to follow Amazon’s price action in 2010, it is possible for the leading cryptocurrency to revisit crucial support at $30,000.

“It suggests BTC might even possibly test $30,000 but I doubt it (I think the sell-off is near done). but who the hell knows! It’s similar enough for context but never rely on fractals. They are for context only. The BTC fractal is longer in time than AMZN and more volatile. In the end, it’s all noise. The log chart is the truth and that is in itself an approximation of Metcalfe’s Law. If it isn’t noise to you, your position is too big for your time horizon.”

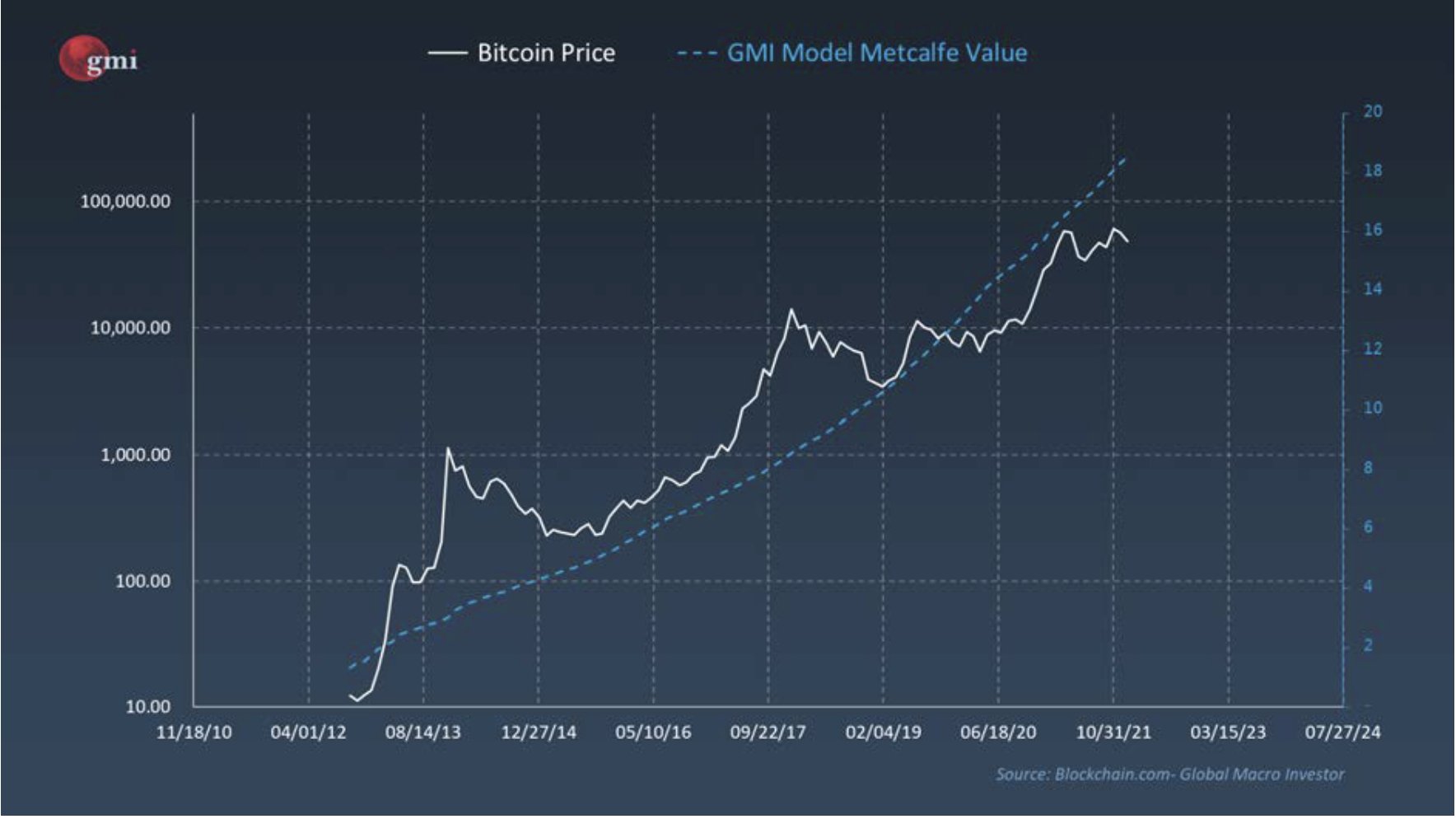

Pal also adds that based on Metcalfe’s Law, Bitcoin’s value should be hovering around $100,000, suggesting that BTC is tremendously undervalued at its current price of $42,144.

“BTC is cheap vs Metcalfe’s Law….(and has been for a long time – my guess is because there is less network applications on BTC currently than ML [Metcalfe’s Law] would prefer).”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/HUT Design/Sensvector