HodlX Guest Post Submit Your Post

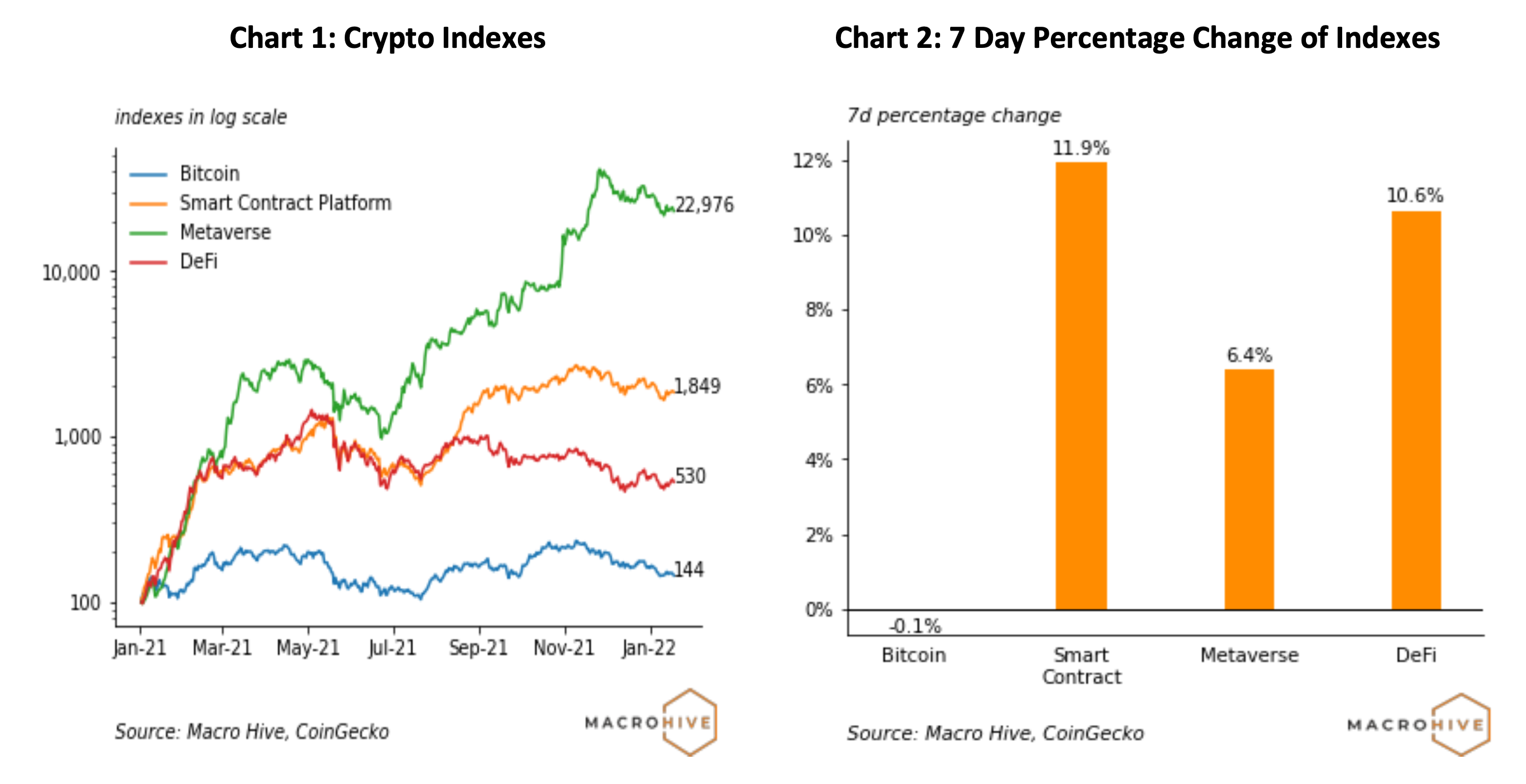

Bitcoin has traded sideways and is currently trading below $42,000 (see charts one and two below). But other crypto markets have performed better. Our smart contract index has jumped 11.9% thanks to a surge in Cardano (up 31%) and our DeFi index has jumped 10.6%. The metaverse index had earlier underperformed but could only muster a 6.4% gain.

In terms of the breakdown within each index, see below.

- Smart contract platform index All coins except for Solana (SOL) in this basket are up on the week. Cardano (ADA) is up the most at 31.2%, followed by Polkadot (DOT) at 3.6%. Ethereum is up 1.6%.

- DeFi index All coins except for Compound (COMP) are up on the week. Aave (AAVE) is up the most at 13.4% while Compound (COMP) is down 4.5%.

- Metaverse index The constituents in this basket had mixed performance. Axie Infinity (AXA) is currently up the most at 6.8%, followed by Enjin Coin (ENJ) at 2.9%. Meanwhile, Gala (GALA) is down the most at 4.5%.

- Bitcoin This is relatively unchanged, only falling 0.1% on the week.

What are in the four indices?

Here are the indices in more detail.

- Bitcoin he OG of crypto markets deserves its own category and is in many ways the true benchmark for any other crypto market.

- Smart contract platforms fter Bitcoin, the big innovation was to have blockchains that were more programmable. These could host smart contracts or decentralized applications and have allowed the emergence of the metaverse and DeFi. Ethereum (ETH) is the most popular version of a smart contract platform. But we also include rivals Solana (SOL), Cardano (ADA) and Avalanche (AVAX). We also include Polkadot (DOT), which allows interoperability between blockchains and the use of smart contracts via parachains.

- Metaverse oins associated with the creation of a virtual space/digital world on the internet using a combination of augmented reality, virtual reality and social networks. One of the largest is this space is Axie Infinity (AXS), which is a play-to-earn gaming platform. Another is Decentraland (MANA), which is a virtual world that allows ownership of land among other things. The three other coins we include are The Sandbox (SAND), Enjin Coin (CNJ) and Gala (GALA).

- Decentralized Finance (DeFi) inancial services built on top of blockchain networks with no central intermediaries. This can be a very broad category, so we narrow this down to platforms that focus on lending and borrowing or to yield farming. The five coins we have selected are Aave (AAVE), Maker (MKR), Compound (COMP), Uniswap (UNI) and PancakeSwap (CAKE).

Disclaimer

The commentary contained in the above article does not constitute an offer or a solicitation or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.

Bilal Hafeez is the CEO and editor of Macro Hive. He spent over twenty years doing research at big banks JPMorgan, Deutsche Bank and Nomura where he had various ‘global head’ roles and did FX, rates and cross-markets research.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal/Vladimir Sazonov