Crypto research firm Glassnode is looking at fresh Bitcoin (BTC) data to see if the recent sell-off indicates that BTC is just in a slump or entering bear market territory.

In its latest weekly newsletter, Glassnode says that due to the wild price swings commonly seen in the crypto markets, a deeper analysis of the data is required to establish a clear picture of what’s really happening.

“Bear markets are hard to define in Bitcoin, as the traditional 20% drawdown metric would trigger a bear almost every second Tuesday given the volatility. Thus we look to investor psychology and profitability as a gauge of likely, and actualized sell-side activity.

What we identified this week are significant realized losses, a steep drawdown, a return to HODLer-led accumulation, and top buyers taking any opportunity to get their money back.”

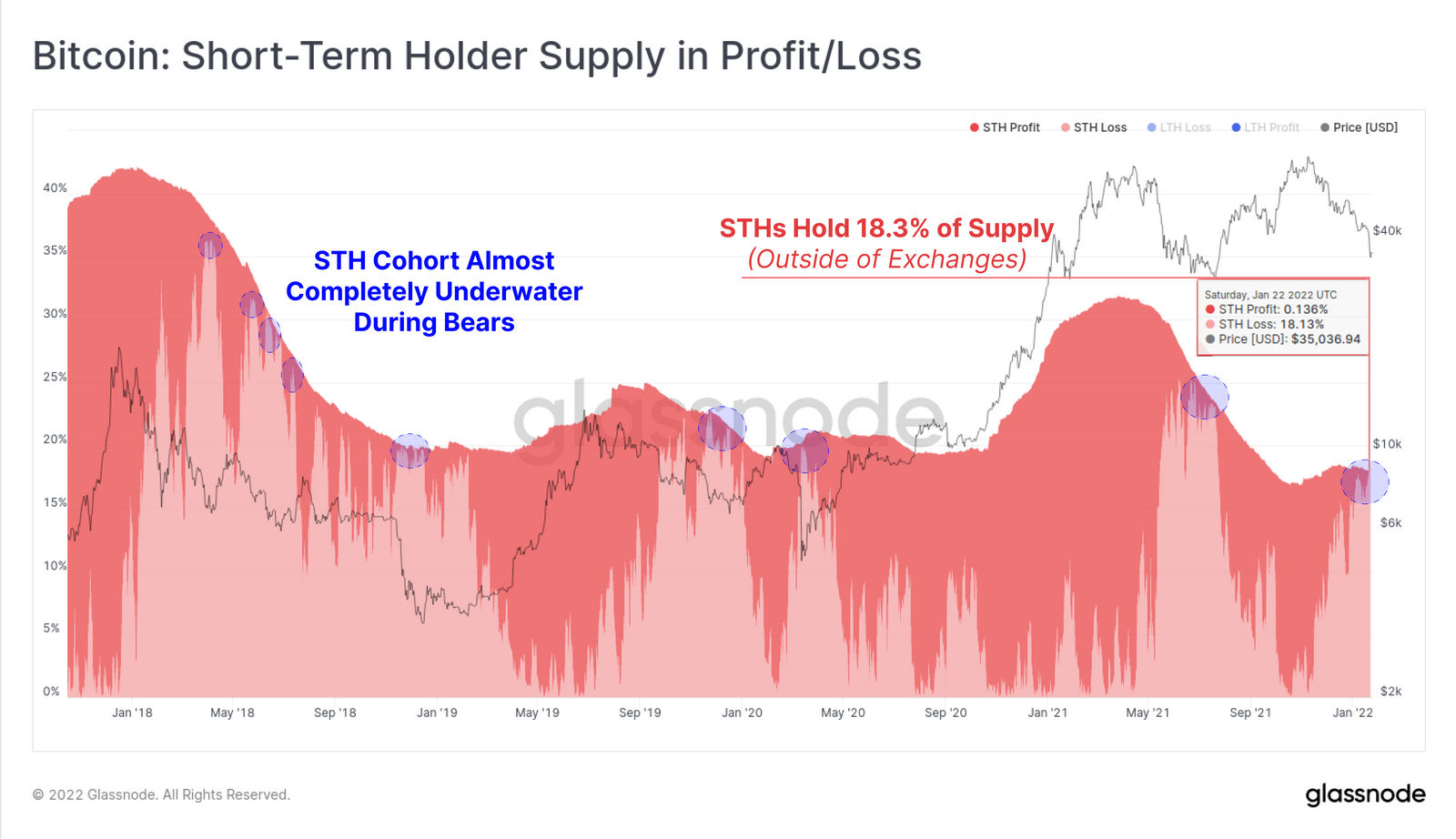

The firm notes that Bitcoin has experienced a double-whammy of price drops and sell-offs from short-term holders (STHs).

“Alongside declining prices, investors have capitulated over $2.5 billion in net realized value on-chain this week.

The lion’s share of these losses is attributed to short-term holders who appear to be taking any opportunity to get their money back.”

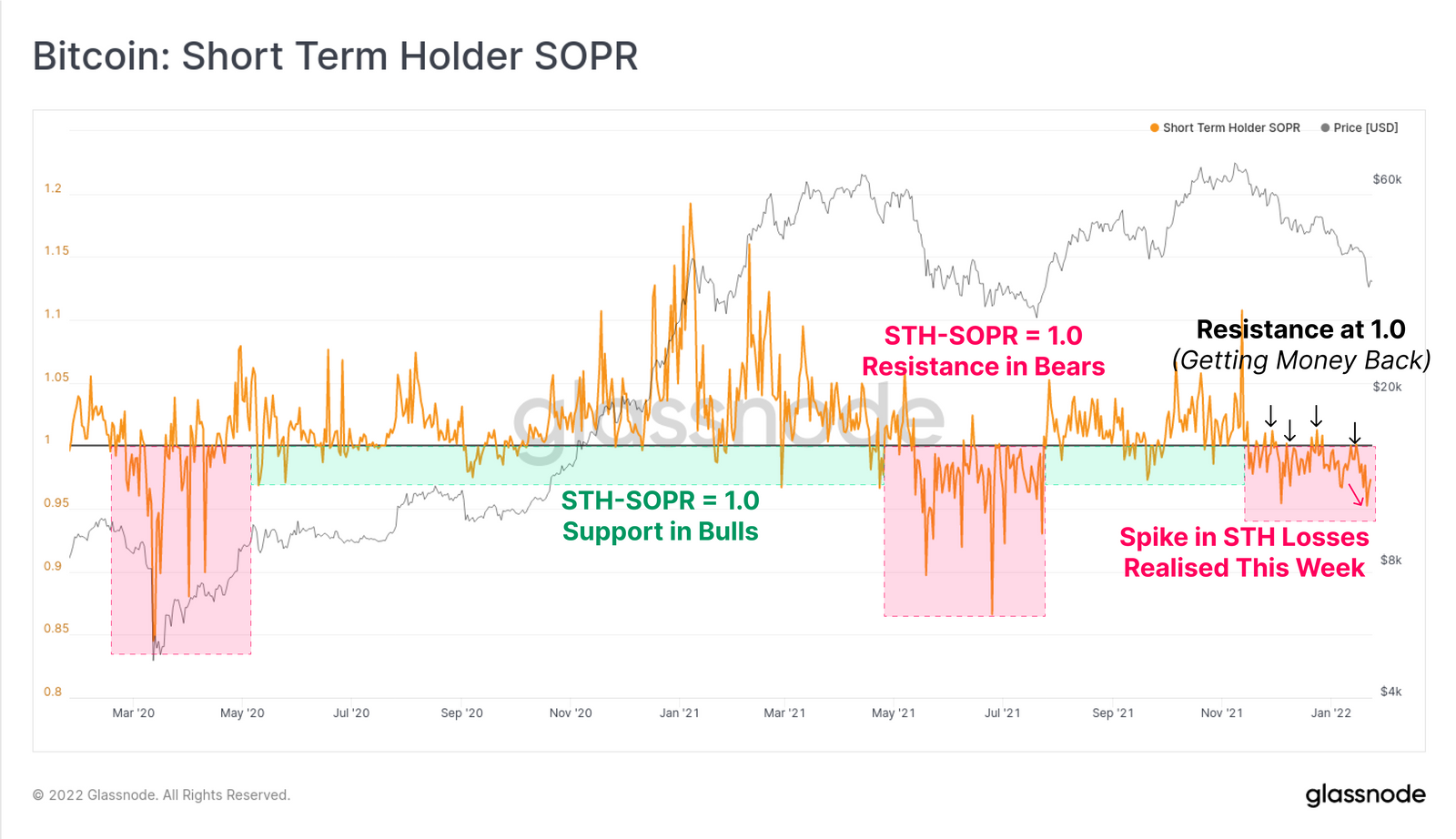

Digging deeper into the data of STHs selling their Bitcoin at a loss, Glassnode says,

“Coins are considered to be owned by STHs when they are younger than ~155-days and are statistically more likely to be spent in the face of volatility.

The STH-SOPR [spent output profit ratio] metric has accelerated downwards this week, after finding resistance at a value of 1.0 throughout this drawdown.

Psychologically, this suggests that recent buyers are taking exits at, or below their cost basis to ‘get their money back,’ creating sell-side pressure and resistance.

Lower values indicate heavier losses are taken by STHs, who in this instance are disproportionately top buyers.”

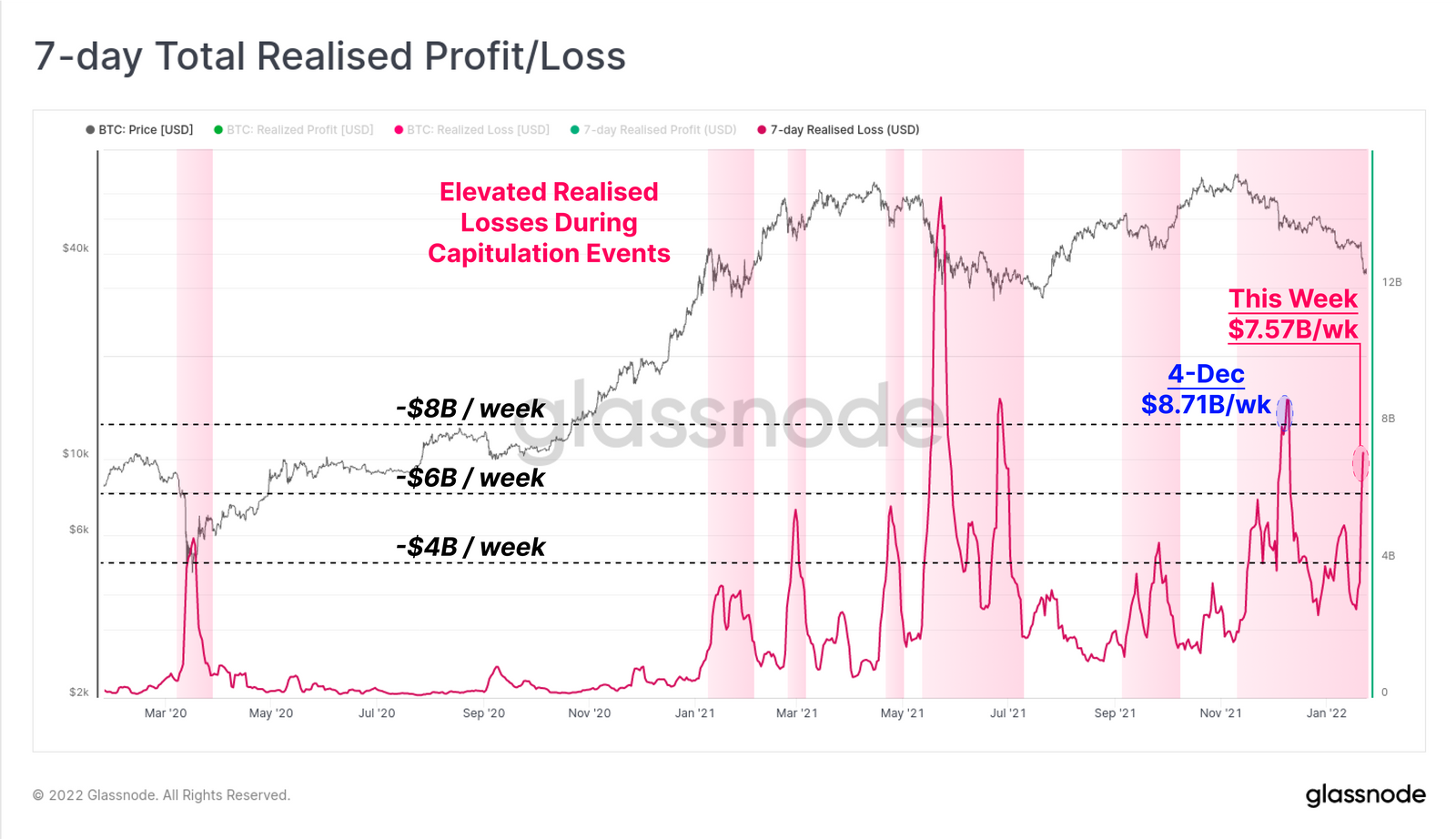

Pulling the lens out further, the firm notes that total realized losses were more than $7.57 billion in just a single 7-day period. Glassnode says such a drop mirrors “major capitulation events over the past 12 months.”

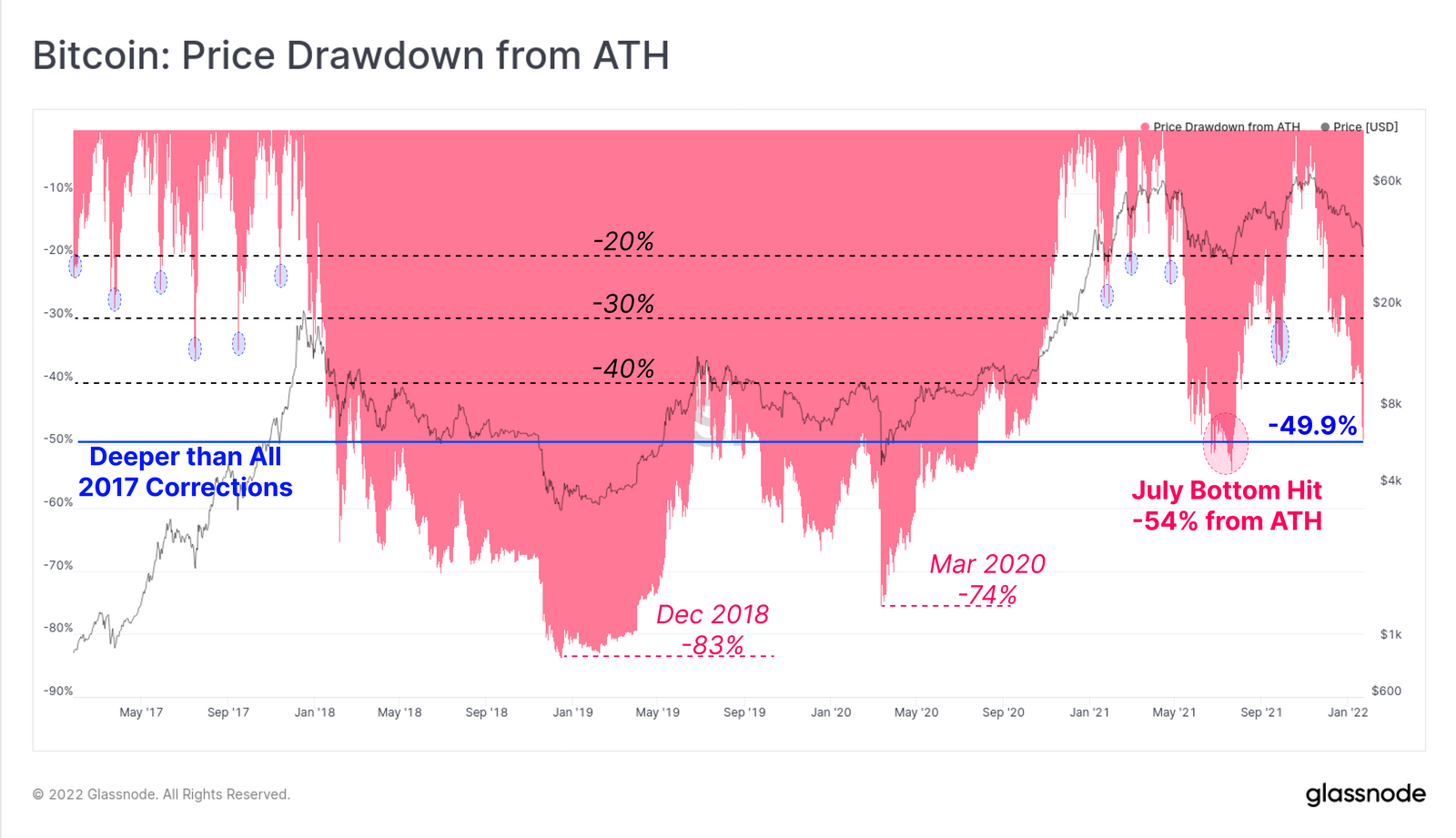

In conclusion, Glassnode looks at the impact of Bitcoin losing nearly 50% in valuation since hitting an all-time high above $69,000 in November of last year.

“This is now the second-worst sell-off since the 2018-20 bear market, eclipsed only by July 2021, where the market fell -54% from the highs set in April.

With the bulls now firmly on the back foot, such a heavy drawdown is likely to change investor perceptions and sentiment at a macro scale.

Numerous signals point to a macro scale bear trend in play. … The bulls either need to step up in a big way, else the probabilities favor the bears.

That said, a relief bounce in the near term is also probable if history is to act as a guide.”

At time of writing, Bitcoin is rallying from its weekly lows, up by 4.36% to $37,254.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Andrey Suslov/Nikelser Kate