Closely followed on-chain analyst Willy Woo says that an inconspicuous group of Bitcoin (BTC) investors may be generating a new wave of strong demand for BTC.

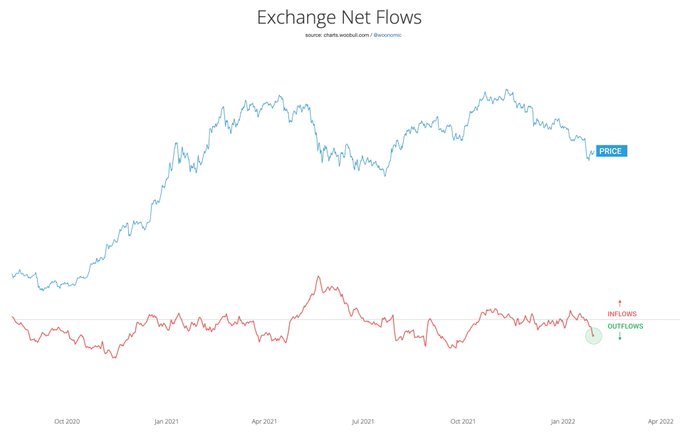

Woo tells his 980,000 Twitter followers that he’s looking at the exchange net flows metric, which tracks the amount of Bitcoin moving in and out of crypto exchanges.

According to Woo, the metric is currently showing the dominance of exchange outflows, indicating a rise in demand and the willingness of investors to hold on to their BTC while waiting for flagship crypto asset to rally.

“I guess BTC is in demand lately.”

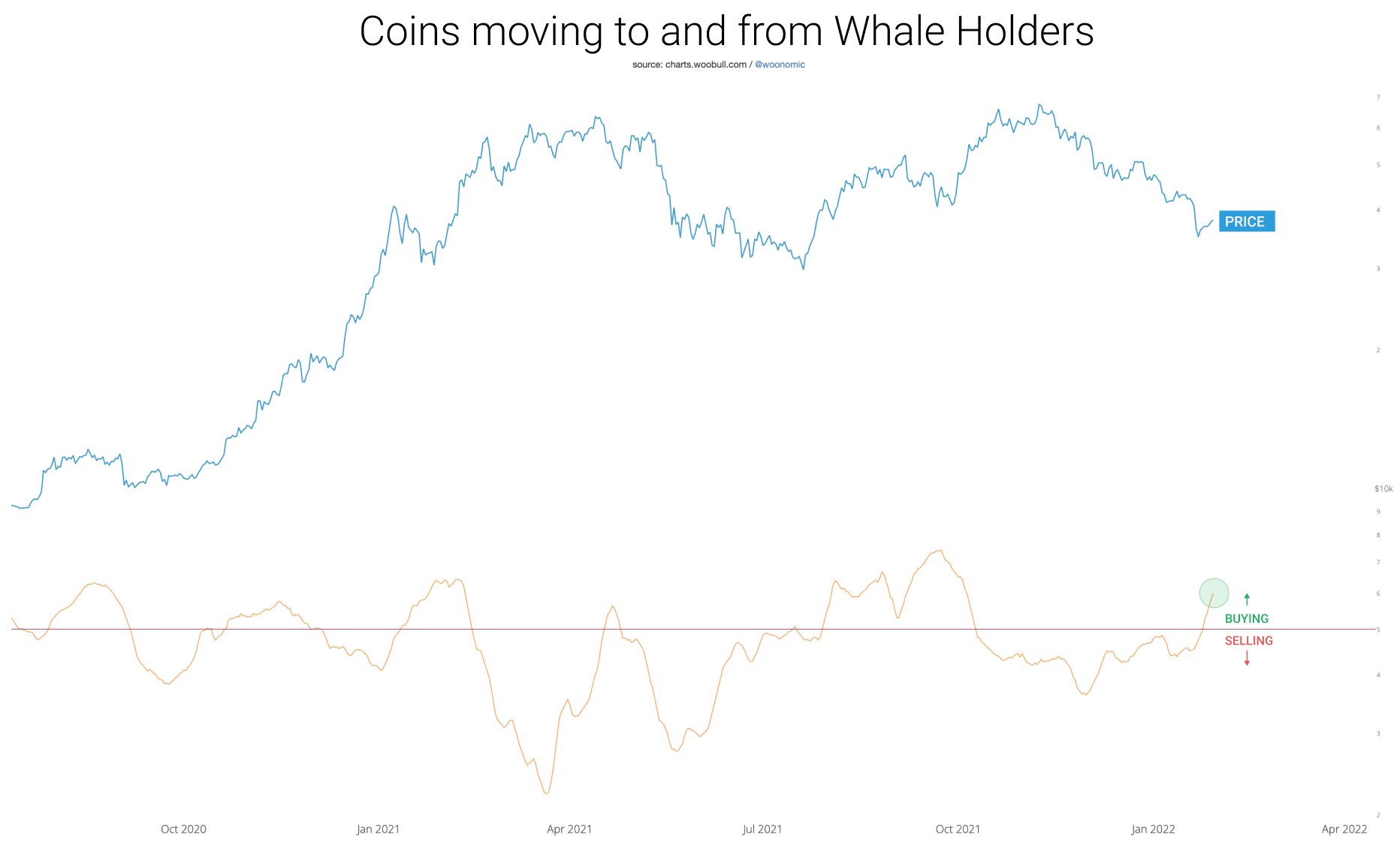

Woo also says that based on the amount of coins moving into the hands of whales, or entities with 1,000 to 10,000 BTC, he thinks institutions are likely behind the buying power.

“Probably institutional money.”

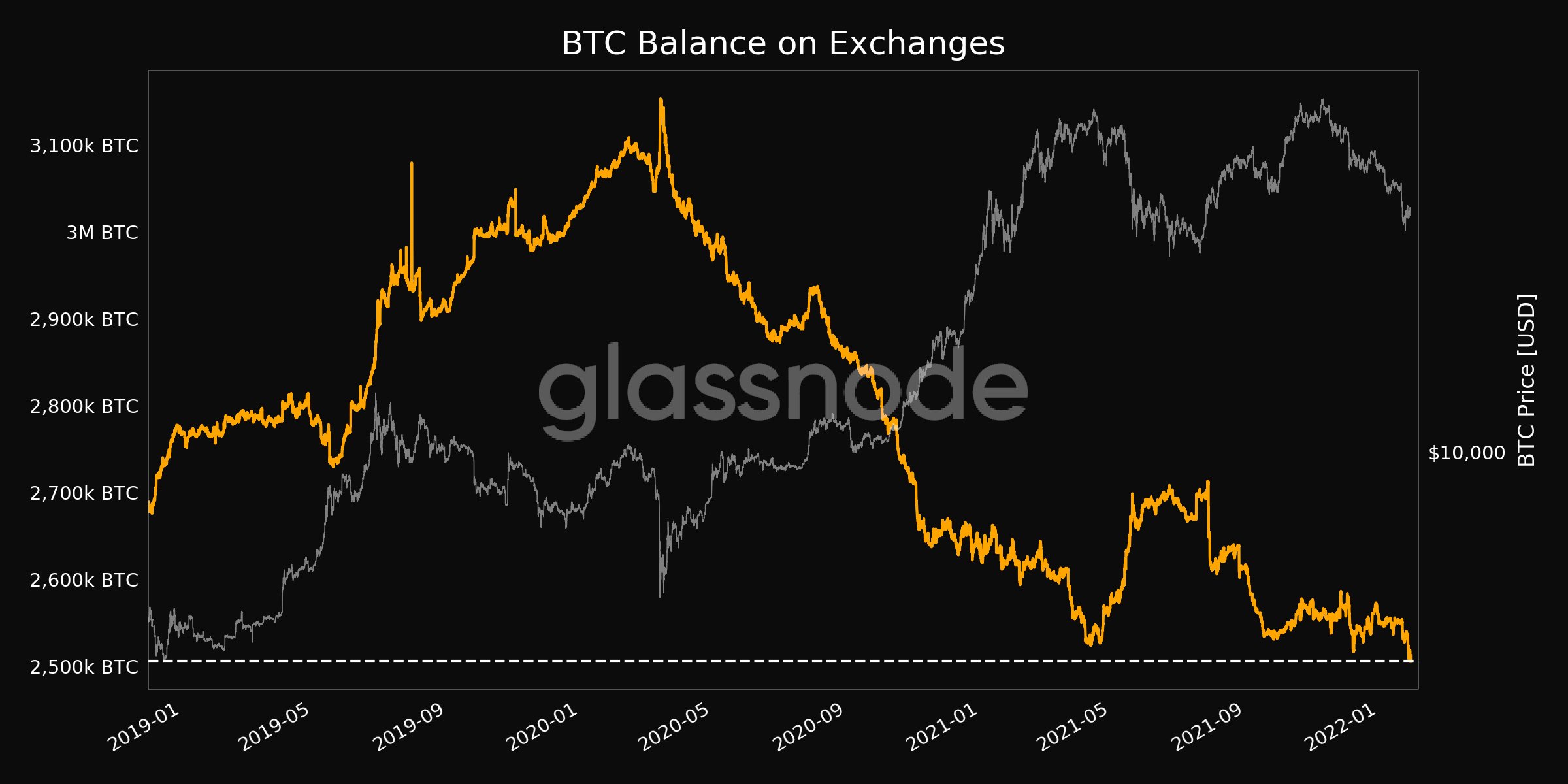

The popular analyst says he uses data from blockchain tracker Glassnode to accommodate for factors like exchanges and exchange-traded funds (ETFs) to get a more accurate picture.

According to Glassnode, the balance of Bitcoin on exchanges is currently at the lowest point in the last three years, suggesting diminishing sell-side pressure for BTC.

“BTC balance on exchanges just reached a three-year low of 2,505,972.824 BTC

Previous three-year low of 2,508,534.211 BTC was observed on 27 January 2022.”

In addition, Glassnode says that the vast majority of all transfer volume on the Bitcoin network is dominated by institutional-sized flows, suggesting that the big players are starting to take control of BTC.

“Bitcoin transfer volumes continue to be dominated by institutional size flows, with more than 65% of all transactions being larger than $1 million in value.

The uptrend in institutional dominance in on-chain volumes started around Oct. 2020 when prices were around $10,000 to $11,000.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal