Blockchain analytics firm Glassnode says that Bitcoin’s on-chain fundamentals have hints of bullishness, suggesting that recent market correction could be close to over.

In its latest report, Glassnode says that while most derivatives traders are betting on more downside for BTC, on-chain models are hinting that a more bullish undertone is in play.

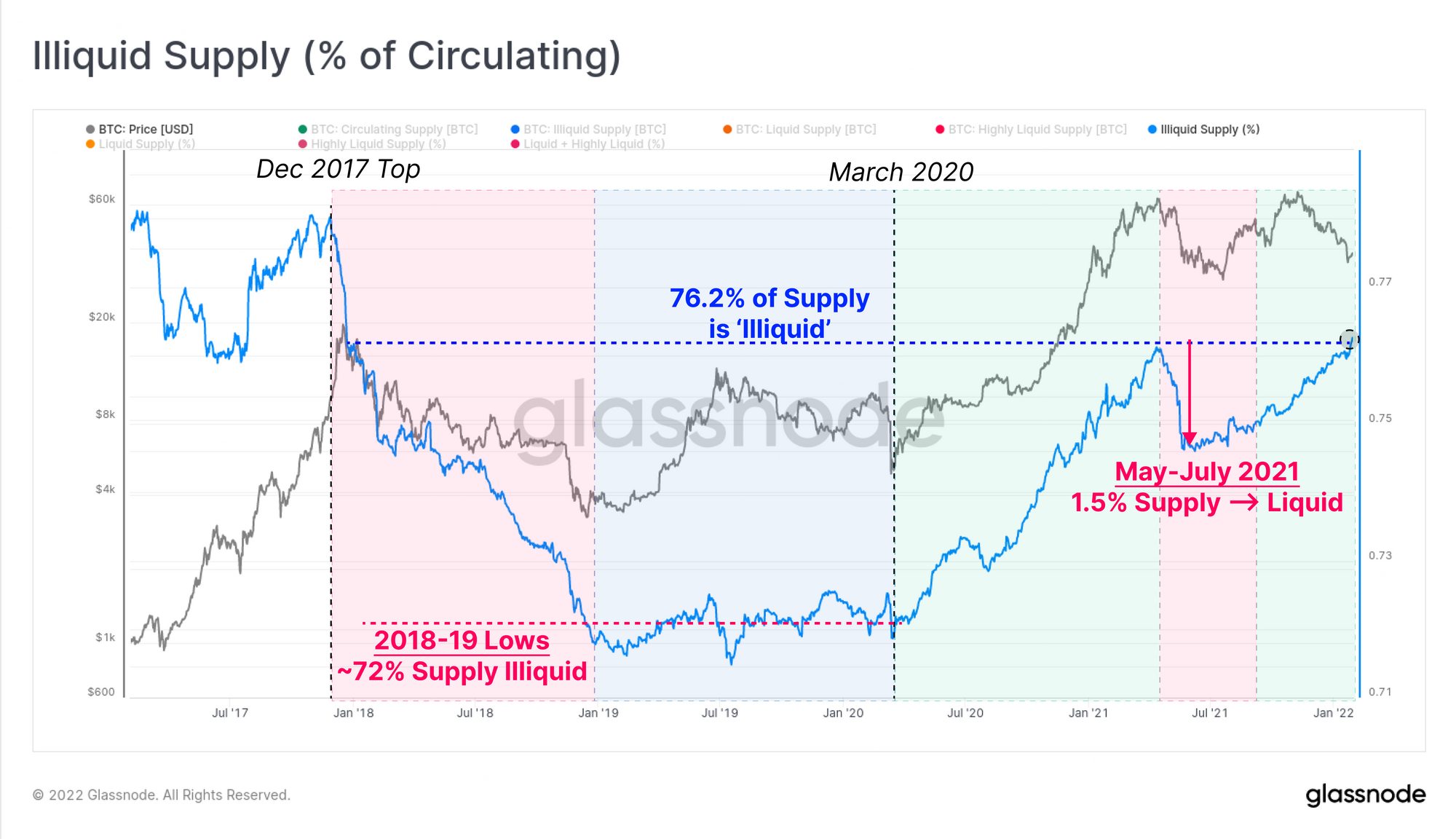

The firm says that the illiquid supply of Bitcoin, or BTC that sits in addresses with little history of selling, is growing while price declines, which is reminiscent of other points in history that ultimately led to bull runs.

“Interestingly, prices in the current market are declining (bearish), whilst Illiquid supply is in a marked uptick (bullish). This week alone, over 0.27% of the supply (~51k BTC) was moved from a Liquid to Illiquid state. Within a macro bearish backdrop, this does raise the question as to whether a bullish supply divergence, similar to May-July 2021, is in effect.”

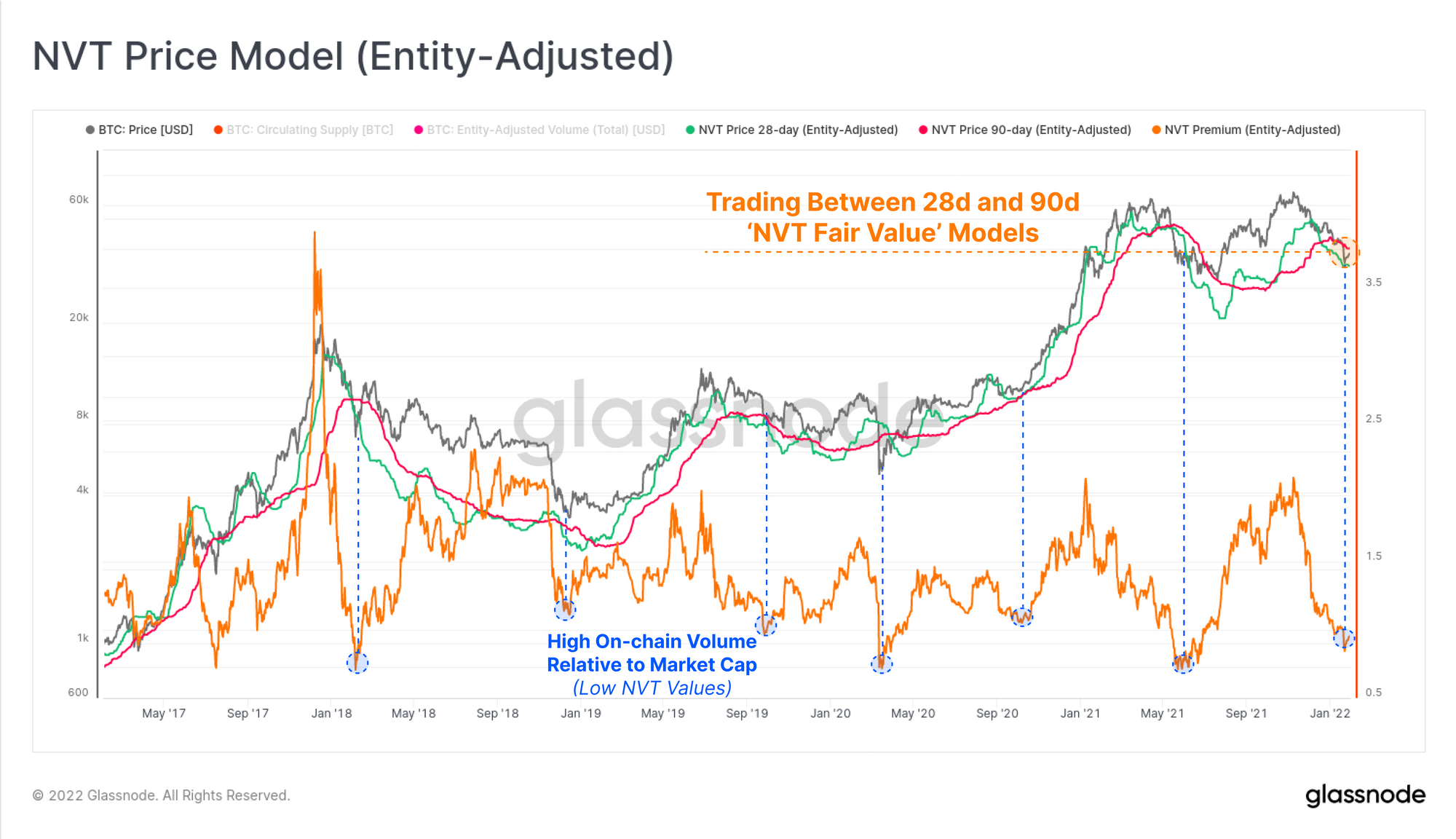

Glassnode also takes into account Bitcoin’s NVT (Network Value to Transaction), which describes the relationship between transfer volume and market capitalization.

The blockchain-tracking company says that Bitcoin’s NVT is currently at a point that suggests that BTC is trading at a premium while echoing bear market bottoms of the past.

“Taking a ratio of price and the 90-day NVT price gives an ‘NVT Premium’, which is currently trading at lows that are historically considered undervalued. Previous instances where settlement volumes have been this high relative to the market cap have preceded strong bullish impulses in bear markets, or at macro market bottoms such as Dec 2018, and Mar 2020.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/increation87