The chairman of investment strategy at JPMorgan says that he was late in recognizing how big the cryptocurrency space would grow and is now taking a deep exploratory dive.

In a wide-ranging newsletter, Michael Cembalest discusses topics including Bitcoin (BTC) as a store-of-value, decentralized finance (DeFi), stablecoins and non-fungible tokens (NFTs).

The JPMorgan chairman also expands on how blockchain adoption can be distinct from cryptocurrency valuations.

While stating for the record that he speaks for himself and not JPMorgan, the analyst says,

“I did not anticipate the increase in crypto values from $25 billion to $250 billion to $2.5 trillion (and now $1.5 trillion), and I recognize that I am late to this.

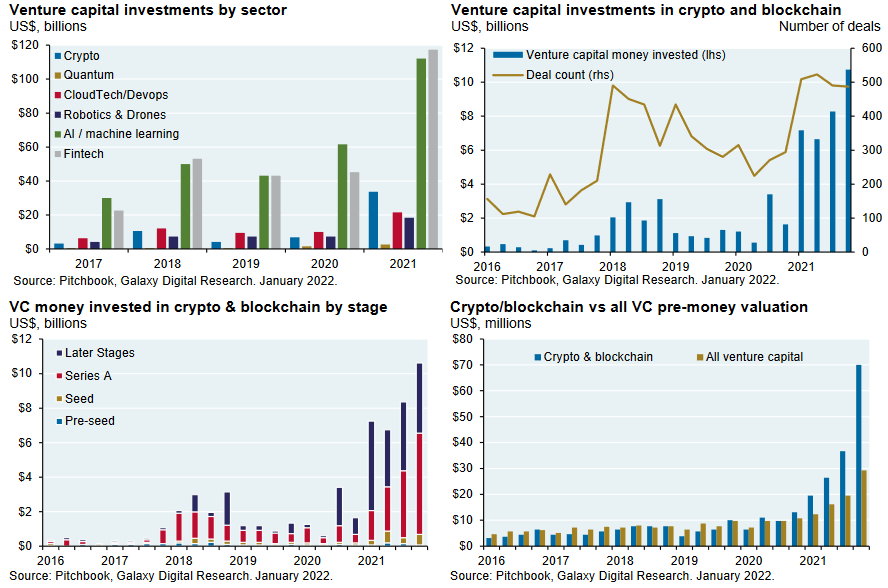

There’s a ton of money pouring into crypto and blockchain investments. Venture capitalists [VCs] have been plowing money into crypto at an accelerating pace, rivaling other innovation categories.”

Cembalest takes note of where the VCs are putting their money:

“[Around] 40% in trading, investing and lending businesses; ~20% in Web 3.0 applications and NFTs; ~10% in custody; and the remainder in a variety of businesses focused on compliance, mining and data security.”

Regarding crypto adoption, the investment strategist says that institutional portfolios are taking on more and more exposure.

“Crypto adoption is rising across investor types and regions. While institutional ownership has been low to date, it is now growing.

Bridgewater [Associates] estimated that ~1 million Bitcoin (around 5% of total issued supply) are now held by institutional investors via custodial intermediaries.”

Beyond blockchain being seen as an investment vehicle or source of innovation, Cembalest cites people’s desire for a store-of-value to protect against monetary inflation.

“I understand why people are interested in cryptocurrencies with a fixed supply as a store-of-value. The developed world has drowned itself in debt and fiat money, and at a pace that dwarfs anything seen in the wake of the financial crisis in 2008.

Central banks and treasuries have created a massive confidence void, and it would have been strange if some alternative to fiat money didn’t appear on the scene.

I accept the notion that a digital store of value could exist… Bitcoin is beginning to capture a larger subset of store-of-value investments when compared to the value of gold, [although] Bitcoin’s volatility continues to be ridiculously high…”

The JPMorgan analyst concludes his in-depth analysis by saying he still doesn’t plan to invest in cryptocurrencies unless a big sell-off presented bargain entry prices.

“I won’t be buying it even though part of me wants to…

I would take another look if crypto valuations and the companies linked to them plummeted to deeply distressed values.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia